AUNG MYO HTWE

~ Tim Murphy, Investing Groups Team.

Today we conclude our Investing Groups Roundtable series. Given the recent market volatility and economic uncertainty from the changing tariff policies, we wanted to give SA readers a glimpse into what our Investing Group Leaders are discussing with their subscribers. Part 1 looked at Income and Value investing, and Part 2 looked at the macro picture. Today we have the remaining responses—with a variety of sectors being covered, from shipping and commodities to tech and biotech. Again, we posed the following two questions (responses submitted between April 25 and April 30):

1. What have you been discussing with your subscribers about the effects of the recent trade policy changes—and how they’re shaping your view in the near and long term?

2. In light of the new trade policies and their impact, what’s a current Top Idea you’re focused on in your service—and why?

J Mintzmyer of Value Investor’s Edge: The recent increase in tariffs, as well as significant uncertainty regarding future tariff levels or potential trade deals, has significantly slowed down shipping activity and is likely to cause weakness in the overall market. In the near term, we are looking for tactical opportunities in the shipping sector, especially if these stocks have been sold off unfairly. In the long term, we remain heavily invested in deep value plays while avoiding any names with significant leverage or exposure to the retail goods sector.

IDEA: International Seaways (INSW), a diversified tanker company with a fleet of 81 crude and product tanker vessels, is one of our current top ideas. INSW sold off tremendously over the past few months due to a disappointing winter season and fears that rates could weaken if sanctions against Russia are lifted during 2025. We believe the selloff is overdone and expect INSW to benefit from OPEC export growth along with increased sanctions against Iran and the ‘dark fleet’ of unregulated vessels. Rates have already begun sharply rallying, yet INSW is barely off lows and still nearly 50% below its 52w high.

Disclosure: Long INSW

Andrew Hecht of The Hecht Commodity Report: Tariffs create trade barriers, impacting prices across all asset classes. Since commodities are global assets, the ongoing trade issues are distorting prices, which I expect to continue over the coming weeks and months.

IDEA: My top pick has been gold and silver over the past months. However, I am also bearish on crude oil, as I believe the U.S. administration will increase U.S. petroleum and gas output and pressure OPEC+ to reduce prices to battle inflationary pressures. For further analysis on commodities, I recommend my recent Premium article reviewing Q1 2025 performance across the sector.

Disclosure: Long physical gold.

From Growth To Value of Potential Multibaggers: The least you can say is that the changes breed uncertainty, and that’s something the market hates. In the worst-case scenario, this is the end of a period of 80 years of prosperity, in which the US became the dominant world power based on free trade. I know that sounds dramatic, but if this is serious and not just a negotiation technique, it fundamentally shifts the policy that made the US so powerful and rich. But even if it is a negotiation technique, there’s damage, as the US allies don’t trust the US anymore. Europe already started talking to China, exactly the opposite of what you would want.

IDEA: I think The Trade Desk (TTD) is very attractive at this point. For the first time ever, the company missed its own guidance, and the market sold it off. It was very expensive, and I gave it a Valuation Score of 3/10. Now that the price is down so much, I scored it at 9/10 for valuation. The quality is also high, and there is little impact of tariffs, as 85% of TTD’s revenue is from the US and internationally; they bring in dollars into the country, so they will still be welcome. Of course, a recession could impact TTD like any other company. For a deeper analysis of TTD, I recommend you read my February article.

Disclosure: Long TTD.

Joe Albano of Tech Cache: My focus has been less on global policy and more on what the market sentiment has been, leading up to the recent volatility. The charts have been pointing to a serious correction for several months, especially in tech. I’ve talked about it since the Seeking Alpha Election Forum back in October, and we’re now in the thick of it. The tariffs and global trade policies have merely been catalysts and not necessarily the driving forces, as the market has been waiting to get tipped over and reverse.

IDEA: Cybersecurity has come to the forefront as it’s resilient in a recessionary environment. But what rises to the top is Rubrik (RBRK) as its correction appears to already be behind it, even with a looming pullback to come from higher levels. Between the company’s fundamental performance, its niche in the sector, and its chart setup, I’m not only bullish on it, but I went long a few weeks ago when it dipped below $50, in line with my March article. This one has the potential to outperform the market and provide returns over the next year or two.

Disclosure: Long RBRK

Cestrian Capital Research, Inc. of Growth Investor Pro: The theme we have adopted is to try to focus on signal price and not the ‘narrative’ from the talking heads about what may, or may not, be happening with trade policy on any given Tuesday. Our constant message has been that ultimately a workable trade policy is likely to be implemented as a result of pressure from bond and equity markets and—most importantly of all—the midterms. We believe we remain in a bull market with buyable dips and sellable rips.

IDEA: We continue to believe that the ability to trade long/short the S&P 500 and/or the Nasdaq-100 is the most effective way to take advantage of the current environment. We teach this hedged trading method all week long in our service. To learn more about this approach, I recommend you read my recent Premium article.

Disclosure: Long TQQQ, UPRO, and PSQ.

Quad 7 Capital of BAD BEAT Investing: Since Tariffs were telegraphed, though the degree of the announcement was much more than expected, we were well insulated with having raised cash and adding hedges. On the selloff, we started buying tariff-resistant stocks, gold, and some select oversold names, such as NFLX, for a bounce. As we look ahead, we still do not have clarity. We have been expecting companies to reduce or pull guidance. We have narrowed trading ranges and are raising stops to protect gains in open trades. Each Saturday, we feature our “thoughts on the market,” with a weekly game plan, and have told investors SP500 5525-5550 is where to add hedges.

