The path to financial freedom isn’t reserved for Wall Street insiders or the already wealthy. With thoughtful planning and consistent action, ordinary individuals can build substantial wealth through smart investing. The financial markets offer numerous opportunities for growth, but navigating them requires understanding fundamental principles that separate successful investors from those who struggle.

The foundation of investing success

Before diving into specific investment vehicles, establishing a solid financial foundation is crucial. This means creating an emergency fund covering 3-6 months of expenses, paying off high-interest debt, and understanding your risk tolerance.

Many new investors make the critical mistake of jumping into markets without proper preparation. Smart investing begins with financial stability and a clear understanding of your goals.

This stability creates the necessary cushion that allows investors to weather market volatility without being forced to liquidate investments at inopportune times.

Diversification is your strongest ally

Diversification remains one of the most powerful strategies for building wealth while managing risk. This approach involves spreading investments across different asset classes including:

- Stocks for growth potential

- Bonds for stability and income

- Real estate for inflation protection

- Cash equivalents for liquidity

- Alternative investments for diversification

Proper diversification doesn’t mean owning dozens of similar investments. Instead, it means building a portfolio of assets that respond differently to economic conditions, creating balance through uncorrelated returns.

The principle works because when one segment of your portfolio underperforms, others may compensate, smoothing your overall investment journey and potentially reducing anxiety during market turbulence.

Time in the market beats timing the market

The compounding effect transforms modest investments into significant wealth, but only when given sufficient time. An investor who begins with $5,000 and adds $500 monthly for 30 years, earning a 7% average annual return, would accumulate approximately $620,000.

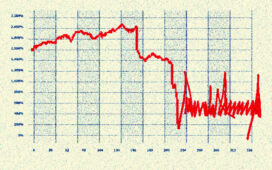

This growth occurs regardless of market timing skills. In fact, attempting to predict short-term market movements typically leads to poorer results than maintaining consistent investments through market cycles.

Data shows that investors who try timing the market often underperform market indexes by 4-5% annually. This performance gap stems from emotional decision-making during market extremes and missing the market’s best days, which frequently occur during volatile periods.

Tax-advantaged accounts supercharge wealth building

The government provides several tax-advantaged investment vehicles that can significantly accelerate wealth accumulation:

- 401(k) plans offer pre-tax contributions, reducing current tax burdens

- Roth IRAs provide tax-free growth and withdrawals in retirement

- Health Savings Accounts deliver triple tax advantages for medical expenses

- 529 plans help fund educational expenses with tax benefits

- Solo 401(k)s and SEP IRAs benefit self-employed individuals

Maximizing contributions to these accounts before investing in taxable accounts ensures that more of your money works toward building wealth rather than satisfying tax obligations.

For example, someone in the 24% tax bracket who maxes out their 401(k) at $22,500 annually saves $5,400 in taxes that year. Invested properly, those tax savings alone could generate over $600,000 in additional retirement assets over 30 years.

Low-cost index funds deliver superior results

While active investing attracts attention, passive investing through low-cost index funds consistently delivers superior long-term results for most investors. These funds provide instant diversification, professional management, and remarkably low fees compared to actively managed alternatives.

The mathematics of investing makes fee minimization essential. A seemingly small 1% difference in annual fees can reduce a portfolio’s final value by nearly 30% over 30 years of growth.

Major investment firms now offer broad-market index funds with expense ratios below 0.05%, allowing investors to capture market returns with minimal friction costs.

The balanced approach to wealth creation

Building wealth through investing isn’t about finding the next hot stock or timing market movements. Instead, successful wealth creation combines consistent contributions regardless of market conditions, proper asset allocation based on your timeline and goals, fee minimization to preserve returns, tax-efficient investing strategies and emotional discipline during market turbulence

This balanced approach may seem less exciting than chasing market trends, but historical evidence strongly suggests it delivers superior results for most investors.

Beyond the basics

As your wealth grows, additional strategies become viable, including real estate investment trusts (REITs), dividend growth investing, and potentially alternative investments like private equity or venture capital.

However, even sophisticated investors benefit from maintaining focus on the fundamental principles that drive successful wealth creation. The path to financial freedom isn’t built on complexity but on consistency, patience, and discipline.

By implementing these five strategies, establishing financial stability, embracing diversification, investing for the long term, utilizing tax-advantaged accounts, and minimizing investment costs, investors position themselves for success regardless of economic conditions.

The journey to financial freedom begins with a single investment but continues with thousands of smart decisions made consistently over decades. The most successful investors recognize that growing wealth isn’t about becoming rich quickly but about becoming wealthy inevitably.