Keeping a cool head can be pivotal amid market turmoil

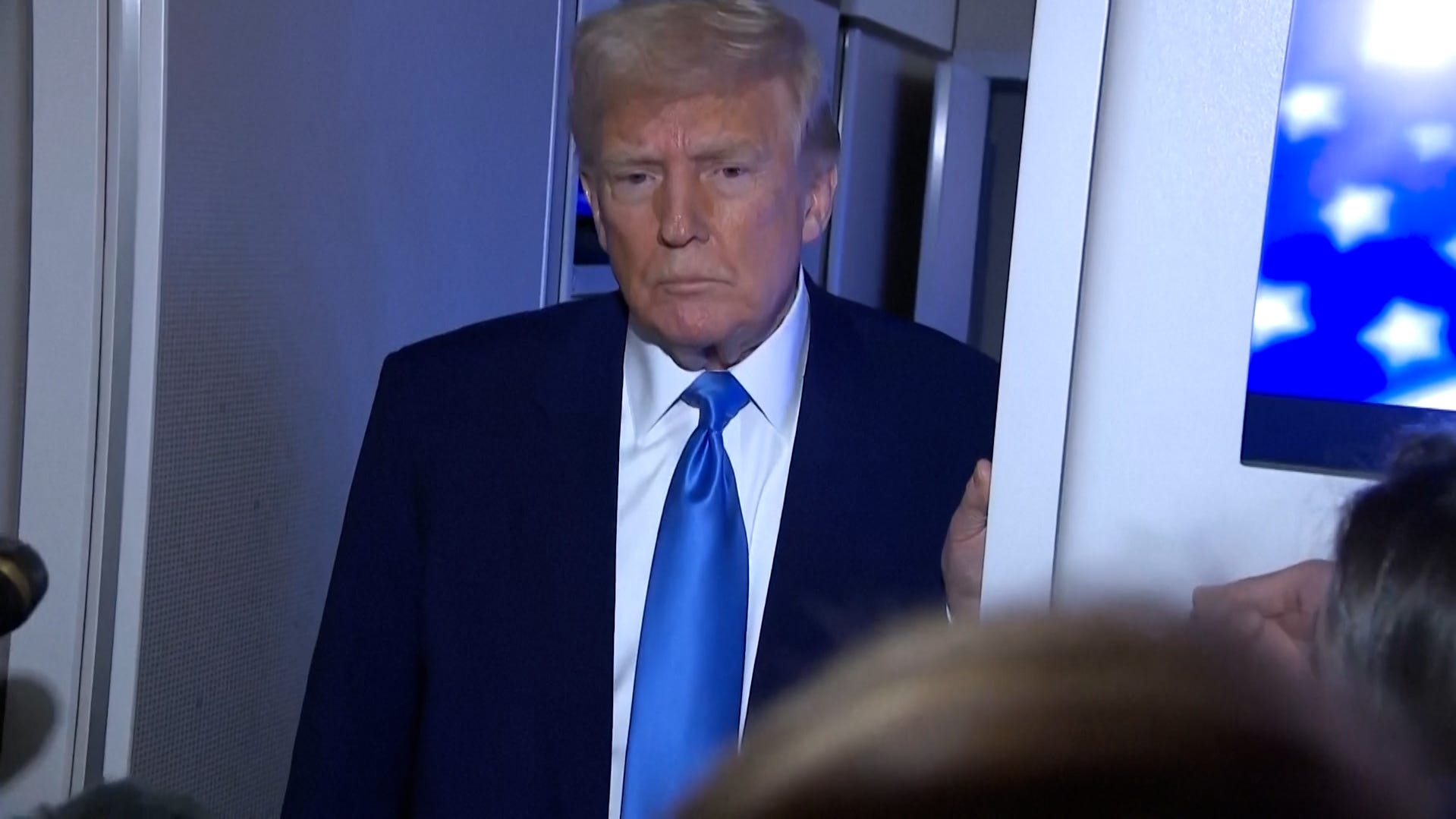

President Trump calls tariffs ‘medicine’ as stock market plunges

President Donald Trump spent the weekend at a golf tournament in Florida as the stock market continued to plunge.

Have you checked your 401k balance since President Donald Trump announced widespread tariffs last week on what he called “Liberation Day”?

Chances are, it’s down — maybe way down.

The markets have lost more than $11 trillion since Trump’s inauguration and more than half of that happened on Thursday and Friday, according to global investment research company Morningstar.

On Monday, the CEO of the world’s largest asset manager, Larry Fink of Blackrock, said stock markets could fall by another 20% because of the tariffs and said the economy is probably already in a recession.

Amid so much turmoil, the Beacon Journal reached out to Jesse Hurst, founder of Impel Wealth Management in Cuyahoga Falls, to explain what’s happening and what consumers can do to help protect their nest eggs.

Here’s what he said early Monday afternoon, as the markets whipsawed between losses and gains:

Why have the markets been sinking after President Donald Trump announced sweeping tariffs?

Markets hate uncertainty. The level of the new tariffs and the manner in which they are being calculated, communicated, and implemented are creating significant uncertainty around global trade and their impact on future corporate earnings. Corporate earnings tend to affect stock prices over long periods of time. Since the rules are rapidly changing, no one is certain how to measure the impact at the present time.

