Super Micro Computer (NASDAQ:SMCI) has been on a wild ride, battling financial reporting concerns that escalated into the threat of a Nasdaq delisting. The uncertainty sent shares into freefall, plunging 70% from late August to mid-November.

Discover the Best Stocks and Maximize Your Portfolio:

However, Supermicro has since taken a crucial step forward. By submitting its audited financial reports ahead of Nasdaq’s Feb. 25 deadline, the company maintained its listing on the stock exchange.

Yet, despite clearing this hurdle, SMCI shares tumbled following the filing. A key factor behind the decline is the lack of a full-throated endorsement from its accounting firm, BDO, which issued an “adverse opinion” on the company’s internal controls over financial reporting. Supermicro acknowledged these deficiencies in its Form 10-K filing and committed to addressing them.

Adding to the pressure, broader market headwinds – including geopolitical uncertainties and concerns over declining AI capex – are compounding the sell-off. Meanwhile, SMCI faces company-specific challenges, from execution risks to difficulties securing R&D funding in the capital markets, further contributing to the downward trend.

Still, not everyone sees the downturn as a red flag. One top investor, known by the pseudonym JR Research, believes that the market’s lukewarm response could be a buying opportunity.

“While SMCI is not completely out of the woods, investors can still look forward to the Blackwell ramp,” explains the 5-star investor, who is among the top 2% of TipRanks’ stock pros.

JR points out that the market is well aware of the concerns revolving around SMCI – specifically related to its execution, scaling, and liquidity – and is therefore likely discounting share prices accordingly.

A further indication that the market has not fully embraced the SMCI bull narrative is the analyst projections of $33.1 billion for the company’s FY 2026 revenues. This falls 17% short of the company’s estimates, and demonstrates that the bar for SMCI has been lowered a notch or two.

“SMCI could outperform over the next few quarters, while the market takes its time to assess whether to give the company the benefit of the doubt, while looking past its recent compliance challenges,” adds the investor.

To this end, JR Research is standing firm with a Buy rating. Though the investor believes that the worst has passed, JR nonetheless urges investors to buy in slowly as the risk of volatility remains. (To watch SMCI’s track record, click here)

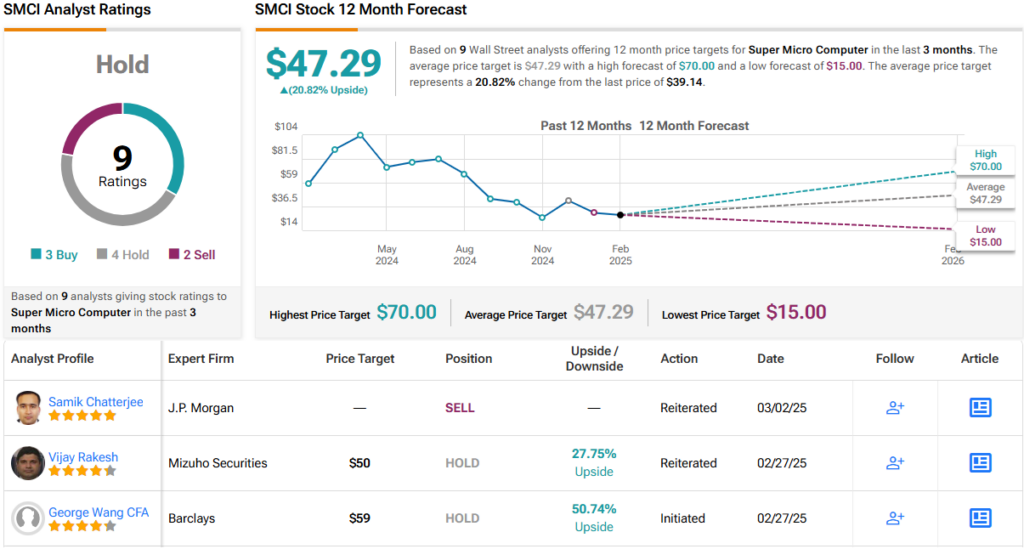

Meanwhile, Wall Street is holding back on an outright endorsement. With 3 Buy, 4 Hold, and 2 Sell recommendations, SMCI carries a consensus Hold (i.e., Neutral) rating. Its 12-month average price target of $47.29 suggests a ~21% upside from current levels. (See SMCI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Source link