Alabama‘s Tommy Tuberville trades more stocks than any other member of the U.S. Senate, finding himself on lists of top congressional traders with the likes of Democratic Rep. Nancy Pelosi and Republican Sen. Markwayne Mullin.

Tuberville’s not the richest member of Congress and he may not be the most successful trader. But his trading does catch a lot of attention. Tuberville’s stock trading activity has drawn so much public scrutiny that he’s one of just six individuals featured on an investment app’s “invest like a politician” list.

And the timing of some of his trades, and his holdings of some agricultural commodities and foreign stocks, have raised questions and sparked headlines.

Tuberville’s trading has been highlighted over the last several years in a slew of media coverage. He’s noted as a top trader in a New York Times analysis of lawmakers trading stocks related to their committees. Financial trade publications have called out Tuberville’s “suspicious” Apple stock trade ahead of a market downturn for the tech company in early April, as well as his disclosure in 2023 of $250,000 in futures trading for wheat, corn, cattle and soybeans and his trading of foreign and defense-related stocks.

AL.com reviewed all of Tuberville’s annual and periodic disclosures about his trading activity for the last six years. Here’s what we found:

- Tuberville frequently makes trades of risky stock options, as well as trades stock and commodities in industries overseen by Senate committees he serves on.

- It’s impossible to know exactly how much money he makes. That’s despite him reporting more than 1,000 trades in four years.

- He has requested extensions in order to file each of his annual financial reports past the deadline.

- Katie Britt, Alabama‘s other senator, trades differently and far less often than Tuberville. She reported selling only one individual company stock since she first announced her candidacy in 2021.

- Most members of Congress, from both parties, don’t report much stock trading.

There’s an app for that

The “Tuberville Tracker” from the investment app Autopilot follows the trading activity of the former Auburn football coach-turned-senator, allowing users to connect their brokerage accounts and buy stock positions that replicate Tuberville’s portfolio.

The description on the hedge fund tracker reads: “Tommy Tuberville is a Republican Senator from Alabama who famously said if Politicians weren’t allowed to trade, ‘I think it would really cut back on the amount of people that would want to come up here and serve.’

“So since he’s so passionate about trading, here’s the official portfolio to copy him,” the description continues.

And there’s a lot to track.

Since he took office in January 2021, Tuberville has reported making more than 1,300 stock trades. That’s more than any other member of the U.S. Senate, according to Unusual Whales, a startup that helps investors track market activity. And he trails only a small number of House members.

Among all 535 members of Congress, he claims the No. 12 spot for most trade activity. He’s fifth when looking at just Republicans, according to Unusual Whales.

Read more: Tuberville for governor? Senator ‘praying’ about 2026

Autopilot’s app also tracks five other prolific colleagues in Congress and the White House, plus other nonpolitical top investors. Those include former Speaker of the House and Rep. Nancy Pelosi, D-California, and Vice President J.D. Vance, formerly a Republican Senator from Ohio.

Meanwhile, Tuberville has disavowed legislative proposals to ban individual stock trading for members of Congress, despite national scrutiny over his especially active trading and late disclosures. In 2022, he told The Independent that the ban would discourage lawmakers from serving in Congress.

“I think it’s ridiculous. They might as well start sending robots up here,” Tuberville said at the time. “I think it would really cut back on the amount of people that would want to come up here and serve.”

Tuberville’s office did not respond to repeated calls and emails seeking comment for this article.

How much is he trading?

It’s impossible to know Tuberville’s exact income and net worth.

Senate reporting guidelines only require a dollar range for his assets, including stock and stock options, real estate, debt and bank deposits.

By the end of 2023, the Tubervilles’ net worth ranged between $5 million and $19.6 million, according to an AL.com analysis of his assets and liabilities listed in his annual financial disclosure form.

Individually or with his wife, Tuberville owned more than 310 individual stocks, stock options and commodities, according to his 2023 annual report, the latest on file.

