Looking across the Atlantic at the USA, there are many times when it feels like we’re worlds apart – after all, Americans call our beautiful game of football ‘soccer’ and let’s not get into what the word ‘pants’ actually means.

Yet the decisions taken by the USA can still have a huge impact on our everyday finances, and on his return to office, President Donald Trump has not held back on his policies. Over the last few weeks, the President has gone full speed ahead in introducing global tariffs in a bid to boost the US economy, and there’s no ignoring that it’s had a knock-on effect on our finances.

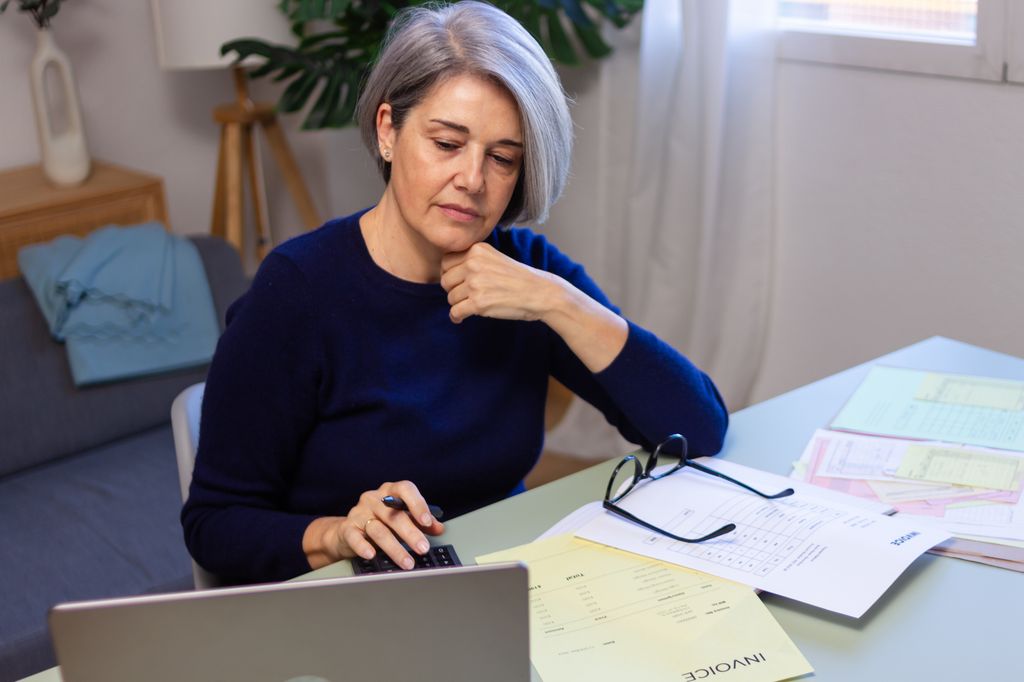

If you have a pension or investments, chances are you’ve noticed a dip in the value of your investments and it can be scary to see, so here’s a quick guide on how to stay calm in the midst of a financial storm.

Turn off the news alerts

Any major global event gets the news cycle spinning at full speed, however, there are plenty of occasions when being up to date on the latest events doesn’t serve any positive purpose. Although it’s helpful to understand the big picture of global financial events, watching the financial markets fluctuate in real time can do more harm than good and lead you to stress about your investments, when the best thing to do is stay calm and leave your investments where they are. After all, investing is not about quick wins and short-term fluctuations are part of the journey, so switch off the news if you find yourself tempted to make a panic move.

Zoom out and look at the big picture

Investing, whether that is putting money into your pension or building up funds in a Stocks and Shares ISA, is a long-term financial strategy. Before you start investing, it’s important to build up an emergency fund of cash for any unexpected events, so that if your investments drop in value, it has no short-term impact on your circumstances or safety net.

Keep in mind that any drop in value of your investments isn’t realised until you cash out, so as long as you take the long-term view and leave your investments untouched, there’s plenty of time to allow for a recovery in their value before you access the funds in ten or twenty years. A bad couple of months rarely derail a ten-year plan.

Remember your why

Sometimes, going back to your why can be a helpful exercise in managing stressful financial moments and keeping you focused on the goal. Take a time out from doom scrolling through your investment accounts and revisit the reason why you started investing or contributing to your pension.

Maybe you’re saving to help your children with university fees down the line, or perhaps you’re planning for retirement before you turn sixty. Unless these milestones are right around the corner, take a deep breath and keep moving forward towards your goals.

Voice your feelings out loud

Talking about money isn’t always easy, yet it’s a sure-fire way to help rationalise some of your thoughts and process any fear about seeing numbers in the red. For anyone who has a friend or family member who is confident in their investment strategy, having a quick chat about how the volatility has made you feel can help put your nerves aside.

Plus, saying out loud that you are anxious because your ISA is down 8 per cent, for example, activates the rational part of your brain and can stop the spiral into a bigger panic. Even if you don’t have anyone on call to speak to, there are plenty of communities online where you can find others who understand the rollercoaster of emotions that can come with investing your money.

Take a break and sleep on it

You’ve probably heard this one before, but often, old advice sticks around for good reason. Before you make any big decisions, sleeping on them is never a bad idea and particularly where decisions are driven by emotions such as fear or worry, taking a time out can give you the headspace you need to reset and reevaluate. With your finances, remember that more often than not, reaching your financial goals is a marathon and not a sprint and it’s inevitable that you hit minor bumps in the road along the way.

NB. The content in this article is solely for educational purposes and does not constitute financial advice. Past investment performance is not indicative of future results.

Ellie Austin-Williams is the author of Money Talks, a Lifestyle Guide for financial wellbeing. Find her on Instagram at @thisgirltalksmoney.