Pipeline master limited partnerships (MLPs) have been on a solid run recently. The Alerian MLP Infrastructure Index, which tracks the sector, generated a total return of 26.7% in 2024 and is up nearly 10% year to date as of this writing.

The MLP pipeline sector is drawing investor interest due to the stocks’ strong distribution payments, robust yields, historically low valuations, and increasing growth opportunities stemming from growing natural gas demand. However, one of my favorite stocks in the sector is Energy Transfer (ET -0.92%).

Let’s look at why I think Energy Transfer is a solid investment option for investors looking to dip their toe into the sector with an investment of a couple thousand dollars.

Growing growth opportunities

Energy Transfer owns one the largest integrated midstream systems in the country, with which it transports, stores, and processes various hydrocarbons. The company is very well situated in the Permian Basin in Western Texas, an oil basin that has some of the best drilling economics in the U.S. This area also has some of the cheapest associated natural gas in the country due to a lack of natural gas takeaway in the region.

With growing energy needs stemming from artificial intelligence (AI) and natural gas exports, Energy Transfer is well-positioned given its access to cheap natural gas. Prices at the Waha hub near the Permian typically trade at a discount and even fell into negative territory at points last year.

To take advantage of the growing opportunities it is seeing, Energy Transfer plans to significantly boost its growth capital expenditure (capex) this year, taking it to $5 billion in 2025 from $3 billion last year. Much of this spending will be directed toward projects in and around the Permian, including its new Hugh Brinson Pipeline, which will take residue natural gas away from the Permian to support increasing demand from power companies and data centers in Texas.

Energy Transfer recently signed its first agreement to directly provide natural gas to data center developer CloudBurst in Central Texas, while it says it has had requests to connect to about 70 data centers in 12 states. It’s also seeing strong inbound inquiries from power plants, including more than 60 plants it doesn’t currently serve in 13 states and 15 plants it does.

Energy Transfer is projecting mid-teens returns on its growth projects. Given that most of these projects won’t be complete until later 2025 or 2026, the increased capex should have a larger impact on the growth of earnings before interest, taxes, depreciation, and amortization (EBITDA) in 2026 and 2027.

Image source: Getty Images.

A robust and growing distribution

While Energy Transfer is set to ramp up growth, the company also has a robust and attractively growing distribution. Last quarter, it increased its distribution by 3.2% year over year to $0.325, good for a forward yield of about 6.5%. It is looking to grow its distribution by 3% to 5% per year from now on.

The distribution is well covered by its distributable cash flow (DCF), which is operating cash flow minus maintenance capex. On that basis, it had a 1.8 distribution coverage ratio last quarter, generating $1.98 billion in DCF and paying out $1.12 billion in distributions. For the year, it produced DCF of $8.36 billion and paid out $4.39 billion in distributions. That allowed its cash flow to easily pay for its $3 billion growth capex.

With the jump in growth capex to $5 billion in 2025, Energy Transfer should be able to pay out around $4.5 billion in distributions (assuming a 3% increase) and have it covered by its growing DCF. However, it will be very tight. That said, the company has really improved its balance sheet and leverage over the past few years, so it is in good shape to pursue these additional opportunities.

An attractive value

Despite its strong performance and burgeoning growth opportunities, Energy Transfer continues to trade at both a relative and a historical discount.

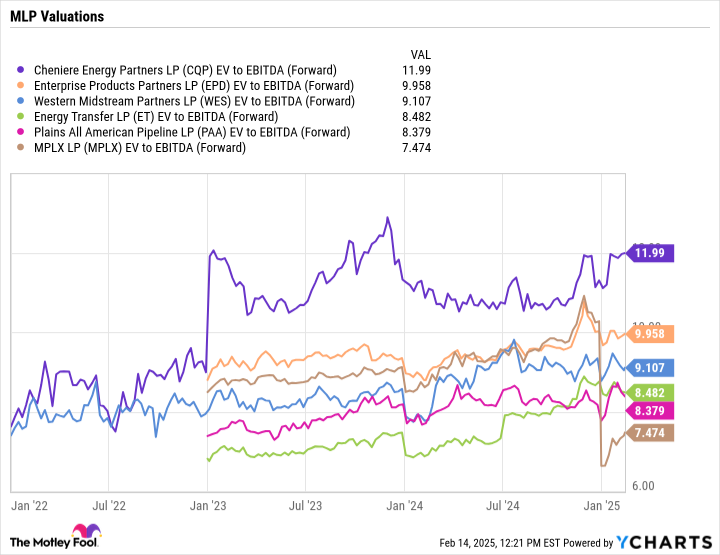

The most common way to value MLPs is on the basis of enterprise value (EV) to EBITDA, as this metric takes into account the net debt to build infrastructure and removes noncash costs such as depreciation to help capture the true current economics of an MLP’s assets.

Enterprise trades at an EV/EBITDA multiple of 8.5 based on 2025 analyst estimates, which is toward the low end of valuations in the group.

CQP EV to EBITDA (Forward) data by YCharts

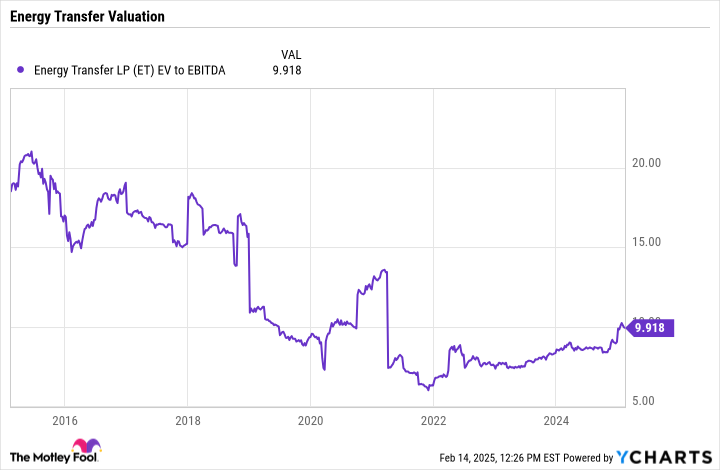

ET EV to EBITDA data by YCharts

It’s also well below where the stock traded before the pandemic, when it often had an EV/EBITDA multiple above 15. Meanwhile, the midstream MLP group as a whole traded at an average EV/EBITDA multiple of 13.7 between 2011 and 2016.

Overall, Energy Transfer is an inexpensive stock with an attractive yield that is seeing a lot of growth opportunities. This makes it a good stock for investors looking to start making an investment in the sector, as it offers solid distribution income and price appreciation potential.