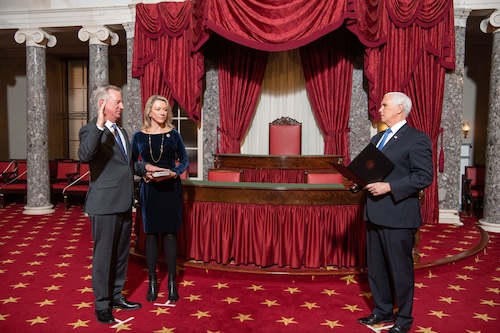

U.S. Senator Tommy Tuberville, R-Alabama, was sworn-in to the United States Senate on Jan. 3, 2021. From left: Tuberville, wife Suzanne Tuberville and U.S. Vice President Mike Pence. (Photo by U.S. Senate Photographic Services)

That year, Tuberville, individually and with his wife, Suzanne Tuberville, bought between $2.5 million and $7.7 million worth of stock, stock options and commodities, and sold nearly the same range, according to his most recent annual disclosure form.

It’s also hard to pinpoint exactly the value of Tuberville’s trades, or whether he’s bringing in profit. Senators are required to file disclosure forms with broad ranges, not exact values. So for example, a trade valued at $4.3 million would be listed as falling in between $1 and $5 million.

But the disclosure forms do spell out how frequently Tuberville buys and sells stock.

In 2024, Tuberville and his wife reported 270 trades of stock, stock options and commodities, according to periodic transaction reports the senator filed with the U.S. Senate.

In 2023, they reported more than 400 stock trades, ranking in the top five for members of Congress with the highest trading activity, per Unusual Whales.

The Tubervilles reported more than 380 trades in 2022 and nearly 280 in 2021.

“Generally speaking, members of Congress do not trade that often,” said Danielle Caputo, with the Campaign Legal Center, a nonpartisan group that monitors rule-following for elected officials. “There are certainly some members that do trade at that same kind of level, but he certainly is at the higher end.”

So far this year, the couple’s trading appears to have slowed down; Tuberville reported just six stock transactions in January.

The majority of congressional members disclose fewer than 100 stock trades per year, according to Unusual Whales.

Tuberville also pursues options trading, which the Wall Street Journal calls “thrill-seeking” and a strategy that’s grown in popularity among “daredevil traders” over the last five years. Stock options are temporary contracts that allow traders to buy or sell stock at a specific value frozen in time, which expires by a certain date. Options trading can be advantageous for more volatile stocks, but also can result in big losses.

‘Red flags’

“When we see a senator or member of Congress trading in businesses or futures that involve their committee assignments, it immediately raises red flags,” Caputo told AL.com.

Caputo said it’s difficult to determine whether a member of Congress is engaging in insider trading because the information that they would hypothetically use in making trades is nonpublic.

Insider trading, or using nonpublic, privileged information learned on Capitol Hill through their roles, such as in committee briefings, for a personal financial benefit, is prohibited for lawmakers by the Stock Act of 2012. But proponents of tighter restrictions on stock trading say that the law, which eliminates pension benefits for lawmakers as a penalty, lacks teeth.

Between 2019 and 2021, nearly 100 lawmakers – about a fifth of all congressional members – or their family members traded financial assets in industries that could’ve been impacted by their work on legislative committees, an analysis by the New York Times found.

Tuberville serves on several committees. Those are agriculture, armed services, veteran’s affairs and health. He also recently joined the Special Committee on Aging.

The New York Times flagged 20 of Tuberville’s trades with direct ties to four of his committees, including companies like Hershey Co., Microsoft, General Dynamics, and Johnson & Johnson.

For instance, in June 2021, Tuberville sold his Microsoft stock options valued between $1,001 and $15,000 while he was sitting on the Senate Armed Services Committee. About two weeks later, the Pentagon canceled its $10 billion cloud computing contract with Microsoft.

After incoming President Donald Trump had started threatening tariffs ahead of his inauguration, Tuberville on a single day this January sold between $15,001 and $50,000 of his stock in both Microsoft and Apple. That came just before a market downturn for tech companies, such as Apple, which plummeted nearly 30% to its lowest point in early April and lost $300 billion in market value as Trump’s tariff threats solidified. Tech companies that depend on manufacturing and trade with China have been caught in the crossfire of the tariffs.

In early April, Tuberville blamed Wall Street for the market downturn. He doubled down on his support for Trump’s tariffs as the value of tech stocks plunged, even though he’d already sold off some of his stocks months before the mass sell-off.

“Wall Street and the globalists… they wanted to stay business as usual. We cannot stay business as usual,” he said in the Fox News interview. “It’s time the American people took care of our own business and not be dependent on anybody else.”

He hasn’t reported any financial trading since Feb. 14, according to the U.S. Senate financial disclosure database.

The New York Times report specifically highlighted Tuberville’s work on the agriculture committee, which was discussing “cattle markets” even as he bought and sold contracts tied to cattle prices starting in 2021.

