If you are looking for a dividend ETF, choose the one that invests like you would if you bought individual stocks.

Investing is hard work and, for some people, that work is better left to a professional. Hiring a professional saves you time and money that you can put to better use elsewhere, such as enjoying the company of family and friends. If you are a dividend lover, Schwab U.S. Dividend Equity ETF (SCHD 0.14%) is a great high-yield exchange-traded fund (ETF) to consider buying right now.

What does Schwab U.S. Dividend Equity ETF do?

Schwab U.S. Dividend Equity ETF is an index-tracking exchange-traded fund. That’s neither good nor bad; it just means that you really need to understand what the index is doing to understand what you are buying when you invest in the ETF. The index in question is the Dow Jones U.S. Dividend 100 Index.

Image source: Getty Images.

As the index name implies, it owns 100 stocks. The beauty of the index, however, is how it goes about identifying those 100 stocks.

The first step is to examine only companies that have increased their dividends annually for at least a decade, excluding real estate investment trusts. This isn’t unique; other ETFs do the same thing.

The magic happens in the next step, which is creating a composite score for all the stocks being considered. The composite score includes cash flow to total debt, return on equity, dividend yield, and a company’s five-year dividend growth rate. Without getting into too much detail, the goal is to find financially strong companies (cash flow to total debt) that are well run (return on equity) and that have attractive yields (dividend yield) and a record of attractive dividend growth (five-year dividend growth rate). These are the same factors that dividend investors typically consider when purchasing a stock.

The 100 companies with the highest composite scores are included in the index and in the ETF. A market cap weighting is used, so the largest companies have the biggest impact on performance. The portfolio is updated annually. Despite what is a fairly extensive screening process, the expense ratio is a very modest 0.06%.

Schwab U.S. Dividend Equity ETF

Today’s Change

(-0.14%) $-0.04

Current Price

$27.71

Key Data Points

Market Cap

$0B

Day’s Range

$27.70 – $27.90

52wk Range

$23.87 – $29.01

Volume

14M

Avg Vol

0

Gross Margin

0.00%

Dividend Yield

N/A

Schwab U.S. Dividend Equity ETF offers a balance

The truth is, Schwab U.S. Dividend Equity ETF isn’t the highest-yielding stock-focused ETF you can buy. Nor is it the best-performing stock ETF you can buy. Rather, it strikes a middle ground, offering an attractive yield, reasonable capital growth over time, and fairly attractive dividend growth.

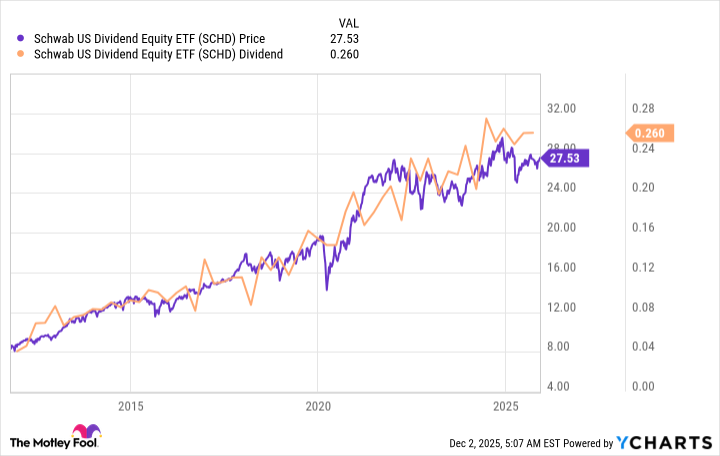

In the real world that means a roughly 3.8% dividend yield, a dividend that has generally headed higher over time, a share price that has also trended generally higher over time. That’s a pretty good compromise for investors who don’t want to put in the work of searching through Wall Street to create a portfolio of dividend stocks. And then maintain that portfolio year after year.

Schwab U.S. Dividend Equity ETF isn’t perfect, but no investment approach is perfect. In fact, the portfolio is slightly out of step with the market right now, as it is underweight in technology (8% of the portfolio) and more heavily focused on the energy (19%), consumer staples (18%), and healthcare (16%) sectors.

While technology is leading the market today, that won’t last forever. When the market starts rewarding well-run companies in other sectors, Schwab U.S. Dividend Equity will be there to benefit.

Don’t miss out on Schwab U.S. Dividend Equity

When it comes to ETFs that track indexes, you don’t want to chase performance. You want to have a deep understanding of what the ETF is actually doing. If the index construction is strong, as is the case with the index Schwab U.S. Dividend Equity is tracking, the ETF is probably worth buying.

Right now, a $1,000 investment in this ETF will allow you to buy roughly 36 shares. And, given the modest exposure to technology stocks, you’ll be adding important diversification that many other ETFs lack, including S&P 500 (^GSPC +0.19%) tracking ETFs where tech makes up a huge 36% of the index.