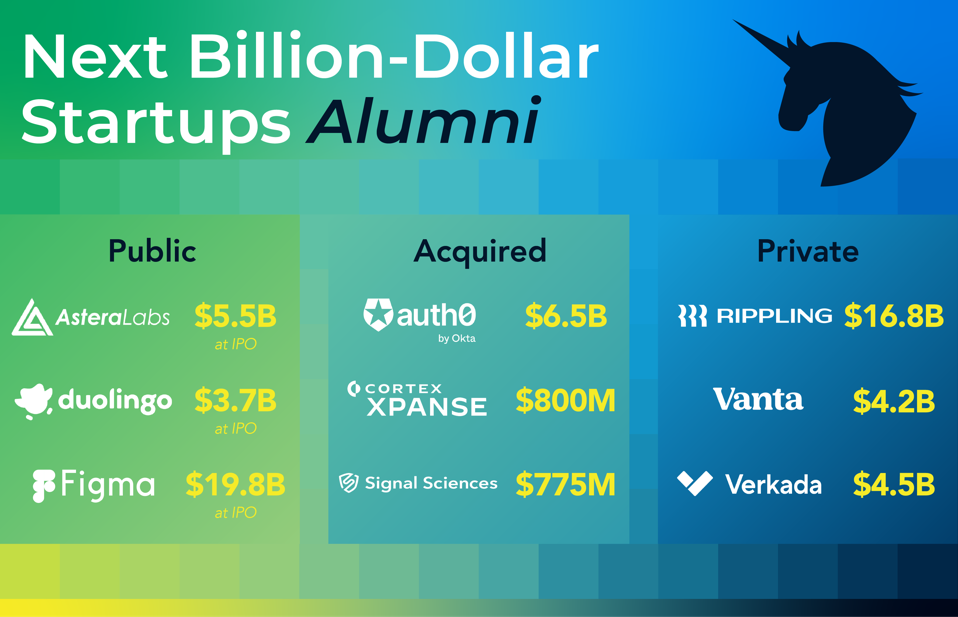

Since Forbes and TrueBridge began publishing the annual Next Billion-Dollar Startups 11 years ago, we’ve continued to track how quickly these standout companies have scaled after being named to the list. Even amid the challenging market conditions of the past several years, many of these startups have gone on to achieve major milestones and create significant value for their investors – whether by going public, being acquired by industry leaders, or reaching a valuation that far exceeds the coveted $1 billion. These changes reflect the enduring strength and adaptability of the startup economy, even in periods of uncertainty.

Next Billion-Dollar Startups Alumni

TrueBridge Capital

Astera Labs

Nasdaq IPO, March 2024

Next Billion-Dollar Startups, 2022

Astera Labs, a provider of connectivity solutions for cloud and AI infrastructure, made a notable debut on the public markets in 2024 at a valuation of $5.5 billion. The company’s IPO underscored investor interest in the semiconductor and data infrastructure sector, particularly as demand for high-speed, low-latency data movement continues to rise. Astera Labs specializes in purpose-built connectivity products that help data centers manage the increasing complexity of AI workloads. The company recently expanded its portfolio with new PCIe and CXL solutions, designed to accelerate next-generation cloud deployments and support the evolving needs of hyperscale customers.

Following a decline consistent with the overall market, Astera Labs’ stock is quickly regaining momentum – its stock price has now more than doubled since IPO – bolstered by these new growth initiatives and solid business fundamentals.

Duolingo

Nasdaq IPO, July 2021

Next Billion-Dollar Startups, 2019

Duolingo, the language learning platform known for its playful green owl and gamified approach to education, made its public market debut in 2021 at a valuation of over $3.7 billion. The IPO was a milestone not just for the company, but for the broader edtech space, signaling investor belief in the long-term potential of digital-first learning models. Duolingo has consistently expanded its reach beyond language learning with products in literacy, math, and music.

Duolingo’s stock has delivered strong returns since its IPO, buoyed by steady revenue growth, high user engagement, and expanding margins. While operating in a competitive and fast-evolving market, Duolingo’s unique blend of product-led growth, sticky user experience, and relentless focus on innovation continues to position it as a category-defining company in consumer edtech.

