Just five US funds invest specifically for racial and ethnic diversity. As Black History Month begins, we looked at these funds for investors seeking to add a diversity focus to their portfolios.

Also, recent research has shown that Black individuals are underrepresented on investment teams, relative to their population in the US. They comprise nearly 13% of the US population but less than 2% of portfolio managers on average. For more on this topic, download Morningstar’s first survey-driven Diversity in Asset Management report here.

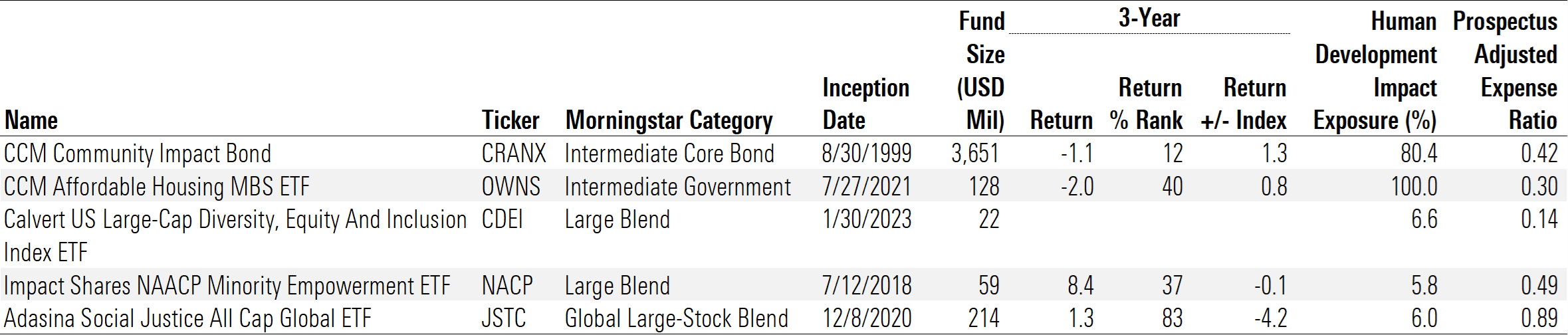

5 Funds That Invest in Racial and Ethnic Equality

Some two dozen open-end and exchange-traded funds in the US have a diversity-focused investment mandate, but most focus on gender. Looking at those that target racial and ethnic diversity narrows the list to just five.

When it comes to investing for racial and ethnic equality, the two fixed-income offerings on the list take a slightly different approach from their equity ETF counterparts. The bond strategies look to fund projects that support minority communities and aim to create positive change (sometimes referred to as “direct” impact). For instance, they may provide loans to minority business owners or increase access to safe and affordable housing. On the other hand, the equity ETFs seek to invest in companies that have diverse workforces and leadership or that promote programs related to equal pay, career development, or equal opportunity in hiring. Because the outcomes of these investments can’t be quantified as easily as the aforementioned fixed-income examples, this approach is sometimes referred to as “collective” impact.

CCM Community Impact Bond CRAIX is by far the oldest and largest fund on the list. The fund’s managers buy bonds that look to create positive impact by targeting projects related to minority advancement, rural community development, poverty alleviation, education and childcare, and more. For instance, CCM holds bonds from the Villas of Cordoba, a residential property in a majority-minority community in Texas. The property manager, Affordable Housing Visions for Texas, also provides educational and financial planning services to residents. Over the trailing 10 years ended Dec. 31, 2024, the fund’s institutional share class trailed its peers in the intermediate core-bond Morningstar Category as well as the Morningstar US Core Bond Index by 14 and 16 basis points, respectively. However, performance recovered recently, and the fund held up better than peers and the index over the trailing three- and five-year periods. The institutional share class is attractively priced at 42 basis points, but fees on the other share classes are less appealing.

CCM manages another fund on the list, CCM Affordable Housing MBS ETF OWNS, where it invests in mortgage loans that were made to minority or low-income families. CCM Affordable Housing MBS ETF stands out for its high degree of exposure to positive impact, based on analysis using Morningstar Sustainalytics Impact Metrics. Sustainalytics Impact Metrics reflect the percentage of a company’s revenues that are associated with positive impact in line with one of five themes: Human Development, Basic Needs, Resource Security, Climate Action, and Healthy Ecosystems. Human Development includes measures that support education, equality, employment opportunities, and healthcare, so it is the best fit to evaluate funds focused on racial and ethnic diversity. One hundred percent of CCM Affordable Housing MBS ETF’s portfolio is associated with Human Development. Although the fund posted negative three-year returns through the end of 2024, it landed in the top half of the intermediate government-bond Morningstar Category and bested the Morningstar US Government Bond Index over the period. For an interview with the fund’s managers, read this.

Calvert US Large-Cap Diversity, Equity And Inclusion Index ETF CDEI is the newest offering on the list, having launched just about two years ago. However, Calvert was one of the early movers in US sustainable investing in the 1980s, so this index builds on a time-tested philosophy and approach. The index-tracking fund seeks to invest in companies that have diverse leaders and workforces as measured by gender, ethnicity, age, cultural background, and skill-set. Since its inception in January 2023, the fund has lagged the Morningstar US Large-Mid Cap Index by more than 2 percentage points. It remains to be seen how the fund will fare over the long term, but its low 14-basis-point fee is a bright spot.

Impact Shares NAACP Minority Empowerment ETF NACP is the strongest performer of the group, gaining 8.4% annualized over the past three years through Dec. 31, 2024, and landing in the top half of the large-blend Morningstar Category. Its returns were more impressive in 2021 and 2022, which boost its five-year track record: The fund gained an annualized 15.3% over the period, beating the Morningstar US Large-Mid Cap Index by nearly a full percentage point and ranking in the category’s eighth percentile. The fund tracks the Morningstar Minority Empowerment Index, which considers factors such as board diversity, corporate policies to eliminate discrimination and ensure equal opportunity, and programs that promote long-term economic development among minority communities. Some of the top contributors to the fund’s performance in 2024 include overweightings in Nvidia NVDA and Meta Platforms META, which rose 171% and 66% last year. Even though Nvidia is down nearly 4 percentage points year-to-date (through Jan. 28, 2025), the fund is still more than 1 percentage point ahead of the Morningstar US Large-Mid Cap Index. [For a closer look at some of the stocks in the fund, read this].

Adasina Social Justice All Cap Global ETF JSTC evaluates index constituents based on proprietary criteria that encompass racial, gender, economic, and climate justice. For instance, the fund excludes companies that own or operate prisons and immigrant detention centers, companies that oppose civil rights legislation, and companies that support restricting reproductive rights. The fund lagged its benchmark over the past three years through December 2024, partly because it underweighted Nvidia and excluded Meta Platforms. As a result of the fund’s climate justice criteria, it also lacked exposure to traditional energy stocks for the period, during which time that sector led the Morningstar Global Target Market Exposure Index, with a 55% cumulative gain.