Capital at risk. All investments carry a varying degree of risk and it’s important you understand the nature of these. The value of your investments can go down as well as up and you may get back less than you put in. Where we promote an affiliate partner that provides investment products, our promotion is limited to that of their listed stocks & shares investment platform. We do not promote or encourage any other products such as contract for difference, spread betting or forex. Investments in a currency other than sterling are exposed to currency exchange risk. Currency exchange rates are constantly changing which may affect the value of the investment in sterling terms. You could lose money in sterling even if the stock price rises in the currency of origin. Stocks listed on overseas exchanges may be subject to additional dealing and exchange rate charges, and may have other tax implications, and may not provide the same, or any, regulatory protection as in the UK. Accurate at the point of publication.

So-called ‘small-cap’ stocks are the shares of companies with relatively low market capitalisations (the figure reached by multiplying the share price by the number of issued shares), typically ranging from £100 million to £500 million.

Small-cap stocks have a devoted following among investors, thanks to their potential to deliver higher growth than their ‘large-cap’ counterparts. Indeed, investors in the FTSE Small Cap index have enjoyed total returns of 23% over the last five years, compared to just 2% for the mid-cap FTSE 250, according to FTSE Russell.

That said, small-cap stocks aren’t for the faint-hearted, with higher volatility and the potential for liquidity issues due to lower trading volumes. Small-caps may also struggle to weather economic downturns without the financial firepower of their larger peers.

To help investors navigate the options on offer, we take a closer look at investing in small-caps and the outlook for the sector.

What are small-cap stocks?

The definition of small-cap stocks varies by country but typically refers to companies with a market cap of between £100 million to £500 million in the UK. In contrast, small-cap stocks tend to range from $300 million to $2 billion in the US.

Looking at the FTSE Small-Cap index, the average market cap is £225 million. While the smallest company in this index has a market cap of just £10 million, anything under £100 million is usually termed a ‘micro-cap’.

Although small in size, they’re certainly not small in number with small-cap stocks representing the largest category on many stock markets. And there are more than 220 small-cap companies on the FTSE All-Share index, compared to only 100 large-cap companies.

How have small-caps performed?

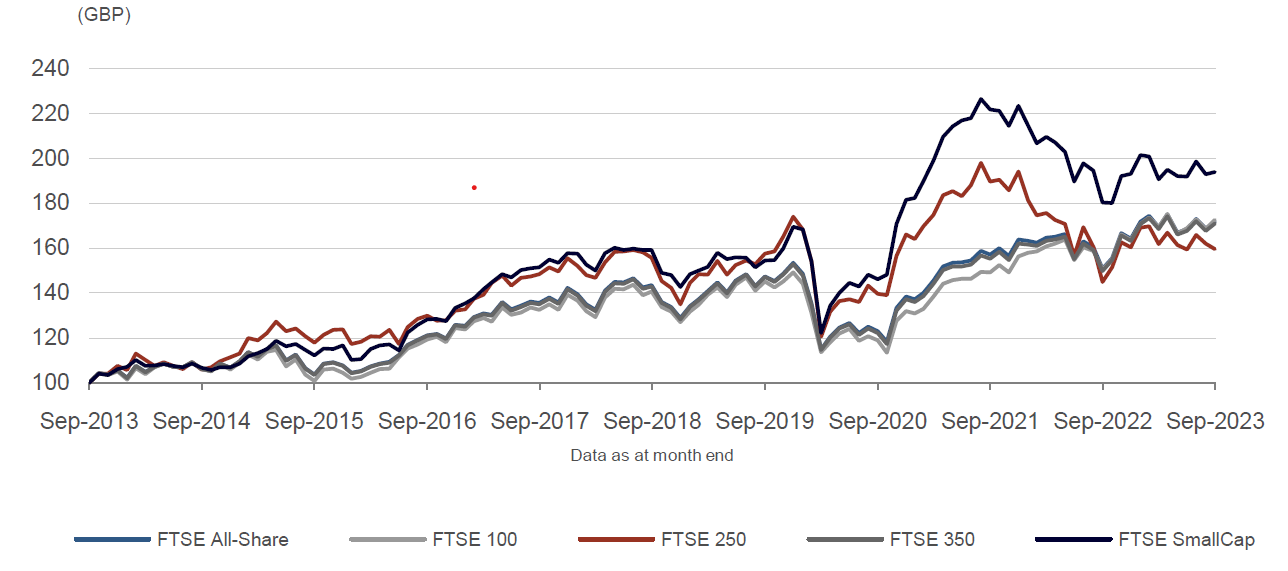

Over the long term, the small-cap sector has outperformed its larger counterparts, earning the distinction of being the highest-returning FTSE sector over the past decade, as shown below:

Source: FTSE Russell

It’s also the second highest-performing sector over the last five years, rewarding investors with a total return of 22%, pipped to the post only by the 23% return for the large-cap FTSE 100 index.

