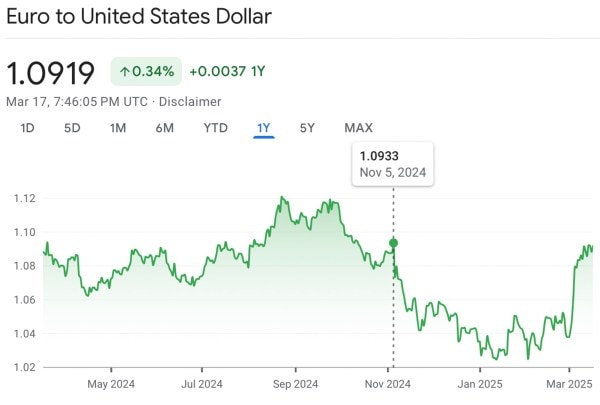

On November 5, 2024, the day the US voted for its next president, the euro, which is the common currency of 20 countries (out of 27) in the European Union, was equal to 1.0933 US dollars. This “exchange rate” between the top two currencies of the world — roughly 60% of all foreign exchange is held in US dollars and around 20% is held in euros — saw a sharp change between that day when Donald Trump won the election and the day he took the oath of office, January 20, 2025.

The euro weakened (or lost value) against the dollar and the exchange rate of one euro fell to 1.0277 dollars (see CHART, source Google Finance). The fall prompted many to believe that euro was likely to hit a parity with the dollar — something it has done just three times since it was created in 1999.

But since the inauguration, the euro has staged a sharp recovery and as of March 17, it was back at 1.0919 — almost the same level where it was on November 5.

Source: Google Finance

Source: Google Finance

On the face of it, these changes, which require being measured in four decimal places, might appear minuscule. But the fact is that trillions of units of money exchanges hands based on this exchange rate, and at that level, even these minuscule changes can result in profit or loss running into millions for those who trade in currencies.

What are currency exchange rates? What determines them?

The exchange rate between two currencies essentially tells you which of the two currencies is more in relative demand. In this specific case, Americans and Europeans demand each others currencies for investing in each other’s region (either in stocks or government bonds) or for spending money in the other region (European tourists in America, for example) or buying goods and services made in the other regions (say, Americans buying a European car).

If demand in Americans for euros outstrips the demand for dollars among Europeans, the exchange rate will reflect it by making euros more costly — that is, by making it “stronger” against the dollar. In such a scenario, a euro will start fetching more dollars. If the boot is on the other foot, the US dollar will gain and the Euro/Dollar exchange rate will “fall”.

So, why did the euro fall in the first phase?

Story continues below this ad

As Donald Trump won the presidency, the dominant view in the market was that his policy choices will supercharge the world’s largest economy, which was already growing much faster than all of its developed world cousins.

This was an understandable reaction. Trump had promised tax cuts and deregulation during his campaign of “Making America Great Again”. Tax cuts would leave US consumers with more money to spend and US firms with more profits. Similarly, deregulation — read easing of official norms for doing business — would unleash the entrepreneurial spirits in the US, boosting overall productivity and production. Together these policy promises meant a buzzing economy where investors were set to make gains.

Of course, there was also the threat of tariffs (which everyone agrees are counter-productive) but the belief in the market was that Trump is using the threat of tariffs just as a negotiating ploy to get better terms for US exporters.

In sharp contrast, during this phase, the EU continued to cut a sorry figure. Most of its economies were expected to stay in the kind of moribund stagnancy that has been a pattern since the Global Financial Crisis of 2008. On the political front, too, there was growing uncertainty, especially among some of the EU’s biggest economies such as France and Germany. Regardless of who was in power, it looked unlikely that governments would resort to kick-starting the economies by boosting expenditure (fuelled by fresh borrowings).

Story continues below this ad

Under the circumstances, the outlook for European companies was muted as were the expectations of investors. The European Central Bank, too, had been found to be behind the curve, and was often caught in a bind between cutting interest rates to boost economic growth and employment or keeping them high enough to contain the scourge of inflation.