IDEA: We have several favorable conviction ideas, as we cover a range of topics including growth, income, the macro picture, and tech portfolio hedging. To share one of those, we would encourage the public readers to have a look at Humana (HUM). A lot of pain is already baked in; there is no tariff risk and they just announced solid earnings. They are working out the issues that came up last year, and the valuation is favorable, with an upside of over $300. We have laid out a tactical trade there recently and think the risk-reward is quite favorable at $250.

Disclosure: Long HUM, short the market through SPY 525 puts December 2025 expiration

The Fortune Teller of Wheel of Fortune: Our message was very clear:

1) This is NOT Q1/2020. Q1/2025 is a self-made “crisis” that is fully under control.

2) Trump has no goal to put the US into recession or crush the stock market

3) Sooner rather than later, trade deals are likely to get signed

4) The 20% correction was a buying opportunity; we took advantage of it

5) It doesn’t mean we ride into the sunset from now on; we find it hard to see a new ATH inside 2025

6) Outside of opportunities to make big-quick profitable swings (big allocations over short periods), we remain focused on solid/defensive/dividend/income plays this year.

IDEA: We believe that small caps in general—and biotechs in particular—are among the most beaten-down and undervalued segments of the market, and they deserve far more attention and appreciation from investors. In our Funds Macro Portfolio, we successfully bought and already sold the biotech 3x-leveraged ETF (LABU). Leveraged ETFs are only suitable for specific purposes/times and short-term holding periods. In our Single Opportunities Portfolio, we hold Regenxbio (RGNX). RGNX is our top biotech pick, thanks to its focus on gene therapy (a growing FDA priority), strong pipeline, solid liquidity, strategic partnerships, and attractive valuation. For more details on our conviction for RGNX, I suggest you read our recent Premium article.

Disclosure: Long RGNX

Bang For The Buck of Off the Beaten Path: I invest in natural resource equities, primarily in the fossil fuel, uranium, and precious metals mining industries. The direct tariff impact has been relatively small, as most of those commodities are exempt from tariffs.

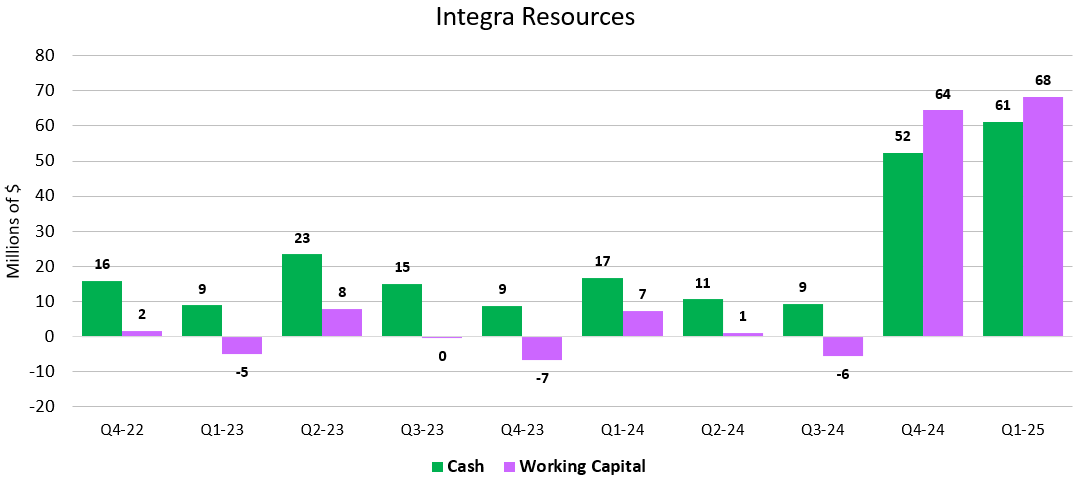

However, there are secondary impacts from retaliatory tariffs and demand implications from weaker economic data. Also, the higher the volatility, the higher the correlation between various industries. I have been buying rather aggressively during April, when we saw more weakness, much of it unjustified in my industries. IDEA: Integra Resources (ITRG) is a U.S. gold mining company with two development projects, and the company recently acquired the producing Florida Canyon Mine. The two development projects, DeLamar and Nevada North, are of relatively high quality. However, the company has been undercapitalized and has had to come to the market every year to raise $20-30M, which has weighed on the stock price.

With the strong gold price and production out of Florida Canyon, the company is generating excellent cash flow, which has finally allowed the company to start to re-rate, while the stock remains cheaply valued. To learn more about ITRG, I encourage you to read my recent Premium article.

Integra Resources Quarterly Reports

Disclosure: Long ITRG

Laurentian Research of The Natural Resources Hub: The U.S. is decoupling from China’s economy, deregulating mining, and boosting domestic development to cut reliance on Chinese critical metal exports. China’s monopoly on these metals has prompted the West to secure resilient supply chains and reduce vulnerability to coercion. Geopolitical tensions and China’s export restrictions impact U.S. and EU industries and military. Investment opportunities in mining are emerging as the U.S. and EU diversify critical metal supplies.

IDEA: One current top idea is Perpetua Resources (PPTA). It is currently undervalued and presents a compelling investment opportunity for investors seeking to capitalize on China’s ban on antimony exports to the U.S. To learn more, here is my April 28, 2025, Premium article on PPTA.

Disclosure: Long PPTA