Walmart (WMT 0.62%) surged 71.9% in 2024, making it the second-best-performing component of the Dow Jones Industrial Average behind Nvidia. Investors may be wondering if Walmart can carry the momentum forward in 2025.

Walmart’s investment thesis has evolved from a stodgy dividend-paying value stock to a high-octane growth stock. With over 50 consecutive years of dividend increases, Walmart is also a Dividend King that sports a coveted combo of passive income potential and outsized market gains — but only if it can sustain its momentum.

Here’s a look at the key elements of Walmart’s success, and whether the stock is worth buying now.

Image source: Getty Images.

Walmart’s banner year

Over the last five years, retailers have dealt with the COVID-19 pandemic, supply chain challenges, inflationary pressures, weakening consumer demand, and more. But through it all, Walmart made the necessary investments to improve its product and services offerings, convey value, and offer convenience.

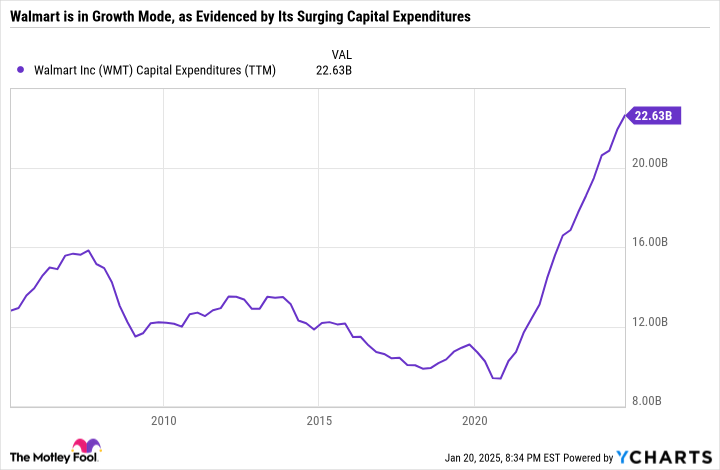

In recent years, Walmart’s capital expenditures have exploded higher. It has poured money into new stores, existing store renovations, e-commerce, Walmart+ subscription-based home delivery, and even artificial intelligence. Those investments are paying off.

WMT Capital Expenditures (TTM) data by YCharts.

Inflation may lead people to pull back on big-ticket spending, but they still need to get groceries and household goods from somewhere. And many will still buy discretionary goods, just at lower prices.

Walmart essentially became the confluence of low-income and higher-income consumers — of consumer staples and discretionary spending. Walmart has been taking market share from other discount retailers and holding its own even while margins plummeted at companies like Target. Walmart’s value proposition resonated with consumers, which is why it was able to hit an all-time high while Dollar General and Dollar Tree hit five-year lows. Similarly, Walmart’s operating margins rapidly rebounded, whereas Target is struggling to unlock its next growth phase.

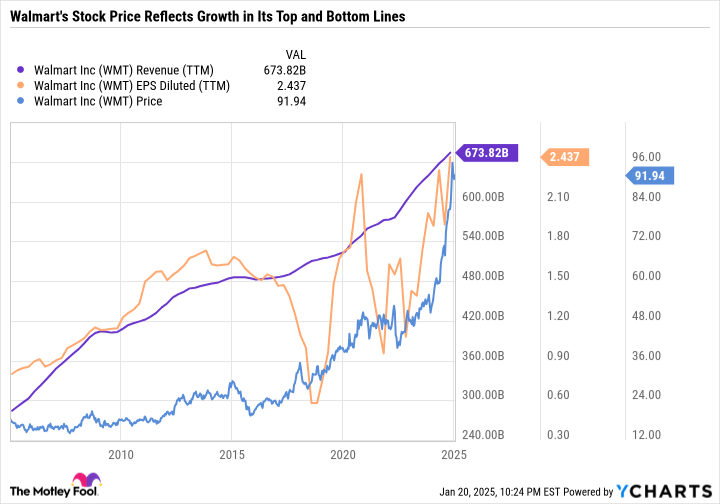

Walmart emerged from a period of stagnating growth and declining margins and achieved record revenue and profits.

WMT Revenue (TTM) data by YCharts.

Walmart’s results are impressive in their own right. But the fact that they came when so many other discount retailers were struggling lit a fire under the stock price. There’s also reason to think the growth could continue.

