In the euphoria of a bull market, every sector, no matter how niche, tends to show an upward trend. Investors and traders often see these market phases as easy money opportunities, where every dip is aggressively bought, and profitable exits seem like a given.

When the market cycle turns, the true challenge arises. The once-euphoric traders of 2024 often find themselves caught in a trap, holding onto their investments in 2025, hoping that the prices will eventually return to their previous highs.

One sector that saw considerable hype and growth between 2021 and 2024 was defence. Many defence stocks, like Hindustan Aeronautical Ltd (HAL) and Bharat Electronics Ltd (BEL), experienced significant gains during this period, making them attractive choices for both traders and investors. But with market dynamics evolving and the bull run appearing to slow, one pressing question is: Has the defence theme played out, or is it still worth considering in 2025?

The Defence theme: A booming sector?

Between 2021 and 2024, India’s defence sector gained significant attention due to increased domestic defence spending, the push for indigenisation under the ‘Atmanirbhar Bharat’ initiative, and the heightened geopolitical tensions that increased demand for national security equipment. Companies like HAL and BEL benefitted immensely from these trends. However, as the market sentiment shifts in 2025, it is essential to critically assess whether these stocks still offer significant upside potential or have already peaked.

While a comprehensive analysis of the entire Indian defence sector is limited due to the lack of historical data on the Nifty India Defence Index, we can analyse two of the major giants in this space – Hindustan Aeronautics Ltd (HAL) and Bharat Electronics Ltd (BEL). Their respective stock charts provide valuable insights into the possible future trends of defence stocks.

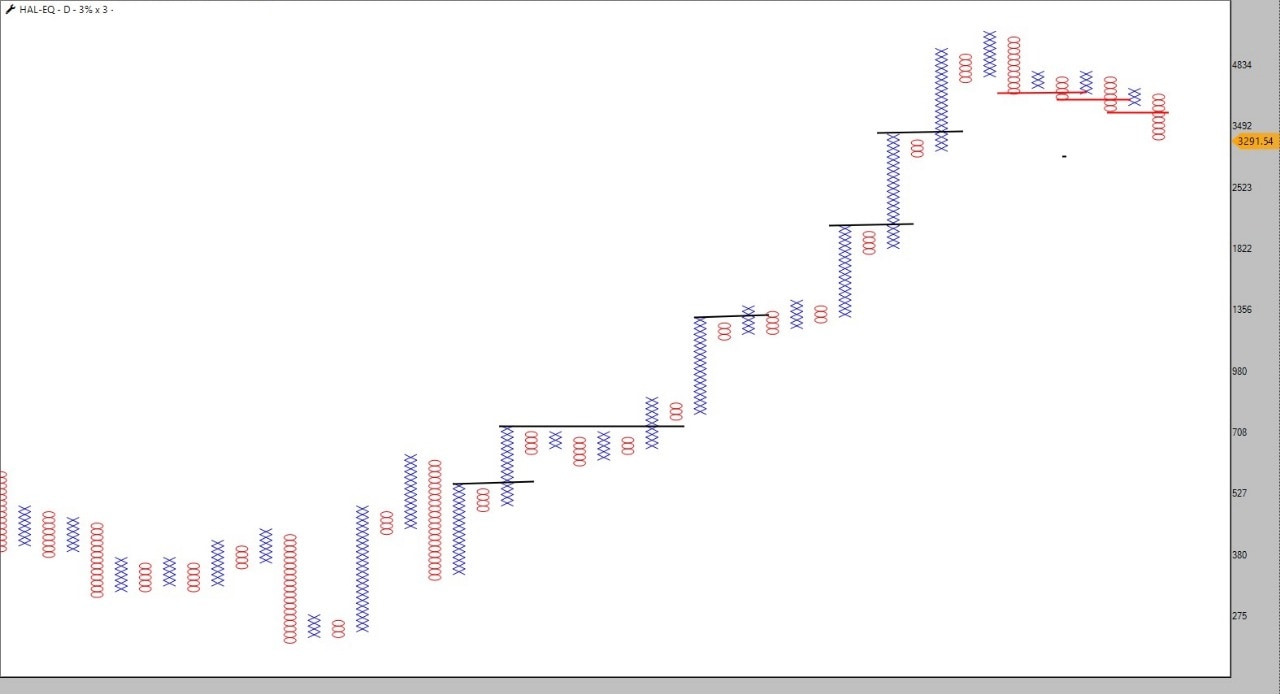

Hindustan Aeronautics Ltd (HAL)

Hindustan Aeronautics Ltd (HAL) is one of the most prominent names in the Indian defence sector. HAL designs, develops, manufactures, and maintains aircraft, helicopters, and related systems for the Indian Armed Forces. As a key player in the aviation segment, HAL has benefitted from increased defence spending and long-term contracts with the government.

Source: TradePoint, Definedge Securities

When analysing HAL’s stock price movements, we can observe that the stock underwent a bullish phase during the past few years. Using a 3% X 3 Daily Point & Figure (P&F) Chart, we can see that the stock price experienced a series of bullish anchor columns, a pattern of a strong bullish trend.

In a P&F chart, an Anchor Column refers to a series of 15 or more X’s (indicating upward movement) or O’s (indicating downward movement), signalling an established trend.

Till Q3 of 2024, HAL continued its bullish trend with strong buy signals. However, this momentum shifted in 2025, and the chart shows the emergence of a bearish anchor column that suggests a weakening of the bullish trend. Additionally, the chart indicates the presence of double-bottom sell signals, which further point to a potential slowdown in the stock’s upward movement.

