“If you don’t understand what you own, you’re toast.”

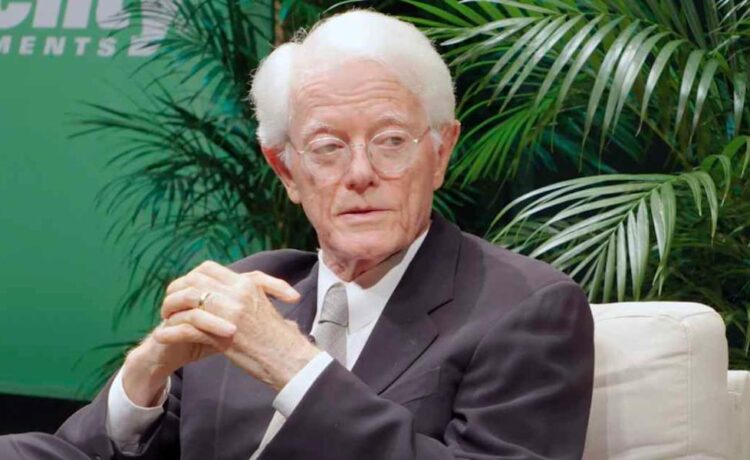

So says Peter Lynch, who made it his mantra while successfully managing Fidelity Investment’s Magellan Fund FMAGX between 1977 and 1990, averaging a 29.2% annual return and consistently outperforming the S&P 500 SPX. Lynch retired as manager at the age of 46, but at 81 remains vice chairman of Fidelity Management and Research.

The widely respected investor made the comment during an interview with Josh Brown, co-founder and CEO of Ritholtz Wealth Management, that was published on Friday. Lynch got his start as an intern at Fidelity in the 1960s after having caddied for then–Fidelity president George Sullivan at a golf course in suburban Boston.

As to knowing what you own, Lynch shared in his conversation with Brown an anecdote about a long-ago call with singer and actress Barbra Streisand, who, he said, mentioned her anxiety over ownership of several stocks and not knowing what to do with them — and not even knowing what the companies did.

“People are very careful. They spend hours getting 50 bucks off on an airplane flight. They look at everything. And they’ll put $10,000 in some crazy stock they heard [about] on the bus — you know? And they have no idea what they’re doing. And somebody invented this awful term, before I got in the business, called play the market,” he said.

“Play,” he said, is “a very dangerous verb” in this context.

“Play the market is not what you do. You buy good companies, [and] you have to know what they do,” Lynch said, adding that an investor should be able to “explain to an 11-year-old in a minute or less” what the case is for owning shares of a particular company — not just that “this sucker’s going up.”

Lynch, remaining in reflective mode, talked about something else he has been quoted as having said: that investors have lost far more money preparing for corrections or trying to anticipate corrections than in actual corrections. Similarly, in the economy, everyone, including the experts, is often wrong — for instance, two years back, in widely forecasting a recession in 2024. “I think,” Lynch joked, “economists have predicted 33 of the last 11 recessions.”