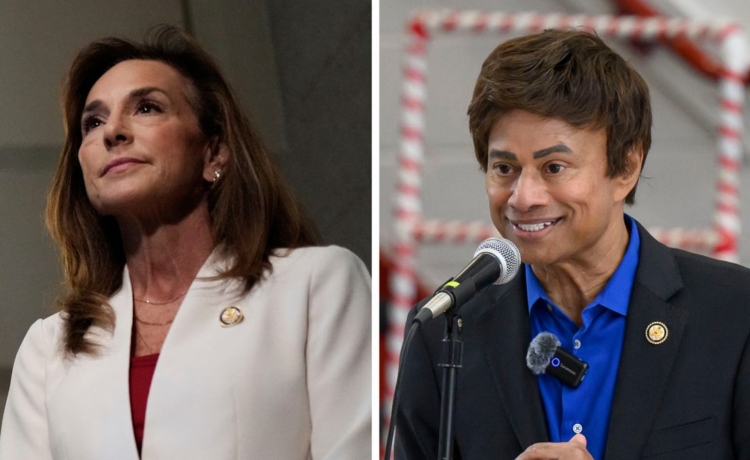

Washington ― Two members of Congress from Michigan, Shri Thanedar and Lisa McClain, recently blew deadlines for the timely public reporting of stock trades required under federal law.

The news comes amid a renewed debate among bipartisan lawmakers in both chambers about banning the trading of individual stocks by members of Congress.

Thanedar, a Detroit Democrat, disclosed the purchase this week of up to $50,000 worth of MicroStrategy Inc. stock more than a year after the transaction on July 1, 2024. He said the purchase was made by his wife, and he learned about it belatedly.

McClain, a Republican from Bruce Township and chairwoman of the House GOP Conference, on Wednesday disclosed more than 460 stock transactions by her husband, Mike, with some dating to March 2024.

All but about 72 of McClain’s trades, including the purchase of Tesla and Nvidia stock in the days after the 2024 presidential election, were reported outside the 30-day window required for disclosing stock transactions, with the longest at 518 days.

Under the 2012 Stop Trading on Congressional Knowledge Act (STOCK Act), lawmakers are required to report stock trades of more than $1,000 within 30 days of notification of the transaction and, at most, no more than 45 days after the transaction. Disclosure violations could result in fines of $200.

McClain’s office said she does not trade individual stocks, and that she filed Wednesday’s disclosure after belatedly learning about the trades.

“She promptly filed the necessary paperwork immediately after being made aware of the transactions made in managed accounts and remains committed to transparency and adherence to all House financial disclosure rules and regulations,” spokesman Mason Devers said by email.

Thanedar’s episode led him to decide to instruct his financial advisers to sell off his individual stock holdings, all of which pre-date his time in Congress, he said. Instead, he’ll invest in non-individual stocks like mutual funds or similar options, he said.

“It’s just too complicated. Every time I buy or sell, I got to report. I could just as well invest in (exchange traded funds) or others that are not individual stocks. Every time I sell a stock, it becomes the news — you know, like when I sold Tesla stock sometime back,” Thanedar said.

“It’s just too much hassle. Media gets on it and gets all excited about it, and social media gets all excited, and there is nothing there.”

Thanedar said he supports legislation introduced in the House to prohibit members from trading stocks.

“I personally believe that no member of Congress should use any non-public information to enrich himself or herself,” Thanedar told The Detroit News. “I strongly support all the legislation that has been proposed.”

The Senate Homeland Security panel last month narrowly voted to send to the full Senate a bipartisan ban on trading or owning stocks and other “covered investments” by members of Congress, the president, and vice president and their spouses and dependent children, starting 90 days after enactment.

The legislation is based on a deal that was negotiated last year among Sens. Gary Peters, D-Bloomfield Township; Josh Hawley, R-Missouri; and others. The bill also prohibits the use of blind trusts to hold stocks.

President Donald Trump’s Treasury secretary, Scott Bessent, on Wednesday also called for a ban on single-stock trading by members of Congress in a Bloomberg interview.

“It is the credibility of the House and the Senate that you look at some of these eye-popping returns — whether it’s Rep. (Nancy) Pelosi, Sen. (Ron)] Wyden, every hedge fund would be jealous of them,” Bessent said.

“And the American people deserve better than this.”