Figma

Nasdaq IPO, July 2025

Next Billion-Dollar Startups, 2019

Figma has become synonymous with collaborative design and workflow innovation. It pioneered real‑time, browser‑based UI/UX collaboration, transforming how teams create together. After an attempted $20 billion acquisition by Adobe fell through, Figma’s private valuation climbed to $12.5 billion in a 2024 tender offer. Its July 2025 IPO was a blockbuster, with the stock shooting up to more than 3 times its pricing on the first day of trading. With broad enterprise adoption and standout product extensions like FigJam and Dev Mode, Figma isn’t just dominating category-standard design – it’s building the infrastructure of modern collaborative creation.

Auth0

Acquired by Okta for $6.5 billion, May 2021

Next Billion-Dollar Startups, 2018

Auth0, recognized for its developer-friendly identity management platform, was acquired by Okta in 2021 for $6.5 billion – one of the year’s largest cybersecurity deals. Since its founding, Auth0 has simplified authentication and authorization for thousands of organizations, accelerating digital transformation across industries. The acquisition allowed Okta to expand its reach among developers and offer a more comprehensive identity solution. The transaction underscored the increasing importance of secure digital identity as businesses worldwide shift to cloud-based operations.

Expanse

Acquired by Palo Alto Networks for $800 million, December 2020

Next Billion-Dollar Startups, 2020

Expanse was on the front lines of cybersecurity, tackling one of the industry’s most overlooked problems: the sprawling, ever-changing attack surface. Its technology gave organizations the visibility and control needed to secure their internet assets in an increasingly complex landscape. Palo Alto Networks’ $800 million acquisition was a strategic leap, turbocharging its own offerings with Expanse’s proactive approach. The deal was a clear sign that reactive security is out and comprehensive, forward-thinking protection is in.

Signal Sciences

Acquired by Fastly for $775 million, October 2020

Next Billion-Dollar Startups, 2020

Signal Sciences, a leader in web application security, was named to the Next Billion-Dollar Startups in 2020 for its innovative approach to protecting web applications and APIs. The company’s platform offered real-time threat detection and defense, earning the trust of major enterprises. Fastly’s acquisition of Signal Sciences strengthened its edge cloud security capabilities and allowed it to deliver more comprehensive protection to customers. The transaction reflected the increasing convergence of security and performance in the cloud era.

Rippling

$16.8 billion valuation

Next Billion-Dollar Startups, 2020

Rippling, a 2020 Next Billion Dollar Startups standout, didn’t just streamline HR and IT, it redefined what an all-in-one workforce platform could be. By unifying everything from payroll and benefits to device management and app provisioning, Rippling offered a radically simple solution to one of the most complex challenges in business ops. Its massive valuation – now topping $16.8 billion – reflects not just rapid growth, but deep confidence in its ability to scale with modern organizations. In an era where efficiency, automation, and employee experience are non-negotiable, Rippling has positioned itself as the operating system for the modern workforce and it’s just getting started.

Verkada

$4.5 billion valuation

Next Billion-Dollar Startups, 2019

Verkada reimagined enterprise security through cloud-based, AI-powered video surveillance. By combining easy deployment with intelligent analytics, Verkada offered organizations a radically simpler and more effective way to protect their assets. Its latest valuation – at $4.5 billion — reflects strong growth and confidence in its ability to transform how companies approach physical security. In a world where safety and real-time insights are paramount, Verkada has positioned itself as a leader in smart security solutions, with plenty of runway ahead.

Vanta

$4.2 billion valuation

Next Billion-Dollar Startups, 2021

Vanta has emerged as a leading AI-powered trust management platform, helping organizations automate compliance and security. Originally focused on SOC 2 automation for startups, it has expanded into a full-stack solution to serve customers in almost 60 countries. In July 2025, Vanta closed a $150 million Series D led by Wellington Management that brought its value to $4.2 billion, a massive increase over the $2.5 billion valuation it achieved just one year earlier. The company’s cash has fueled global expansion and the launch of more than 350 new features in the past year alone, including an AI agent.