The potential bullish trend change level for the stock is around 4,300. If the stock closes above this level, it could signal a potential bullish trend.

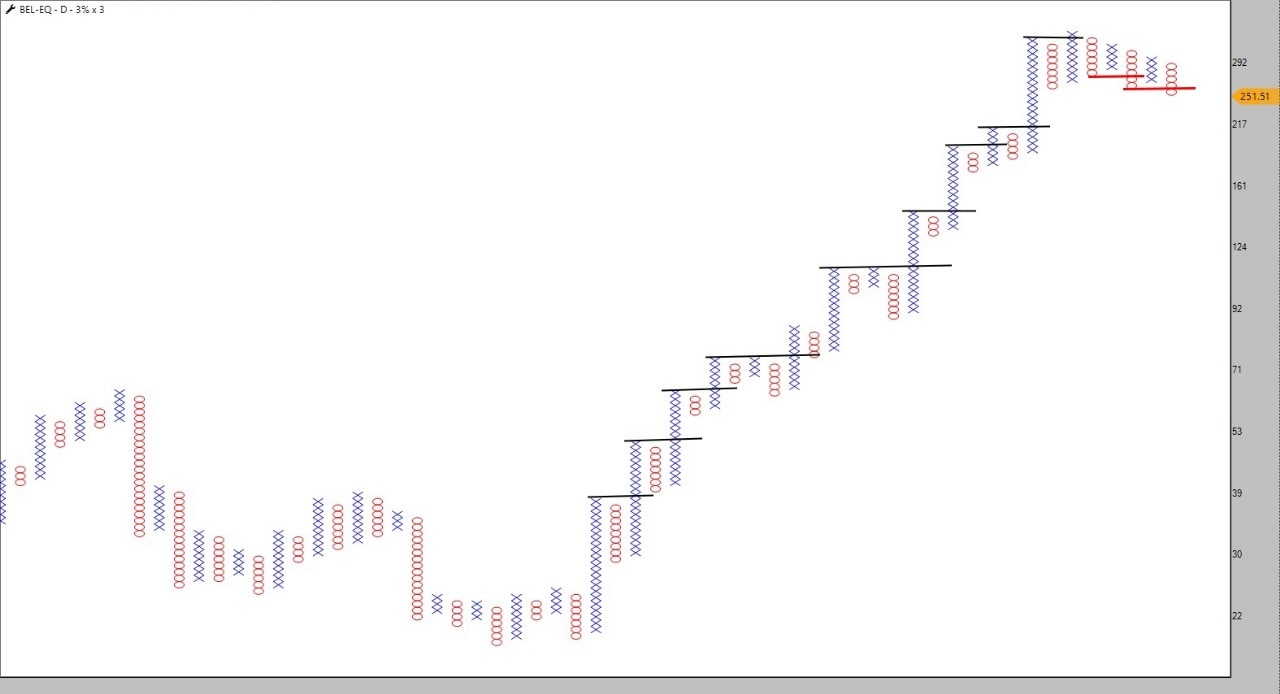

Bharat Electronics Ltd (BEL)

Similar to HAL, Bharat Electronics Ltd (BEL) is another heavyweight in the Indian defence sector. BEL manufactures advanced electronic products for Indian defence services, including radar systems, electronic warfare systems, and communications equipment. With the increasing emphasis on technological advancements in national security, BEL has been a key beneficiary of the government’s focus on modernising India’s defence infrastructure.

Source: TradePoint, Definedge Securities

The chart shows a pattern similar to that of HAL. The stock had a series of bullish anchor columns, indicating strong momentum in the earlier part of the cycle. However, similar to HAL, BEL’s share price trend has now shown signs of weakening. The price has recently experienced a triangle breakdown followed by a double-bottom sell pattern, which indicates that the bears are now gaining control, and the stock is facing increased selling pressure.

Investors looking to track BEL’s future movements should watch for a close above 300. If the stock breaks above this level, it could suggest that the bulls are coming back. Conversely, if the stock fails to surpass this resistance, it may signal further downside risk.

The cautionary tale: Is the Defence Sector over?

Despite the optimism surrounding the defence sector in recent years, there are growing concerns that the sector may have already priced in most of its growth prospects. The stocks of HAL and BEL have seen substantial price appreciation, and the current technical indicators suggest that the bullish momentum has slowed, if not reversed.

As with any cyclical theme, timing the entry and exit is crucial, and investors need to be aware that the defence sector’s growth might not be as strong in 2025 as it was in previous years. While long-term structural growth in India’s defence capabilities and continued government spending on national security remain important, the stock market is always ahead of the curve. The market has already priced in the expected growth from these companies, and any future gains could be slower or more volatile.

Additionally, external factors such as geopolitical stability, government policy shifts, and global defence spending will continue to significantly influence the performance of defence stocks. If any of these factors take an unexpected turn, the sector could experience a downturn.

Disclaimer

Note: We have relied on data from http://www.definedgesecurities.com throughout this article. Only in cases where the data was unavailable have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Brijesh Bhatia has over 18 years of experience in India’s financial markets as a trader and technical analyst. He has worked with the likes of UTI, Asit C Mehta, and Edelweiss Securities. Presently he is an analyst at Definedge.

Disclosure: The writer and his dependents do not hold the Stocks discussed in this article. However, clients of Definedge may or may not own these securities.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.