Famed investing legend Peter Lynch once noted, “insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.”

It suggests investors should ignore insider selling as background noise and to focus on the company’s business. After all, the executives might have a child’s college education to pay for, are putting a new addition on their house, or want to install a jacuzzi.

Selling when the stock is falling, though, can signal a belief it is overvalued and the insider lacks confidence it can hold on or recover.

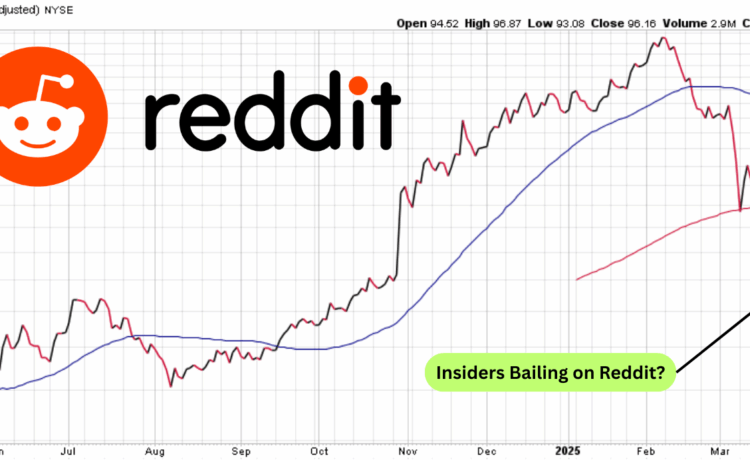

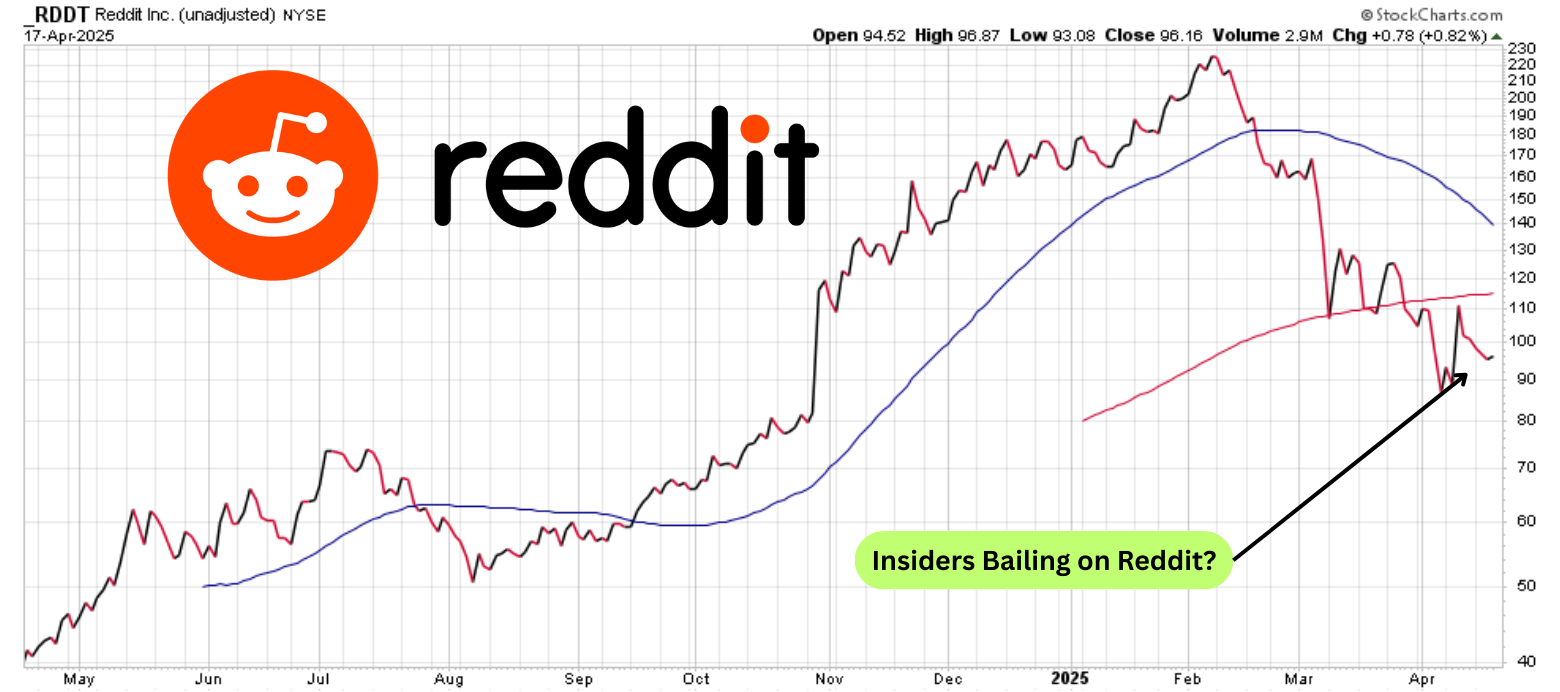

That’s why investors have noticed Reddit (RDDT) COO Jennifer Wong dumping 33,334 shares of RDDT stock valued at more than $3.1 million last Wednesday. Shares of the social media stock have been falling hard since hitting an all-time high of $230 per share in February.

A poorly received earnings report sent RDDT stock careening lower and Reddit now trades 58% below that peak. What investors want to know is whether Wong is getting out ahead of a further collapse or is this just the background noise Lynch warned about.

Clouds On the Horizon

On the surface, Reddit’s fourth quarter earnings report was upbeat. Revenue rose 72% year-over-year to $428 million while net income surged to $71 million, or $0.36 per share, versus $18.5 million, compared to essentially break-even.

What concerned the market was the stock’s valuation after the big run-up in price (a near 600% gain since its IPO), AI’s long-term durability, and Reddit’s ability to keep users engaged.

Just 45% of its users were logged into the site in the fourth quarter, a 49% drop from last year before and slightly lower than the number logged on in the third quarter.

User engagement is important to the social media site because Reddit’s business is built on participation. Without logging in, users can’t create posts or comment on other posts. Despite logged in users growing 27% year-over-year, the number of logged out users grew 70%. That means over half of all of Reddit’s 379.4 million daily active users are just passing through the site.