The net effect was that investor money flowed to the US, thus weakening the relative demand for euros and its exchange rate relative to the dollar.

What caused the reversal?

There are two main reasons:

Worsening prospects of the US economy: Instead of the anticipated tax cuts and deregulation, the bulk of Trump’a first two months as President has been about slapping tariffs — which effectively works like a tax hike on domestic consumers, and thus dampens overall demand and economic activity. The other area of focus has been cutting down the size of the Federal government both in terms of number of employees and overall budget, which, too, crimps overall demand as people lose jobs and businesses lose contracts.

What has been equally, if not more, damaging is the uncertainty that has come with these policy decisions. Between the daily fluctuations of what the President announces and the legal challenges his decisions face (both inside the country before the judiciary and outside, say, in the World Trade Organisation), market participants/ investors aren’t sure what is happening. Nor are the businesses and consumers who are unable to plan their expenditures and inventories because of the uncertainty surrounding prices.

Story continues below this ad

Many experts now believe that the US economy will lose a step or two — if not actually slide into a recession. For instance, according to an interim report titled “Steering through uncertainty”, published by the Organization for Economic Co-operation and Development (OECD) on March 17, “the annual GDP growth in the United States is projected to slow from its strong recent pace (2.8%), to be 2.2% in 2025 and 1.6% in 2026. In other words, in just two years, the US growth rate will be halved as a result of the uncertainties.” Poorer growth prospects are starting to reflect in the stock market as trillions of dollars of investor wealth has already been extinguished. Loss of wealth has its own adverse impact — called negative wealth effect — as people hold back demand because they “feel” poorer, thus further accentuating the slowdown.

With weaker US growth, there is a good chance that the US Federal Reserve (that runs monetary policy) may cut interest rates. But lower interest rates imply lower returns for investors who buy government bonds.

The net result of faltering stock markets and lower returns from government bonds has been to make investors take out money from the US and look elsewhere.

Improving prospects of EU economies: For many investors, that somewhere else has been Europe. While the same OECD report dialled down the GDP projections for the US, it projected EU GDP growth to rise from 0.7% in 2024 to 1% in 2025 and 1.2% in 2026.

Story continues below this ad

The odd thing is that it was Trump’s aggressive posture on tariffs and security matters (read Ukraine) that shook up the EU leadership and led them to decide that governments in EU will give up fiscal austerity — that had been the norm since the Global Financial Crisis in 2008 — and instead look to push up European growth rates. Led by two of its biggest economies — Germany and France — Europe is beginning to show promise that it can extricate itself from economic stagnancy and become an engine of global growth.

Will this trend sustain?

There is no guarantee, and there are too many ifs and buts.

What if the emerging political consensus in Europe — that governments need to pump-prime the economy — falters?

What if Trump tariff confusion settles down before it derails the US economy grievously?

Story continues below this ad

Over the coming days and weeks, it would be instructive to watch what the US Federal Reserve Chairman Jay Powell says as he announces the monetary policy stance on March 19. Similarly, April 2, when Trump has promised to place reciprocal tariffs, is another crucial date to watch out.

What is the impact on India?

As explained above, the euro is strengthening against the dollar partly due to the weakness in dollar (which, in turn, in linked to the weakness in the us growth prospects) and partly due to the strength of the euro (which, in turn, in linked to the improving growth prospects of the EU economies).

Both these trends will reflect on rupee’s exchange rate with the two currencies.

To the extent that the dollar is weakening, rupee will gain against the dollar — as indeed it has done with the rupee strengthening from 87.5 to a dollar on February 6 to 86.5 as of March 18. A stronger rupee helps reduce inflation because India imports the bulk of its crude oil requirement in dollars.

Story continues below this ad

At the same time, to the extent that euro is strengthening, the rupee will weaken against the euro — the rupee has fallen from 87.4 to a euro on January 5 to 94.5 on March 18. A weaker rupee will help Indian exports to the euro area.