How to Access Mutual Funds and Stocks in DigiLocker and ensure your nominees are informed of your holdings even when you’re no longer around.

Wondering how to view your mutual fund and stock investments in one place — without digging through emails or paperwork? With DigiLocker now integrated with SEBI’s ecosystem, you can securely access all your financial holdings in just a few taps. But here’s the real game changer: what happens to your investments when you’re no longer around? DigiLocker now lets your nominated loved ones know exactly what you owned — making it easier for them to claim what’s rightfully theirs, without the confusion or paperwork nightmare.

In order to simplify financial transparency and digital convenience, SEBI has now enabled investors to access mutual funds and stocks in DigiLocker.This integration bridges the gap between technology and finance, making it easier than ever for individuals to manage their investments from a single, secure platform.

If you’ve ever struggled with tracking your demat account statements or mutual fund holdings, or you’re concerned about how your family might access your investments in case of an emergency, this update is a game changer.

Here’s everything you need to know — and exactly how to get started.

What is DigiLocker?

DigiLocker is a flagship initiative by the Government of India under the Digital India program. It provides every Indian citizen with a cloud-based platform to store, access, and share digital documents.

Think of it like a digital locker for your most important paperwork — Aadhaar, PAN card, driving license, and now, financial documents like mutual fund and demat holdings.

Key features:

- Government-verified digital documents

- Easy access anytime, anywhere

- Linked with Aadhaar for authentication

- Now connected with SEBI and financial intermediaries

What’s New with SEBI and DigiLocker?

In 2024, SEBI announced that:

Investors can fetch and store their mutual fund and stock holding statements directly into their DigiLocker account.

This move aims to:

- Reduce unclaimed financial assets

- Improve visibility of holdings across platforms

- Make it easier for nominees and heirs to access information

- Promote paperless investing and smoother compliance

Benefits of Accessing Holdings via DigiLocker

Here’s why this integration matters for you:

1. All Your Financial Docs in One Place

Fetch your NSDL/CDSL demat account statements and mutual fund statements and store them digitally for easy access.

2. Secure & Paperless

No need to keep printed statements or email archives. DigiLocker is government-backed and encrypted.

3. Nominee Access Made Simple

You can add a Data Access Nominee. If something happens to you, they’ll be notified and given read-only access to your financial documents — avoiding legal limbo.

4. No More Lost Investments

This system will help significantly reduce unclaimed shares and mutual fund units, a growing problem due to a lack of awareness and access among heirs.

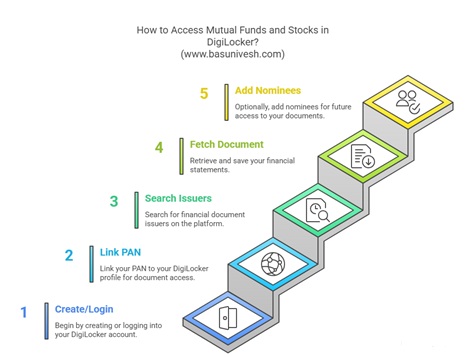

Step-by-Step: How to Access Mutual Funds and Stocks in DigiLocker?

? Step 1: Create or Log in to DigiLocker

- Visit https://digilocker.gov.in or download the DigiLocker app.

- Sign in using your Aadhaar number or mobile number.

- Complete OTP verification to get started.

? Step 2: Link Your PAN

- Go to the ‘Profile’ section in DigiLocker.

- Link your PAN for financial document access.

? Step 3: Search for Issuers

- On the homepage, select “Search Documents”.

- Type in “NSDL”, “CDSL”, or “CAMS/KFinTech” (for mutual funds).

- You’ll see options like “Demat Holdings Statement” or “Mutual Fund Statement (CAS)”.

? Step 4: Fetch the Document

- Click on the issuer.

- Enter required details like PAN, date of birth, or client ID.

- Once authenticated, your statement will be auto-fetched and saved in your DigiLocker.

? Step 5: Add Nominees (Optional but Recommended)

- Go to the Nominee/Sharing Settings.

- Add an email/phone number of your Data Access Nominee.

- They’ll get access to your financial documents in case of your passing, once verified by a KRA (KYC Registration Agency).

Enable Auto-Updates

Many issuers allow for auto-fetching or auto-updates, meaning your financial documents will get refreshed in DigiLocker periodically. This saves you the effort of pulling new statements every month.

For Legal Heirs: How Nominees Get Access

In case of an investor’s death:

- The death is registered with a KRA.

- DigiLocker gets notified and updates the account status.

- Nominees are alerted via email/SMS.

- They can now log in and view the investor’s documents in read-only mode.

This significantly reduces the hassle of documentation and court procedures for accessing assets.

Conclusion –

With SEBI enabling integration of demat and mutual fund holdings into DigiLocker, managing your financial life just became smarter and more secure. It’s not just about convenience — it’s also about transparency, preparedness, and legacy planning.

Whether you’re a seasoned investor or just getting started, syncing your financial holdings with DigiLocker is a move you’ll thank yourself (and your family) for.