It’s clear the market thought RDDT stock was overvalued as the number of sales sold short had risen 27% in just one month. The stock is still richly valued, trading at 44 times next year’s earnings and over 13 times sales, even after the big haircut in price.

Digging into the details

That’s why investors might be worried about Wong’s big stock sale. While the transactions occurred on Wednesday, her Form 4 wasn’t filed with the Securities & Exchange Commission until late Friday evening.

Friday was also Good Friday and the stock market was closed. Long weekends are typically when companies release bad news to bury them when people aren’t paying attention. Wong’s filing, of course, may not be so nefarious, so let’s look closer at the stock sales.

A series of four transactions were made between $92.27 per share and $95.11 per share, and the stock ended up rising less than 1% the following day to close at $96.16 before the holiday weekend.

While Wong sold some 33,000 shares, she still owns well over 1.4 million shares. So while the dollar amount sold was significant, the share count represented just 2% of her holdings. There were two notable points in the filing as well.

First, the stock was the result of a 10b5-1 stock trading plan, a rule adopted by the SEC to protect executives and companies from charges of insider trading. It allows them to legally buy or sell shares in their company even if they are aware of material non-public information so long as the trade was specifically laid out in a plan before the executive or company became aware of the information. This suggests Wong’s stock sale wasn’t just a quick exit before the stock fell further.

The second point is it was an exercise of stock options that gave Wong the right to buy the shares at $5 each. She clearly made a tidy profit on the transaction by selling the stock afterward, but this transaction seems to be a clear case of the insider selling being Lynch’s background noise.

Key Takeaway

Wall Street still has a bullish outlook on RDDT stock with a $142 per share price target implying 48% upside in the stock. I still believe there is a lot of air beneath the stock and until it figures out how to grow its user base and get them to engage with the platform, it will trend lower before going higher.

This insider sale, however, is much ado about nothing.