In the past five years, Alphabet’s shares have surged by more than 240%.

Alphabet (GOOG -0.28%) (GOOGL -0.27%) is one of the top growth stocks in the world. With dominant businesses like YouTube and Google Search, the company attracts massive amounts of web traffic and advertising revenue. And with the rise of artificial intelligence (AI), it can potentially leverage this technology to get even more out of those businesses, creating value for users and shareholders.

Given the potential for AI to transform Alphabet’s business, is the stock likely to double in value over the next five years?

Alphabet’s modest valuation works to its advantage

Although Alphabet is one of the largest companies in the world with a market cap of $2.3 trillion as of this writing, it’s not an expensive stock given how much profit it generates. Investors are paying just under 30 times earnings to own a piece of the business. By comparison, rival Microsoft trades at 40 times earnings, while Amazon sports a price-to-earnings ratio of 57.

While Alphabet stock has risen 37% year to date, its valuation hasn’t ballooned. And that can help it deliver stronger returns in the long run with more potential upside for what’s still a modestly-valued stock.

But the business itself still has to perform well, and that could come down to what impact AI has on the company.

Will AI help or hurt Alphabet’s business?

There’s a lot of excitement around what AI can do for Alphabet and other companies. But for it to double in value, it will need to demonstrate that AI will help its business more than hurt it. That’s by no means a given at the moment.

If people go to AI offerings like ChatGPT rather than Google Search for their queries, that will diminish the value of Alphabet’s popular search engine, especially to advertisers. However, if the company can use AI to enhance its own services, that will likely be pivotal to its growth over the next five years.

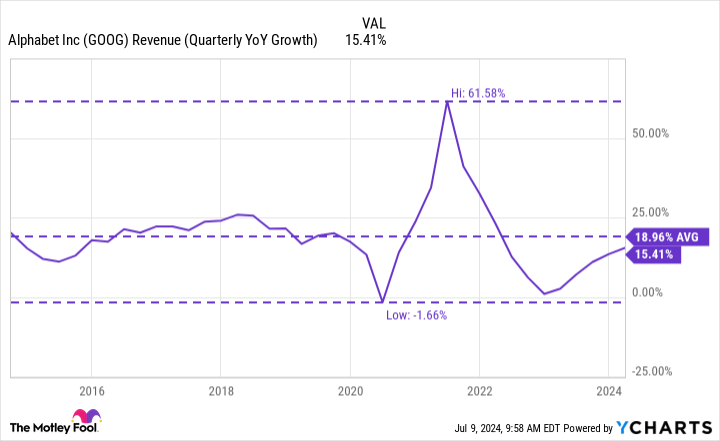

Alphabet’s growth rate has already been accelerating in recent quarters, though it’s slightly trailing its 10-year average.

Data by YCharts.

So, the assumption investors should be careful not to make is that AI will be a net positive for Alphabet. Execution will need to improve as the rollout of some of the company’s early AI features have run into problems.

Is Alphabet stock likely to double in five years?

Alphabet is likely to grow bigger and more profitable in the years ahead. However, that doesn’t mean the stock will double over this period. AI still poses a considerable threat and opportunity to its online empire. Growth investors should understand that while Alphabet’s modest valuation does make its shares an attractive buy right now, the significant growth needed to see the stock double over the next five years is anything but certain.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.