While large-cap sectors like IT and pharma spearheaded the initial surge, a remarkable transformation began to unfold. Sectors that had languished for over a decade, such as public-sector banks (PSU banks), realty, infrastructure, central public sector enterprises, and metals, began to rise, signalling a profound shift in market dynamics.

Read this | In 2024, metals sector poised for gradual turnaround

Between 2011 and 2020, sectors like PSU Banks, Realty, Infra, CPSE, and Metals struggled to gain traction, largely ignored by investors. However, from 2021 to July 2024, these once-overlooked sectors have made a strong comeback, displaying newfound strength and resilience.

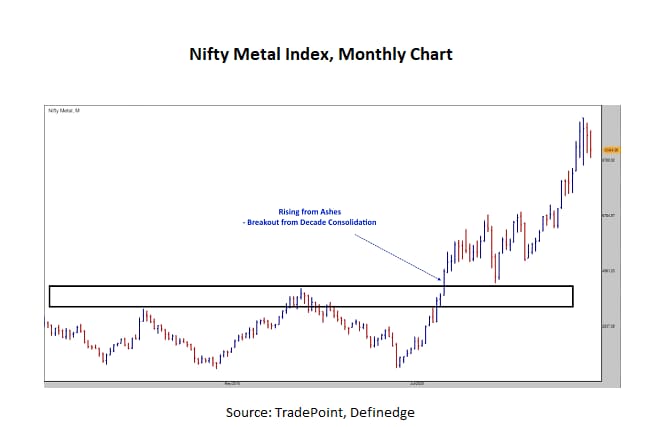

Metals: From dormancy to dominance

Among the resurgent sectors, the metals sector stand out. The sector, encompassing copper, nickel, steel, aluminium, lead, and zinc, plays a vital role in the global economy and trade.

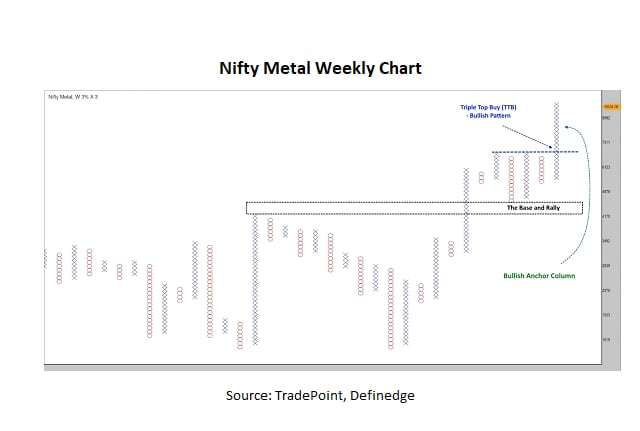

After years of consolidation, the Nifty Metal Index has finally broken out, signalling a significant shift in market dynamics.

View Full Image

Copper: Leading the charge

Copper is often seen as a barometer for the global economy. Prices of the benchmark US COMEX Copper have surged by over 160% from pandemic lows.

Historically, copper has led the way for other base metals, with its price movements often signalling broader market trends. However, the post-pandemic “new normal” has introduced anomalies, with some base metals no longer closely following copper’s lead.

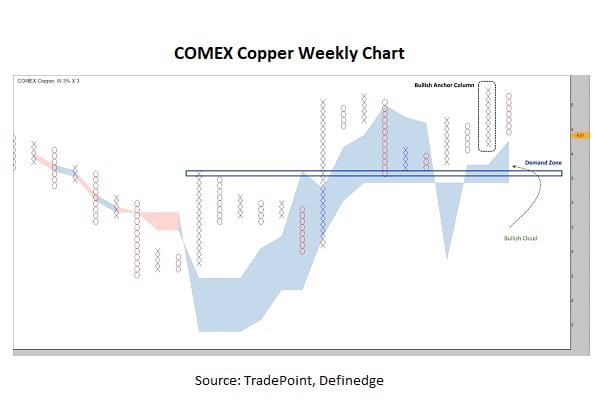

The copper market has remained bullish, as illustrated by the Point & Figure (P&F) chart—a tool that eliminates noise by focusing solely on significant price movements.

P&F charts, used in technical analysis, differ from traditional charts by disregarding the influence of time. Instead, they focus on substantial price changes, filtering out minor fluctuations. In this method, ‘X’ represents bullish moves, while ‘O’ indicates bearish trends.

View Full Image

On the weekly 3% X 3 P&F chart, copper prices have pulled back from their highs but continue to exhibit a strong bullish trend, evidenced by a Bullish Anchor Column with over 15-X. Prices remain above the D-Smart Line, suggesting that the bulls are still in control.

The D-Smart Line, a proprietary indicator, combines the Running Line (RL) and the Walking Line (WL). Blue clouds indicate a bullish trend (RL above WL), while red clouds denote a bearish trend (RL below WL).

For copper, the $3-3.30 range now serves as a crucial support zone within the bullish cloud, indicating the potential for further upward movement through 2024 and possibly into 2025.

Given this bullish outlook, investors should closely monitor Hindustan Copper, a significant player in this space.

