Is the unloved UK stock market finally having a moment in the sun?

The influential Bank of America Fund Manager Survey names the UK as the most preferred investment region for the next 12 months, and Alexandra Jackson, who runs the £46 million Rathbone UK Opportunities Fund, hopes it’s finally a chance to shine.

‘It’s a huge turnaround,’ she says. ‘Since 2016 the UK has been out of favour – Brexit, then successive crises including Covid, the Ukraine war and an inflation spike. No wonder global investors collectively thought ‘why bother’. That sentiment is decisively changing now.’

Jackson has stuck with the UK through the bad times. She started her career at Rathbones’ flagship Global Opportunities Fund, in 2014 she became co-manager of the new UK Opportunities Fund and took up the reins three years later.

She says she applies the same standards to the UK fund as she did when investing globally.

‘We identify factors common to shares that outperformed throughout economic cycles,’ she says. ‘Applying these factors to the UK market raises the bar on companies we invest in – they’re not just ‘good for a UK company’, they’re world class.’

With just 53 holdings and few constraints on investment choices, Jackson can afford to be picky. She says she has plenty of good options, even with significant numbers of companies relisting in the US or being taken private.

‘If we had 200 or 300 stocks in the portfolio, I’d be nervous. But 50-60 high-quality companies is still very achievable,’ she explains, describing the spate of foreign takeovers of UK stocks as a sign that companies here are ‘grossly undervalued’, and that computer company Raspberry Pi’s recent successful UK float is ‘a great first step’ to positive UK sentiment.

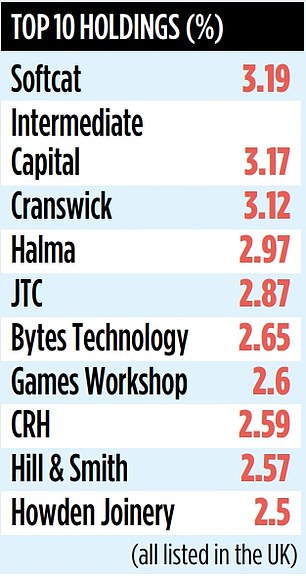

Jackson’s holdings are an eclectic bunch. Her top ten includes fitted kitchen business Howden Joinery, IT infrastructure company Softcat and fantasy roleplay expert Games Workshop.

She recently trimmed back exposure to AI-related software stocks, feeling that the tech boom had got ahead of itself. However, she’s taken a position in online greeting card provider Moonpig, hoping for value in the firm’s ‘experiences’ offering – vouchers for treats and spa days – which can be marketed to its 500,000-subscriber base.

Jackson’s approach offers investors with a UK bias something different, including a strong tilt towards mid-cap businesses. It’s a fund for those who believe British companies could grow, but is less likely to appeal to income seekers as it has just a two per cent yield.

The performance of the fund is likely to diverge from that of the complete index of UK companies because it does not hold whole sectors. For example, it owns no banks, tobacco, oil, mining, utilities or telecoms companies.

‘It’s not an ideological standpoint,’ Jackson explains. ‘It’s a result of not finding stocks in those sectors that fit our process. We’ll keep looking, though.’

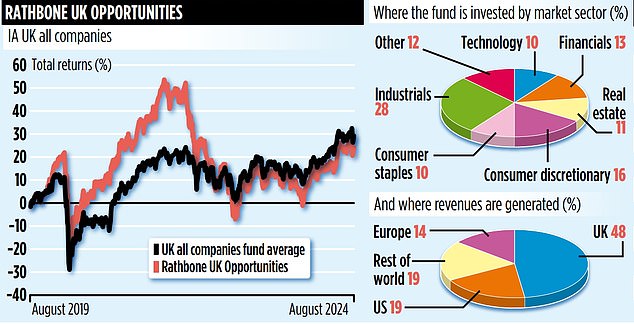

Given that the stocks are UK-based, the revenues are worldwide. Just 48 per cent of fund revenues are generated within the UK, 19 per cent from the US, 14 per cent from Europe and another 19 per cent from the rest of the world.

‘We like the geographic diversification this split offers in volatile geopolitical times,’ Jackson says.

UK Opportunities is up 14 per cent this year, narrowly above its UK All Companies benchmark, but it is down 11 per cent over three years and up 23 per cent over five.

- Rathbone UK Opportunities has an ongoing fee of 0.63 per cent and its stock market identification code is B77H7W3.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading fees

Trading 212

Trading 212

Free dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.