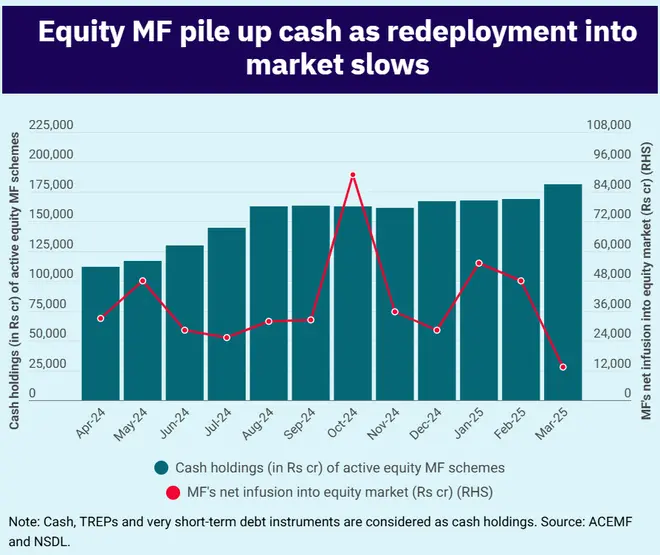

Active equity mutual fund managers in India are exhibiting increasing caution when redeploying accumulated cash. According to ACEMF data, cash holdings across 506 actively managed equity schemes reached a record ₹1.81 lakh crore in March, up from ₹1.69 lakh crore in February.

This cautious stance comes despite mutual funds receiving average monthly net inflows of approximately ₹35,000 crore over the past year. Market uncertainty has clearly made fund managers hesitant to abandon their defensive positions. Data from NSDL reveals that mutual funds’ net infusion into the equity market dropped sharply to ₹13,459 crore in March, down from ₹47,943 crore in February.

Multiple factors are contributing to this reserved approach. Heightened geopolitical tensions, escalating global trade war concerns, substantial foreign institutional investor (FII) outflows, and domestic growth worries have collectively created market uncertainty. These conditions have pushed fund managers toward a more conservative strategy.

Dry powder strategy

Fund managers view these cash reserves as strategic “dry powder,” positioning themselves to capitalize on attractive entry points during potential market corrections. This approach seems particularly prudent in the current market environment. Also, mutual funds with higher cash positions are better equipped to weather market corrections compared to those that are fully invested in equities.

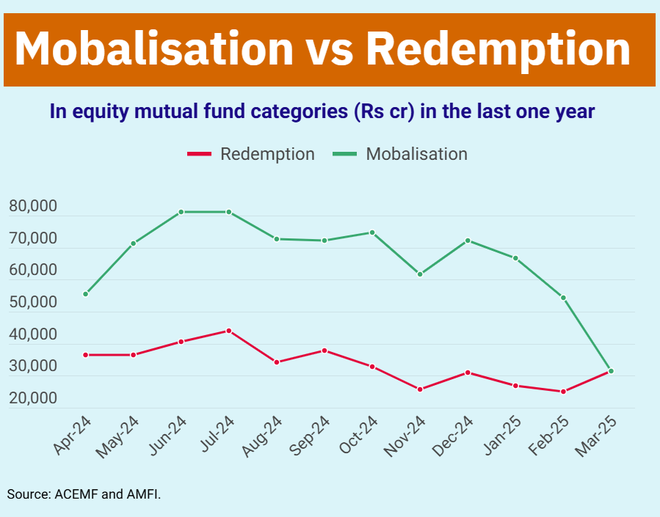

Another factor driving increased cash holdings is the need for liquidity buffers against redemption pressures. Without adequate cash reserves, funds might be forced to sell quality stocks during market volatility. According to AMFI data, net inflows into equity funds have declined consecutively in recent months, dropping to ₹25,082 crore in March from ₹41,156 crore in December 2024, reflecting both increased redemptions and decreased new investments.

Published on April 11, 2025