Artificial intelligence (AI) stocks haven’t been performing well on the market in 2025 amid the tariff-fueled turmoil that threatens to send the U.S. economy into a recession. Share prices of cloud infrastructure provider Oracle (ORCL -0.81%) are down nearly 20% so far in 2025 as of this writing, while data streaming platform provider Confluent (CFLT 1.41%) has dipped more than 23%. Both companies saw an uptick in their financial performances thanks to AI adoption, but the generally negative stock market sentiment is taking its toll.

With AI adoption still in its early phases of growth, it won’t be surprising to see these two stocks make a comeback. Analysts expect both Oracle and Confluent to deliver solid gains in the coming year, and they seem capable of sustaining their momentum in the long run.

Let’s take a closer look at the reasons why buying these two AI stocks following their recent declines could be a profitable move.

1. Oracle

Oracle stock was popular in 2024 thanks to the rapidly growing demand for the company’s cloud infrastructure services, which are being used by customers to train and deploy AI models and applications. When the company released its fiscal 2025 third-quarter results (for the three months ended Feb. 28) last month, they showed customers continue to rent its cloud infrastructure to tackle AI workloads.

Oracle reported a stunning 63% year-over-year jump in its contract value in Q3 thanks to AI. That was much faster than the overall 6% rise in its quarterly revenue. Management pointed out on the March earnings conference call that “record-level AI demand drove Oracle Cloud Infrastructure revenue.” It’s also interesting that the demand for Oracle’s AI cloud infrastructure exceeded its supply.

As a result, the company is focused on aggressively bringing more capacity online so that it can fulfill its huge contract backlog and convert it into revenue. According to CEO Safra Catz:

We expect that our available power capacity will double this calendar year and triple by the end of next fiscal year. As we bring more capacity online, our revenues will clearly accelerate. What we are seeing in the market is that we are the destination of choice for both AI training and inferencing.

Oracle claims that the performance and cost advantage of its cloud infrastructure are working in its favor and attracting customers looking to run AI workloads in the cloud. This explains the massive increase in the number of contracts that the company has been signing, which led to the 63% jump in its remaining performance obligations (RPO) last quarter (now totaling $130 billion).

RPO is the total value of a company’s contracts that it is yet to fulfill. Oracle points out that “RPO figure is the leading indicator of demand for our cloud services, while our live data center count and power capacity is the leading indicator of the conversion of RPO to revenue.” So, Oracle’s focus on bringing online more cloud capacity explains why it expects its cloud infrastructure-revenue growth to accelerate going forward.

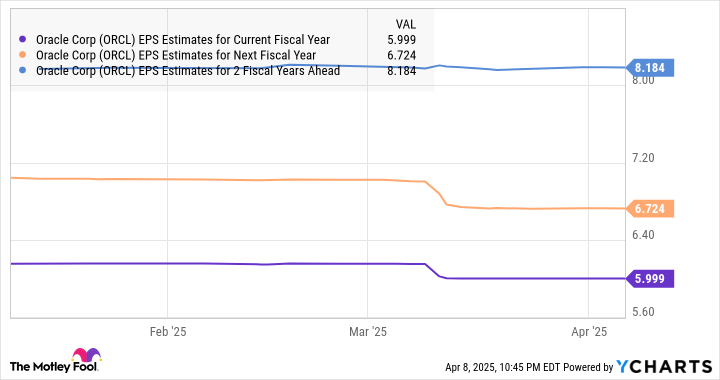

The company forecasts its revenue to jump by 15% in fiscal 2026 followed by a 20% increase in fiscal 2027. Those numbers point toward a big improvement over the 8% revenue growth that Oracle is expected to clock in the current fiscal year. That’s expected to translate into an acceleration in the company’s bottom line from next year.

Data by YCharts.

This potential improvement in Oracle’s earnings explains why analysts are upbeat about the stock’s performance. It carries a 12-month price target of $186 according to 42 analysts covering the stock. That would be a 38.5% increase from current levels. Moreover, the long-term opportunity in the cloud infrastructure market could send this AI stock much higher over the next five years.

So, investors can consider buying Oracle right away following its recent drop as it is trading at an attractive 20 times forward earnings.

2. Confluent

Cloud-based data streaming provider Confluent has dropped 43% from the 52-week high it hit in mid-February following the release of solid Q4 2024 results. This sharp decline has brought Confluent’s price-to-sales ratio to 7.6 as compared to almost 10 at the end of 2024. What’s more, the stock is undervalued with respect to the potential earnings growth it could deliver over the next five years.

This is evident from its price/earnings-to-growth ratio (PEG ratio) of just 0.52 based on the five-year earnings growth projection as per Yahoo! Finance. The PEG ratio is a forward-looking valuation metric that takes a company’s potential earnings growth into account, and a reading of less than 1 indicates that a stock is undervalued based on its growth potential.

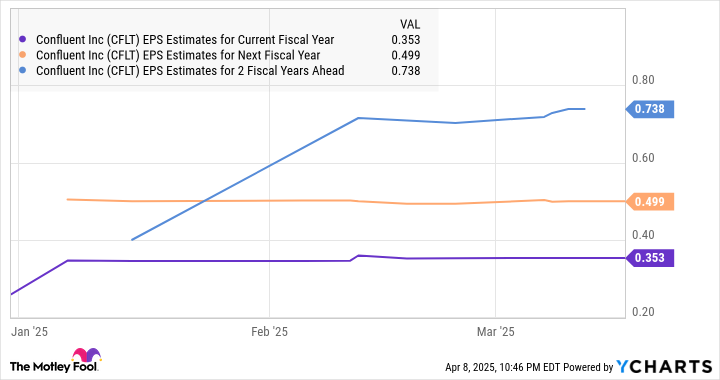

As the following chart tells us, Confluent’s earnings growth is expected to step on the gas following 2025’s estimated increase of 22%.

Data by YCharts.

AI is set to play an important role in helping Confluent boost its earnings. That’s because Confluent’s generative AI tools are helping it drive an increase in customer spending. The company’s cloud-based data streaming platform allows customers to store, manage, and access their data on a cloud-based platform in real-time instead of storing it in silos.

It is now offering AI solutions to its customers to make better use of the data stored on Confluent’s cloud-based platform. Confluent customers are building copilots and AI agents that can monitor data streams in real time, apart from accessing real-time data for powering their generative AI applications, such as chatbots to tackle time-sensitive workloads.

The adoption of AI-related tools explains why Confluent’s dollar-based net retention rate stood at an impressive 117% in 2024’s Q4. This metric compares the annual recurring revenue (ARR) from the company’s customers at the end of a period to the ARR from those same customers in the year-ago period.

So, a reading of more than 100% in this metric suggests that its existing customers are spending more money on Confluent’s offerings. Another thing to note is that Confluent’s customer base increased by 17% in Q4 2024 to 5,800, which means that the company can cross-sell its AI products to more clients. And this explains why Confluent’s earnings are expected to grow at a faster pace in the coming years.

Analysts are expecting the market to reward its healthy earnings growth with terrific upside. The 33 analysts covering Confluent have set a 12-month median price target of $38 on the stock, which would be a jump of 76.7% from current levels. This cloud stock could indeed soar impressively as the discussion above tells us, and the attractive valuation means that now could be a good time for investors to buy it while it is beaten down.