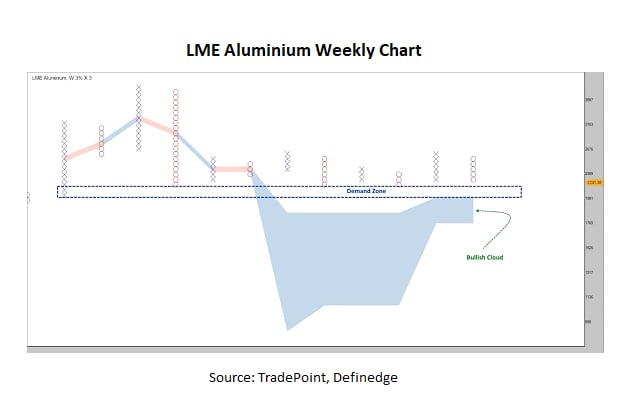

Aluminium: Poised in the demand zone

The weekly 3% X 3 P&F chart for LME Aluminium reveals that prices are trending above the bullish cloud of the D-Smart Line. Although a breakout may take time, the long-term technical structure remains bullish. Investors might consider monitoring stocks like National Aluminium and Hindalco.

View Full Image

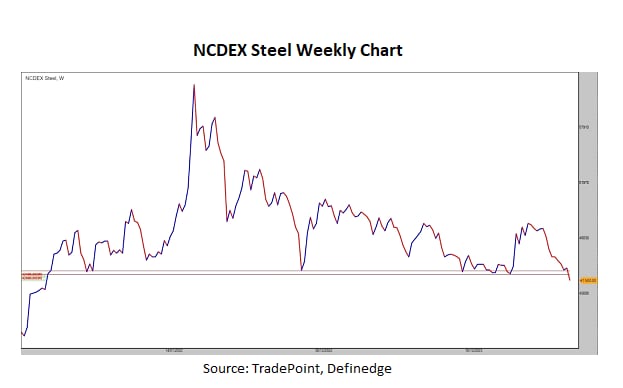

Steel: Facing headwinds

Steel, a vital component of the metals industry, has faced significant challenges recently. Prices at mandi Gobindgarh, Punjab—a key benchmark in India—have plunged to a 52-week low, underperforming other metals due to domestic factors.

View Full Image

Unlike copper and aluminium, which have shown more resilience, steel prices have struggled, hovering near their demand zone without gaining upward momentum.

More here | Steel prices dip to the lowest in 3 years, hurt by Chinese oversupply

The Point & Figure (P&F) chart for steel reveals a clear breakdown below a critical support zone, now turned resistance at ₹42,000-43,000. This level is likely to serve as a supply zone, suggesting a bearish outlook for major steel producers like Tata Steel, Jindal Steel, and JSW Steel.

Is the metals rally losing steam?

Despite the setbacks in steel, the broader metals rally may not be over. Markets rarely move in a straight line; instead, they often follow zigzag patterns, creating opportunities for re-entry.

View Full Image

The long-term chart of the Nifty Metal Index continues to exhibit a bullish trend, having recently broken out of a Triple Top Bullish (TTB) pattern. This breakout has produced a Bullish Anchor Column, signalling sustained upward momentum.

While recent trends point to consolidation, the long-term outlook remains optimistic. A breakout above 9,700 could reignite the sector’s bullish momentum. For investors, patience could be crucial, as the sector may be on the verge of another surge.

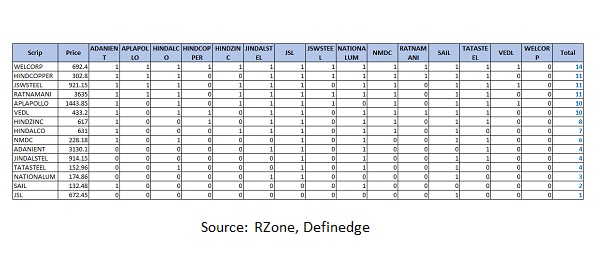

Relative Strength Matrix: Identifying momentum stocks

Developed by Definedge, the Ultimate Matrix is a novel tool designed to assess the relative strength of stocks within a sector.

This matrix compares the performance of each stock against its peers. A stock scores 1 if its performance is bullish relative to another, and 0 if bearish. Stocks with higher total scores are considered outperformers within the group. These scores, derived from P&F charts, serve as reliable indicators of momentum.

View Full Image

Applying the Relative Strength Matrix to Nifty Metal stocks using a 1% X 3 P&F chart can help identify which stocks are leading and which are lagging, enabling more informed investment decisions.

Metals sector in 2024 and beyond

After a decade of underperformance, the metals sector has emerged as one of the market’s most promising areas. Despite the challenges in steel, the overall outlook remains bullish, particularly for base metals like copper and aluminium.

As the saying goes, “Good things come to those who wait.” For metals stocks, patience may well be rewarded as the sector continues to evolve in this new normal.

Note: The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Brijesh Bhatia has over 18 years of experience in India’s financial markets as a trader and technical analyst. He has worked with the likes of UTI, Asit C Mehta, and Edelweiss Securities. Presently he is an analyst at Definedge.

Disclosure: The writer or his dependents may or may not hold the stocks/commodities/cryptos/any other asset discussed here as per SEBI guidelines.