Tuberville denied receiving nonpublic information on the agriculture committee or sharing related information with his brokers in a 2022 interview with The New York Times.

“I don’t trade stocks, my brokers do,” Tuberville told The Times.

“I don’t limit them to anything, what they can do, what they can’t do,” he added. “I give them money, say to them: ‘I’m in public service now; you do it. Don’t lose it all!’”

For Tuberville’s agriculture committee assignment, one of his subcommittees includes Commodities, Risk Management, and Trade.

The committee held its first hearing of the congressional session on June 23, 2021, a few months into Tuberville’s appointment. It was entitled, “examining markets, transparency, and prices from cattle producer to consumer.”

“Back in Alabama cattle production represents a $2.5 billion industry, so I am thankful we are having this today,” Tuberville said during the hearing. “We have got a lot of our farmers and cattle growers in serious trouble.”

During the hearing, Tuberville heard testimony from the vice president of the United States Cattlemen’s Association, a ranch partner, an agricultural economics professor, a social sciences professor and an animal protein analyst. Less than a month later, Tuberville started selling off some of his own cattle commodities.

Through August 2023, Tuberville reported buying and selling off commodities and futures contracts not only for cattle, but also soybeans and related products, red wheat and corn. During those two years, he reported buying 73 of these holdings cumulatively valued between $73,000 and nearly $1.1 million, and sold roughly the same amount.

That period also included a Feb. 9, 2022, hearing with the chairman of the Commodity Futures Trading Commission, which Tuberville attended.

Out of the 23 senators on the agriculture committee, only Tuberville owns and trades agriculture commodities, according to an AL.com review of years of annual financial disclosure reports for every senator on the committee.

Many of the other senators have index funds, retirement plans, or in some cases own stock in individual companies that are in industries outside agriculture. Others don’t report any trading.

Potential conflicts

It’s not just Tuberville’s agricultural trades that have drawn attention.

In March and September 2021, Tuberville also traded stocks and stock options in companies directly involved in COVID pandemic response, while sitting on the Health, Education, Labor and Pensions committee. That included Johnson & Johnson, a COVID-19 vaccine producer, Regeneron Pharmaceuticals, which led COVID antibody research clinical trials, and 3M, a producer of N95 masks.

In February 2022, Russia invaded Ukraine, and since then, the United States has provided more than $66 billion to the Ukrainian resistance. While on the Armed Services Committee, Tuberville attended a hearing on March 8 in the days following Russia‘s official invasion that included extensive discussion on the Ukraine conflict and how the U.S. could step in.

Then, on March 30, he bought between $1,001 and $15,000 in stock from defense contractor Northrop Grumman Corp.

Tuberville’s most frequent trades in 2023 were for stock in Cleveland-Cliffs Inc., a mining and steel company based in Ohio. With holdings totaling between $1 million and $5 million, he owned more stock and stock options in Cleveland-Cliffs than any other company, as of 2023, per his most recently filed annual disclosure form.

His other individual holdings include between $500,000 and $1 million of Intel Corporation stock and stock options, and between roughly $515,000 and $1 million of U.S. Steel Corporation stock and stock options, as of 2023.

Never on time

Annual reports covering the previous calendar year are due May 15. But that deadline isn’t one that Tuberville has adhered to.

For each annual report he’s filed, including for his four years in office and even as a candidate, Tuberville has never turned them in on time and has applied for extensions multiple times, including this March for his 2024 annual report. In 2020, he asked for extensions three times.

In 2021, Campaign Legal Center filed a complaint with the Senate Ethics Committee, alleging Tuberville had violated the STOCK Act by failing to disclose stock trades worth up to $3.5 million within 45 days.

It’s unclear if he was investigated or penalized; a spokesperson for the ethics committee didn’t respond to a request for comment.

At the time, a spokesperson for his office told CNBC that he didn’t know about the trades because his financial advisors – who he didn’t identify – handle his trading.

Insider‘s “Conflicted Congress” investigation in 2021 ranked lawmakers’ disclosure of financial conflicts and activity in 2020 and 2021 by “solid,” “borderline,” and “danger.” They labeled Tuberville as the latter for failing to report trading activity on time 132 times. Only one other senator – the late California Democrat Diane Feinstein – and 11 other representatives were also labeled “danger.”

At the time, Insider reported that Congress’ method of collecting fines from members for violating the STOCK Act is “spotty and inconsistent,” and that no public records exist tracking those with violations or penalties for it.

What about Alabama‘s other senator?

By contrast, Sen. Katie Britt, R-Ala., and her husband trade a lot less, mostly dealing in mutual funds that include groups of stocks and other types of assets, which are managed externally by financial professionals. The couple has only reported one stock transaction for an individual company, in 2024.

[Can’t see the chart? Click here.]

On July 24, the Britts sold OneWater Marine Inc. stock worth between $1,001 and $15,000, according to her disclosure report. The company buys and operates yacht and boat dealerships, and doesn’t intersect with any Senate committees Britt sits on: Appropriations, Judiciary, Banking, Housing and Urban Development, and Rules and Administration.

In 2023, Britt and her husband, Wesley Britt, made 55 transactions – none of them involving individual companies.

Britt’s disclosure showed the couple – sometimes jointly, sometimes as individuals – bought and sold mutual funds and exchange traded funds, or ETFs. In 2023, they purchased between $198,036 and $895,000 in mutual funds and ETFs in 2023 and sold between $19,019 and $285,000.

As of that year, their net worth ranged between $-4.85 million to $4 million, according to an AL.com analysis. The negative minimum value is because of the couple’s reported debt, ranging between nearly $2.3 million and $7.5 million.

Alabama Republican Senate candidate Katie Britt greets her supporters and talks to the media at her primary election night campaign party in Montgomery on May 24, 2022. (Joe Songer for AL.com).Joe Songer

As of 2023, their largest holdings included between $500,000 and $1 million in Apple stock held jointly and commercial real estate in Enterprise owned by Britt’s husband and valued between $500,000 and $1 million.

Since Britt was sworn into office in January 2023, Britt has struggled to meet the May 15 annual deadline for her financial report. She’s asked for extensions each year since she initially ran as a candidate in 2021.

Public pushback

The majority of the public – across partisan lines – favors a ban on stock trading for federal lawmakers, as well as the president, vice president and Supreme Court justices, according to a 2023 survey by the University of Maryland. The research found that 86% of the public supports a ban. More than 90% of those who support the ban favored the argument that there are “too many potential conflicts of interest when Members of Congress can hold and trade stocks in individual companies.”

Even President Trump has said that he’d “absolutely” sign legislation banning stock trading in Congress.

“Well, I watched Nancy Pelosi get rich through insider information, and I would be okay with it,” Trump told Time Magazine in an interview on April 22. “If they send that to me, I would do it.”

This issue became a bigger conversation at the start of the COVID pandemic, when members of Congress were making big purchases and sales of pharmaceutical stocks while serving on committees making decisions and receiving briefings regarding the pandemic threat.

A group of Democratic senators have pushed for a new version of the Ending Trading and Holding in Congressional Stocks, or ETHICS, Act, which would ban stock trades by federal lawmakers and their families. One of its sponsors, Oregon Sen. Jeff Merkley said that lawmakers buying and trading stocks “erodes public trust and invites corruption.”

In September, more than 40 former politicians sent a letter to Senate leaders of both parties, urging the chamber to bring the legislation to a vote. The group was organized by Issue One, a D.C.-based political reform group.

“Public trust in the federal government remains at historic lows,” the Sept. 16 letter reads. “Including the revised ETHICS Act in the ‘must pass’ package would be an important step to rebuild public confidence by addressing public concerns about perceived or actual instances of corruption that arise from insider trading. Passing this legislation would also signal that members of Congress are taking seriously their commitments to serving their constituents above their own personal profits.”

The act has stalled in the Senate since December, but it would impose civil penalties if members don’t comply with financial disclosure requirements or stick to restrictions on communications between trustees and beneficiaries for investments held in blind trusts.

Meanwhile, Sen. Josh Hawley, R-Mo. just reintroduced a similar act – called the Preventing Elected Leaders from Owning Securities and Investments (PELOSI) Act – on April 28.

“Members of Congress should be fighting for the people they were elected to serve—not day trading at the expense of their constituents,” Hawley said in a press release. “Americans have seen politician after politician turn a profit using information not available to the general public.”

If legislation like this passes, members like Tuberville would have to immediately stop buying individual stocks, and divest from any individual assets over the next few years.

“It’s time we ban all members of Congress from trading and holding stocks and restore Americans’ trust in our nation’s legislative body,” Hawley said in the release.