Analyst consensus estimates call for $2.48 in fiscal 2025 earnings per share (EPS) and $2.76 in fiscal 2026 EPS. Walmart is scheduled to release fourth-quarter and full-year fiscal 2025 results on Feb. 20. For context, Walmart earned $1.91 in fiscal 2024 diluted EPS — a record high.

Walmart earned $1.73 in fiscal 2020 EPS (adjusted for its 3-for-1 stock split), which was the year ended Jan. 31, 2020, before the pandemic. So compared to that period, Walmart’s earnings growth is nothing short of excellent. The problem is that investors have already taken notice, given the massive gain in 2024.

Walmart stock isn’t a good value

Walmart is an excellent example of why a phenomenal business can be a poor investment opportunity. The stock was arguably undervalued heading into 2024. But now, Walmart is priced to perfection.

Even if it achieves fiscal 2026 earnings estimates of $2.76 per share, it would still have a 33.3 price-to-earnings (P/E) ratio based on the current stock price of around $92 per share. That’s a sky-high valuation for a company expected to grow earnings by 11.3%.

For Walmart to reach a $1 trillion market cap, its stock price would have to be around $124.50 per share. If you think Walmart is a little overvalued right now and a 35 P/E ratio is more reasonable, it would have to earn $3.56 in EPS to reach a $1 trillion market cap.

At a 30 P/E ratio, EPS would have to be $4.15. And at a 25 P/E ratio, EPS would have to be $4.98.

For context, Walmart’s five-year median P/E is 30.5, and its 10-year median P/E is 26.8.

Here’s a look at Walmart’s projected EPS, assuming 10% annual earnings growth after fiscal 2026, and what the stock price would be based on different P/E multiples.

|

Metric |

Fiscal 2025 |

Fiscal 2026 |

Fiscal 2027 |

Fiscal 2028 |

Fiscal 2029 |

Fiscal 2030 |

Fiscal 2031 |

Fiscal 2032 |

|---|---|---|---|---|---|---|---|---|

|

Projected EPS (10% Annual Growth After Fiscal 2026) |

$2.48 |

$2.76 |

$3.04 |

$3.34 |

$3.67 |

$4.04 |

$4.45 |

$4.89 |

|

Stock Price at 25 P/E |

$62.00 |

$69.00 |

$76.00 |

$83.50 |

$91.75 |

$101.00 |

$111.25 |

$122.25 |

|

Stock Price at 30 P/E |

$74.40 |

$82.80 |

$91.20 |

$100.20 |

$110.10 |

$121.20 |

$133.50 |

$146.70 |

|

Stock Price at 35 P/E |

$86.80 |

$96.60 |

$106.40 |

$116.90 |

$128.45 |

$141.40 |

$155.75 |

$171.15 |

Based on a 25 P/E and assuming the 10% earnings growth rate, it would take Walmart over seven years to reach a $1 trillion market cap, over five years based on a 30 P/E, and over three years based on a lofty 35 P/E.

No matter how you slice it, Walmart is an expensive stock. It’s no longer a compelling passive income source, either.

Walmart is a Dividend King with 51 consecutive years of increasing its payout. But because the stock price gained so much in a short period, Walmart only yields 0.9% — which is less than the 1.2% yield of the S&P 500.

When Walmart releases its fiscal 2025 earnings next month, investors should expect another sizable dividend raise, as Walmart did last year. But it would take several years of massive dividend raises (or for Walmart’s stock price to fall) for Walmart to become a viable income stock again.

Better buys now

Walmart’s valuation is stretched too thin for it to reach a $1 trillion market cap in 2025, or in the next couple of years, for that matter. However, its market cap is roughly double that of the second-largest Dividend King, Procter & Gamble. So it will probably become the first Dividend King to reach the $1 trillion milestone, just not this year.

Investors looking for passive income should turn to other high-yield dividend stocks at cheaper valuations.

Investors looking for a combination of growing dividends and earnings growth may want to consider companies like Broadcom, Visa, Salesforce, Alphabet, and Meta Platforms, which I expect will all boost their payouts by 10% or more in 2025.

Walmart is a great company. But the valuation is way too expensive, the yield is too low, and the growth rate isn’t high enough to make it worth buying now — unless you believe the company will rapidly accelerate its earnings growth, or are simply comfortable paying a premium price for a quality company.