How low could the markets go?

We can look at past periods of volatility and geopolitical uncertainty as a guide to how low things could go. During the 1973-1974 Arab oil embargo and the accompanying inflation, the stock market dropped approximately 43% as measured by the S&P 500 index. In the aftermath of the bursting of the dot.com bubble and 9/11, the stock market dropped approximately 47%. During the great financial crisis of 2007-2008, the stock market dropped approximately 57%. Finally, during the 2020 COVID-19 outbreak, the stock market dropped 34% in just a few weeks before recovering due to massive fiscal and monetary stimulus. However, it is important to remember that each situation has its own unique qualities and characteristics.

Is this a market correction or a crash, and what’s the difference?

A stock market correction is generally defined as a drop of 10% or more, while a bear market is defined as a drop of more than 20%. There is no general definition for a stock market crash. It generally tends to be correlated to the severity and speed of the downturn.

What should people worried about their shrinking 401(k) balances do?

Luckily for people who are still in the accumulation phase of life and are depositing money into savings vehicles such as their 401(k)s on a regular basis, the decline in stock prices gives them the opportunity to buy more shares of what they were already purchasing at a lower price.

Since I started in the business in 1987 and we experienced bouts of volatility, clients came to me concerned that the balance of their 401(k) plans had dropped when they should have been focusing on how many shares they were buying while things were “on sale.” Warren Buffett is fond of saying that Americans love to buy everything they can on sale except for their financial assets.

Does that advice also apply to people closer to retirement, say within 10 years?

If you are planning to retire in the next five to 10 years, the same advice applies. Focus on accumulating the resources you will need to fund a retirement that could likely last 20 to 30 years while prices are down. Once you are within two to three years of retirement, you should focus on using upturns in the market to create short-term liquidity that you will need to live through bouts of volatility and downturn during your retirement years.

What can retirees who are no longer contributing to their 401(k)s do to minimize risk while still positioning themselves for future growth?

Making certain that their asset allocation is consistent with their risk profile and stomach for volatility. You make money in the markets by buying low and selling high. Therefore, when markets go through significant upswings like we saw in 2023 and 2024, it makes sense to sell a little bit and take some chips off the table. These funds can be put into lower-risk vehicles like money market funds and short-term bonds to help weather the inevitable bouts of volatility and downturn that will happen during your investing lifetime.

If you are using a 529 college savings plan, should you follow the same advice for a 401(k) or something different?

The thought process and advice would be the same. However, the timeline both for saving for college and depleting the funds during the years of college is much shorter than they are for someone accumulating money for retirement and a 401(k) plan.

Typically, parents are saving money for their child’s education over a 10- to 15-year period of time and then spend it down during four to six years of college and grad school. People saving for retirement typically have 30 to 40 years to accumulate funds that they will spend over 20 to 30 years of retirement life expectancy.

Many say the odds of a recession are rising. What do you see coming?

Most economists expected the U.S. economy to have a recession sometime in 2022 or 2023. This was due to a number of factors, including the Federal Reserve Bank raising interest rates at the fastest pace we had seen in decades to fight inflation that had risen faster than any time since the late 1970s and early 1980s. There were a whole host of economic indicators that pointed toward a future recession that never materialized. At the time the tariffs were implemented, the U.S. economy appeared to be on fairly strong footing, with unemployment low, inflation moderating, and corporate earnings still growing at double digits.

The U.S. economy has proven to be more resilient than many people expected.

We will have to wait to see the impact of these policy decisions and how they are implemented to have a better feel for whether there will be a recession in the near term. However, we do know that many Wall Street firms are raising their probability of a recession to nearly 50%.

Could a severe recession lead to a depression? What’s the difference between recession and depression?

A recession is typically defined as a significant decline in economic activity spread across the economy, lasting more than a few months and normally visible in production, employment, real income, and other indicators. Conversely, a depression is a severe and prolonged downturn in economic activity, characterized by a sharp decline in GDP, high unemployment, and widespread hardship, lasting longer and being more severe than a typical recession.

For a recession to morph into a full-blown depression, there would need to be a number of financial and political economic missteps from both the federal government and the Federal Reserve Bank. Based on the amount of economic history that has been studied and understood by our economic and political leaders, this is less likely to happen today. We can look at the response to the COVID-19 economic shutdowns as to what kind of fiscal and monetary response there might be in the face of such an event.

Could the market quickly recover if the new tariffs were reduced or eliminated? Or have the changes already so upset the global economy that the volatility would remain?

Things are very fluid and moving very quickly. Just this morning, the S&P 500 index moved from being down 4% to being up 3% in less than half an hour based on a rumor. When this rumor turned out not to be true, the market reversed course again in very short order. There is absolutely no way to know with any certainty how markets may respond in the short term. While I certainly understand people’s fears around the current market downturn, history has shown us that acting on these emotions has proven to be detrimental to their goal of accumulating the wealth they will need throughout their retirement years. I believe that the end of the world will once again be postponed.

However, we do know that great American companies will continue to innovate and create products that consumers will buy. This will likely drive corporate earnings and stock prices over time. The U.S. economy and markets have an incredible history of success. Warren Buffett has often said it would be foolish to bet against U.S. companies and the economy in a free market and capitalistic society. I agree with Mr. Buffett.