In a bid to capitalize on growing investor interest in hybrid mutual funds, LIC Mutual Fund has unveiled its Multi Asset Allocation Fund. The open-ended scheme is designed to invest in equities, debt, and gold, aiming for long-term capital appreciation.

Launching with a New Fund Offer (NFO) that opened on January 24 and will close on February 7, the scheme is set to reopen for continuous sale and repurchase on February 18, according to the company’s official statement.

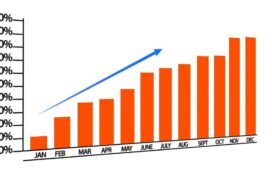

The fund’s benchmark portfolio comprises 65% Nifty 500 TRI, 25% Nifty Composite Debt Index, and 10% domestic gold prices. This introduction comes as hybrid mutual funds witness a 27% rise in assets under management in 2024, reflecting an investor shift toward this category.

(With inputs from agencies.)