However, it’s not been entirely plain sailing for small-cap investors in the last two years. High inflation and interest rates have taken their toll on consumer spending on both sides of the Atlantic, providing a headwind for more domestically-focused small-caps.

Against this backdrop of jittery investor sentiment, the FTSE Small-Cap index fell by 14% in 2022, and the global MSCI World Small Cap index suffered an even steeper fall of 18%.

Abby Glennie, deputy head of smaller companies at abrdn, says: “Performance has been driven by macro conditions, with increasing inflation and interest rates being the key factors, together with an unprecedented amount of uncertainty and volatility in the past two years.

“Small-caps are generally the most volatile and higher-risk asset class within equities, and in a market sell-off, they typically suffer the most.”

While both small-cap indices have bounced back into the black this year, valuations remain well below their two-year high as challenging macro-economic conditions persist.

Why would one invest in small-cap stocks?

One of the biggest attractions of small-caps is their superior growth potential relative to their large-cap equivalents. The general principle is that it’s easier for a smaller company to double its earnings than a larger company or, as veteran small-cap investor Jim Slater put it: “Elephants don’t gallop.”

Darius McDermott, managing director at FundCalibre, says: “Historically small-caps have beaten large caps and delivered better returns over the long term.

“They can grow faster because they’re smaller, they’re typically much easier to control and manage and they can benefit from an immediate payoff if they get taken over by a larger company.”

Ms Glennie says: “Small-caps typically deliver the highest level of earnings growth through time. High earnings growth, combined with attractive returns on capital, should be rewarded in share price returns for investors.”

“Perception of risk is also often overstated. Smaller companies are marginally higher risk than large caps, but offer superior risk-adjusted returns.”

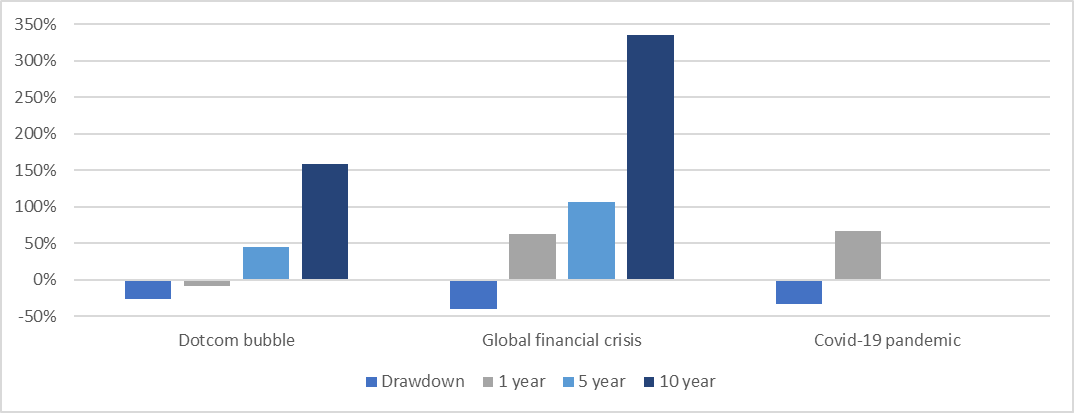

Added to this, small-caps have historically outperformed large-caps after a steep fall in valuation. As their performance tends to be more closely aligned to the economy, small-caps can struggle during an economic downturn but are typically one of the first sectors to recover.

Mr McDermott says: “Recently they’ve underperformed large-caps which is unlikely to last over the long-term, providing a good potential entry point.”

Looking back at performance following a recession, the Numis Smaller Company index achieved an impressive 10-year return of 160% and 340% respectively after the dotcom bubble and global financial crisis, as shown below:

Source: Janus Henderson

Another benefit of investing in small-caps is the opportunity to uncover a hidden gem, as small-caps are less widely-covered by analysts and institutional investors.

Ms Glennie says: “It’s an inefficient part of the market which is significantly less well-covered by sell-side analysts. That provides a much greater chance to exploit inefficiencies and information gaps, making an excellent backdrop for active investment.”

Small-caps also provide the opportunity for investors to diversify their portfolio across companies of differing sizes.

Ms Glennie says: “Smaller companies offer structurally different exposures to large-cap peers. When blended with large-cap equities, there is scope to not only improve returns, but also to reduce risk.”

What are the risks of investing in small-caps?

