The precious yellow metal, gold has gained around 27% so far in 2025. As of 7 May 2025, the spot price for 10 grams of gold, on the MCX, is Rs 97,192.

Before we reveal the name of the best gold ETFs, let’s understand the undercurrents that are working in favour of gold.

What’s Putting the Spotlight on Gold?

#1 Donald Trump’s Protectionist Policies

The US President Donald Trump’s tariff tantrums in the endeavour to Make America Great Again (MAGA), which can be termed as economic vandalism, is triggering macroeconomic uncertainty globally.

As more than 180 would face reciprocal tariffs, if negotiations fail, bodes well for gold. This is because gold – a real asset – typically does well in periods of uncertainty.

It is feared that if after current the 90-day pause, steep reciprocal tariffs are implemented, the US could slip into a recession.

The ripple effects of that will be seen in many economies, including emerging market economies like India.

#2 Rising Geopolitical Tensions

As you may know, geopolitical tensions and conflicts have increased in many parts of the world…

- We have the ongoing war between Russia and Ukraine

- In the Middle East, Israel and certain militant groups of the region

- US-China relations are in the most difficult position since the establishment of formal relations in 1979

- China and Taiwan relations are also strained

- Between China and India at the Line of Actual Control (LAC)

- And of course, the current situation between India and Pakistan.

The Reserve Bank of India (RBI) has pointed out that geopolitical conflicts remain one of the top risks to financial stability.

Even the International Monetary Fund’s (IMF’s) recent report on financial stability highlights this fact.

#3 Rising Global Public Debt

The IMF has observed that global public debt is high in many countries and is likely to keep increasing.

With an upward trend, by the end of the decade, the debt level could be nearing 100% of GDP surpassing the pandemic level.

This would particularly hold true further if revenues and economic growth decline significantly than current forecasts due to increased tariffs and weakened growth prospects.

#4 The US Dollar Index has Been Battered and Bruised

Amid the high debt and tariff tantrums of President Donald Trump, the US Dollar index has been battered and bruised.

The reason?

Fearing a recession in the US investors have dumped US financial assets and preferred to take refuge in gold.

A further fall in the dollar index could result in gold exhibiting its sheen even more. In the past, even a stronger dollar has not taken the attention of smart investors away from gold.

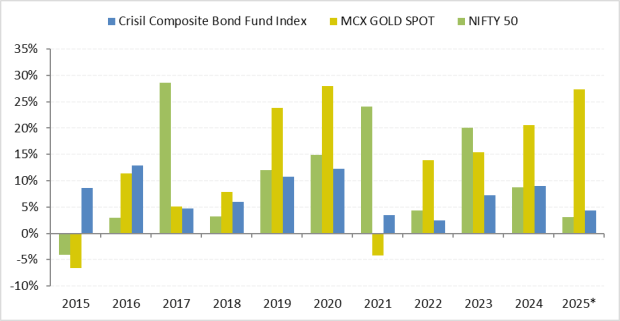

How Gold has Fared Compared to Equity and Debt in the Past

Source: ACE MF

The graph above makes it clear whenever there were looming risks, gold fared better than equity (a high-risk asset) and even debt for that matter.

These were the COVID-19 pandemic in 2020, the start of the Russia-Ukraine war in 2022 (precisely on 24 February 2022), and when Hamas launched a surprise attack on Israel in 2023 (precisely on 23 October 2023).

Simply put, gold has proved its trait of being a haven and store of value in times of uncertainty.

You see, even central banks recognising the risks in play for the global economy, as a part of their foreign exchange reserve management, are actively buying gold.

They consider it to be a secure real asset that does not carry credit or counterparty risk, unlike financial assets.

Smart investors, too, are buying gold in the form of gold Exchange Traded Funds (ETFs). The data released by the World Gold Council (WGC) reveals a surge in gold ETF inflows which is also one of the reasons behind the stupendous increase in the price of gold.

From an asset allocation perspective, it makes sense to allocate around 10-15% of your entire investment portfolio towards gold and hold with a long-term view of over 5 to 10 years. Invest in gold the smart way ––in the form of Gold ETFs.

What Are Gold ETFs?

Gold ETFs are passively managed mutual funds that make direct investments in gold. The investment objective of a gold ETF is to generate returns broadly in line with the domestic price of gold and gold-related instruments subject to a tracking error (TE).

TE is the variance between returns of the underlying benchmark (gold in this case) and the Net Asset Value (NAV) of the gold ETF.

By and large, when gold appreciates and the NAV of gold ETFs goes up, you, the investor, benefit.

To gain exposure to gold without having the hassle of physically holding it, a gold ETF is a worthwhile low-cost investment option.

To invest in gold ETFs, you need a demat account and trading account, and the purchase order can be placed through your broker just like the way you buy shares on the stock exchange.

The units of gold ETFs are backed by 0.995 finesse of physical gold by the respective fund house. The physical gold is held in vaults by an appointed custodian for the ETF on your, behalf.

It’s also insured and valued periodically, as per the guidelines stipulated by the regulator.

Gold ETFs are highly liquid and the sell transaction gets executed at the prevailing NAV which is closely tracked against the domestic price of gold.

To sell the gold ETF units, you need to place the order with the broker who will then execute it on the stock exchange. The proceeds will be received, on a T+2 basis, into your bank account, and the gold ETF units move out of your demat account.

Isn’t that simple? You don’t have to visit a gold merchant or jeweller to sell physical gold and haggle for the right price.

Want to Know Which Are the Best Gold ETFs in India to Invest in?

The five best gold ETFs in India are:

- HDFC Gold ETF

- Kotak Gold ETF

- SBI Gold ETF

- Nippon India ETF Gold BeES

- ICICI Prudential Gold ETF

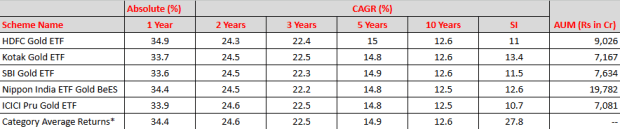

Performance of 5 Best Gold ETFs in India

Please note, that this table represents past performance. Past performance is not an indicator of future returns.

The securities quoted are for illustration only and are not recommendatory.

The list is not exhaustive. *Currently the gold ETF category comprises 20 schemes.

Speak to your investment advisor for further assistance before investing.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

Source: ACE MF

These funds have a long performance track record. Here’s more about these best gold ETFs in India.

Nippon India ETF Gold BeES is one of India’s oldest launched in March 2007 and is also the largest with Assets Under Management (AUM) of Rs 197.83 billion (bn) as of March 2025.

The five gold ETFs have lived up to their objective of providing returns that, before expenses, closely correspond to the returns provided by the domestic price of gold through physical gold.

The funds are currently holding around 98.0% of its assets in gold and the rest is in cash-and-cash equivalents.

These gold ETFs are from mutual fund houses following robust investment processes and systems.

Conclusion

This completes our list of the five best gold ETFs in India to invest in.

Keep in mind that past instances of superior performance may not be sustained in the future.

Hence, invest sensibly following an asset allocation. Do not get carried away. Be a thoughtful investor. When in doubt reach out to your SEBI-registered investment adviser.

What About the Tax Implications of Investing in Gold ETFs?

The capital gains made on the sale of gold ETF units are now taxed at the marginal rate of taxation, i.e. as per your income-tax slab just as in the case of a debt mutual fund scheme.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary