If you’re feeling overwhelmed by the stock market right now, you’re not alone. The S&P 500 had one of its fastest drops on record in early April, and the Nasdaq Composite hurtled into a bear market, falling more than 20% from its high just in February.

President Donald Trump’s trade war with just about every U.S. trading partner and signs of a weakening economy have put investors into a defensive position, and it’s unclear when or how this period of uncertainty is going to end.

At times like these, picking individual stocks is especially difficult so it’s worth considering investing in exchange-traded funds (ETF) as an alternative. These investments trade like stocks, but they do the hard work of choosing the stocks for you, typically for a nominal fee. ETFs are either actively managed, meaning a fund manager will buy and sell the stocks inside it, or they track an index like the S&P 500.

If you have $250 in available funds and you’re looking for a tech ETF to invest in to capitalize on the recent sell-off, one of the best choices out there is the VanEck Semiconductor ETF (SMH -0.56%).

Image source: Getty Images.

A winning growth ETF

The VanEck Semiconductor ETF tracks the MVIS US Listed Semiconductor 25 Index, which aims to follow the overall performance of companies in the semiconductor production and equipment industry.

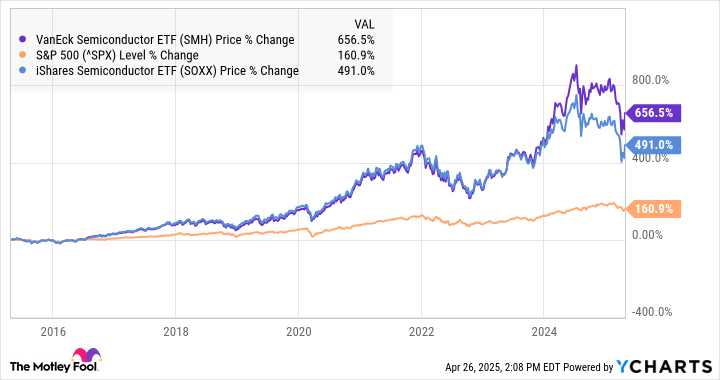

The ETF has a long track record of beating the market, as the chart below shows.

Data by YCharts.

As you can see from the chart, not only has the VanEck ETF trounced the S&P 500, but it’s also beaten its rival iShares Semiconductor ETF (SOXX -0.16%). That gap between the SMH and the SOXX is owed to the SMH’s increased concentration.

The table below shows the fund’s top 10 holdings.

| Rank/Stock | Weighting | Rank/Stock | Weighting |

|---|---|---|---|

| 1. Nvidia | 19.6% | 6. Texas Instruments | 4.8% |

| 2. Taiwan Semiconductor | 11.1% | 7. Advanced Micro Devices | 4.8% |

| 3. Broadcom | 7.8% | 8. Analog Devices | 4.6% |

| 4. Qualcomm | 5.3% | 9. Applied Materials | 4.6% |

| 5. ASML | 4.9% | 10. KLA | 4.3% |

Data source: VanEck Semiconductor ETF.

As you can see, the ETF is highly concentrated in Nvidia, TSMC, and Broadcom stocks, which make up nearly 40% of the fund.

All three of those stocks have performed well in recent years and are considered leaders in the AI boom. They have also driven the fund’s recent outperformance, which has come from the AI leadership of those three stocks.

Why the VanEck Semiconductor ETF is a buy

The SMH’s track record speaks for itself as few stocks, let alone ETFs, have jumped by 600% over the last decade. However, past performance does not guarantee future returns in the stock market.

Still, the VanEck Semiconductor ETF looks well-positioned to keep outperforming the stock market. Its top stocks are still growing rapidly, and the fund trades at a relatively modest price-to-earnings ratio of 32, compared to the S&P 500 at 24.5.

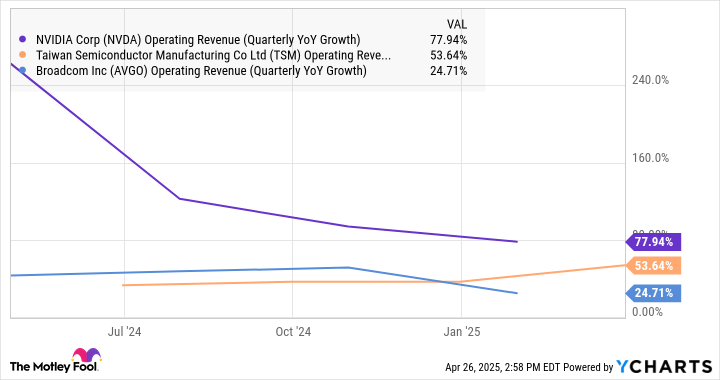

That does represent a premium to the broad market, but it seems deserved based on the growth rates of its top three holdings.

Data by YCharts.

The average revenue growth rate of these three stocks is about 50%, which is much faster than the overall market, and TSMC’s revenue growth rate even accelerated in its most recent quarter, showing that the AI boom driving these stocks is far from over.

Over the longer term, the need for semiconductors should only continue to grow, driven by AI and future technologies that the market isn’t yet pricing in. Meanwhile, the top chip stocks have all built formidable competitive advantages, which should help them continue to outperform the broad market.

While the coming months are likely to remain volatile, the VanEck Semiconductor ETF should continue to deliver strong growth over the long term thanks to the strength of its top holdings and increasing demand for semiconductors. That should provide an outsized return for your $250 investment.

Jeremy Bowman has positions in ASML, Advanced Micro Devices, Broadcom, Nvidia, Taiwan Semiconductor Manufacturing, and VanEck ETF Trust-VanEck Semiconductor ETF. The Motley Fool has positions in and recommends ASML, Advanced Micro Devices, Applied Materials, Nvidia, Qualcomm, Taiwan Semiconductor Manufacturing, Texas Instruments, and iShares Trust-iShares Semiconductor ETF. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.