It’s often said that risk and return are two sides of the same coin, and it’s certainly true for small-cap stocks. As mentioned earlier, returns from small-caps are more volatile as they tend to be hit harder by bearish sentiment during stock market downturns.

Ms Glennie says: “Volatility is a key risk of investing in small-caps. That’s why we talk about ‘time in’ not ‘timing’ as important, and taking a longer-term horizon.”

Mr McDermott says: “The risk in small-caps is that they tend to draw-down [the peak-trough fall] further than large-caps in times of market stress. They also tend to be more sensitive to the domestic economy.”

In addition, small-caps also lack the financial resources of large-cap companies, which may make it more difficult to access financing at favourable rates. This may have a knock-on impact on capital expenditure for future growth, or at worst, lead to potential failure of the business.

Another issue with small-caps is lower liquidity, which can increase volatility and make it harder for investors to buy and sell shares easily without affecting the share price. In addition, the buy-sell spread tends to be wider on small-caps, which can erode gains, particularly in the short-term.

Lastly, large-caps tend to offer higher dividend yields, with small-caps often choosing to reinvest surplus cash in the business. While, in theory, this should lead to an increase in share price over time, it may cause an issue for income-seeking investors.

What are the options for investing in small-caps?

Investing in individual companies

One option is to invest in individual companies, which has the potential to deliver significant returns if the company performs well. However, it is also a higher-risk option and therefore requires careful research.

Mr McDermott says: “One risk of investing in this asset class is there is often less analyst coverage of individual companies, meaning in-depth research and engagement are vital for selecting the right companies to back.”

Ken Wotton, manager of the Baronsmead venture capital trusts (VCTs), says: “It is crucial for investors to dig deeper to discover the true discounted gems. By carefully evaluating specific indicators, investors are best placed to identify robust revenue streams and mitigate overall investment risk.”

According to Mr Wotton, points to consider when assessing small-cap investment opportunities include:

- does the company have a competitive advantage or operating in a structurally growing market, which affords it some pricing power?

- does it have inherent operational gearing, meaning that it has a higher proportion of fixed costs, which can lead to higher profit margins if revenue increases?

- does it have the ability to generate cash, which drives returns through investing in future growth and distributions to shareholders? Mr Wotton says asset-light businesses are typically more cash-generative, as they do not have to spend money on physical assets, with services and software businesses often having modest capital expenditure requirements

- does it have a high-quality management team that can navigate macroeconomic headwinds, together with an incentive structure that aligns the interests of the management team and shareholders?

Investing in small-cap funds

Another option is to invest in a small-cap fund which provides investors with a ready-made, diversified portfolio of small-cap companies. This has the benefit of smoothing average returns and reducing the dependence on the fortunes of an individual company.

Investors can choose from a wide range of actively-managed funds where the fund manager picks a portfolio of small-cap companies, or passively-managed funds that track a small-cap index.

FundCalibre’s Mr McDermott says: “Funds that take an active approach to investing, such as the TM Tellworth UK Smaller Companies fund, are an ideal way to ride the market rebound.

“Managed by Paul Marriage and James Gerlis, their approach based on meticulous research, utilising their own proprietary data models, and engagement with company management, helps them to uncover promising investment opportunities. Another fund we like is the LionTrust Micro Cap Fund.”

Alternatively, there are a number of passively-managed funds that track small-cap indices, such as the iShares MSCI UK Small Cap ETF or the Vanguard Global Small-Cap Index fund.

What’s the outlook for small-caps?

Uncertainty remains very much on the menu for investors until there is better visibility of an end to Bank Rate hikes and the tempering of stubbornly-high inflation in the UK.

Ms Glennie says: “Without doubt, macroeconomic challenges remain but we feel some of those are now easing in the UK. This also is helping drive a consensus view that we are at, or near, the peak of the interest rate cycle.

“We would expect sentiment to improve towards small-caps, with macro factors hopefully dominating less and a focus back to stock-specific drivers. Even without perfect macroeconomic conditions, we see strong investment opportunities.”

Depressed valuations of small-cap companies may also appeal to investors willing to take a longer-term perspective on their portfolios.

Mr Wotton says: “Investing in smaller UK companies during an economic downturn presents challenges but this is when the best businesses and management teams can use agility and effective execution to take market share, thereby laying the foundation for sustainable future growth.

“Investments made in the current environment have the potential to be long-term winners and drive very attractive returns over an extended period.

“By targeting high-quality, cash-generative quoted companies benefitting from structural growth tailwinds, investors can grasp the valuation opportunities on offer and position themselves for an eventual rerating, which will favour robust businesses.”