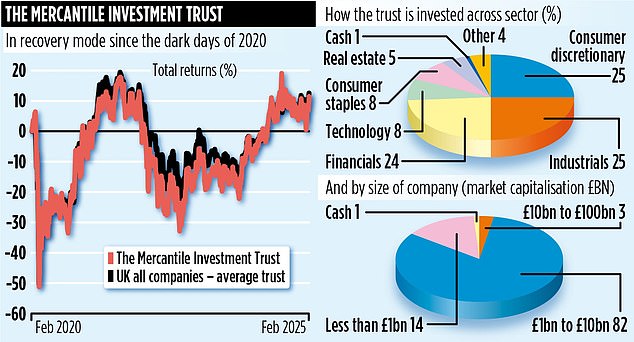

It has been a tough five years for shareholders of Mercantile Trust as the pandemic, inflation, higher mortgages and the Ukraine war have all impacted adversely on investment returns.

The £1.8 billion trust invests in a mix of smaller and mid-cap UK companies, many of which are heavily dependent on the UK economy for revenues.

The result is a meagre five-year shareholder total gain of 8 per cent, which compares poorly against the 35 per cent return from the FTSE All-Share Index.

‘The performance has been lacklustre,’ admits co-manager Guy Anderson, who works for investment house J.P. Morgan Asset Management. ‘It has been a difficult environment to operate in, and in 2022 we had too much of the portfolio in domestic consumer companies which got hit when inflation started rising and mortgage rates rose. But we’re through the worst.’

Although he admits many of the 75 companies that the trust is invested in could also be impacted by the impending increase in National Insurance bills, he is confident that they will counter it by either making cost savings or pushing up prices. He says: ‘Yes, business and consumer confidence will be hit, but I am confident that a growth narrative will eventually come through, benefiting the companies we hold. I’m excited about the opportunities ahead of us and it’s heartening that I am now seeing far more stocks that I want to buy rather than would like to sell.’

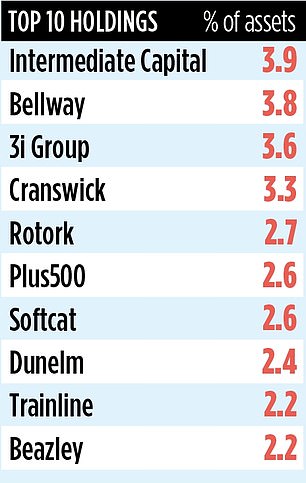

Key holdings he is bullish about include housebuilder Bellway and furniture retail giant Dunelm.

‘Bellway struggled in the pandemic and was hit by higher interest rates and mortgage rates in 2022 and 2023,’ he says. ‘But from both a housing demand and supply side, its prospects now look at lot rosier, which should be reflected in a profit rebound.’

As for Dunelm, Anderson says its ability to take market share from rivals – and its ‘operational excellence’ – stand it in good stead.

Other important stakes include those in private equity company 3i (owner of Dutch retailer Action) and wargames specialist Games Workshop which he describes as a ‘brilliant business focused on driving long-term success’.

He believes that Games Workshop’s deal allowing Amazon to make films and TV programmes based on its Warhammer universe amplifies the company’s intellectual property.

The manager, who has been at the trust’s helm since the summer of 2012, describes himself as a ‘conviction investor’. ‘Every stock I buy must have a powerful investment thesis underpinning it,’ he explains. ‘If the thesis remains intact, I hold it and I don’t let any market noise eat away my conviction in the stock. But if the thesis becomes invalid, I sell. Conviction must not become obstinance.’

Recent disposals include Close Brothers – a result of it being embroiled in the car finance scandal – and Watches Of Switzerland, which published growth targets that it was unable to meet, undermining its credibility.

Anderson’s confidence in his portfolio is demonstrated by the fact that the trust has employed some £328 million of borrowings to increase its UK equity exposure. The average cost of this debt is a tad over 4 per cent.

While the trust’s emphasis is on delivering long-term capital growth for shareholders, it also has 11 years of dividend growth under its belt. Last year’s dividend, paid quarterly, was equivalent to 7.65p a share and this year’s should be higher judged on the three payments it has so far made (4.5p compared to 4.35p previously). Ongoing charges are 0.47 per cent, the market ticker is MRC and the code: BF4JDH5.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading fees

Trading 212

Trading 212

Free dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.