The large-cap segment has experienced significant FII (Foreign Institutional Investor) selling, which has tempered valuations and appear much better placed compared to mid- and small-cap stocks

The large-cap segment has experienced significant FII (Foreign Institutional Investor) selling, which has tempered valuations and appear much better placed compared to mid- and small-cap stocks

Image: Shutterstock

Despite much that has been written about the US economy, India’s economic outlook will depend on what we do domestically. We run a small current account deficit (of around 1.2 percent of GDP) for FY25. Growth will depend on sustained domestic demand, particularly from urban areas where construction and home building will create jobs. Manufacturing will then follow real estate.

Rural demand is a byproduct of urban demand and it will depend on two things: Output, which is largely agriculture proceeds, and transfer of payments (from jobs in urban India).

There was a soft patch in the first half of 2024 when government spending was restrained. The hope will now be for the RBI to start cutting interest rates to stimulate demand. Once we have the right policies, the economy tends to respond quite fast. There is no reason why there should be a slackening in the economy.

We follow the barbell strategy of investing, which focusses on the factor of safety at two distinct ends of the investment spectrum:

Value-Driven Investments: We invest in companies that are currently in distress but have solvable issues. These businesses often trade at significant discounts because the market underestimates their recovery potential. The key is to identify situations where the underlying problems are fixable, offering a margin of safety and significant upside as the companies stabilise and grow.

Quality Compounders: At the other end, we focus on high-quality companies with strong fundamentals and a proven ability to grow consistently over time. These businesses, often referred to as compounders, provide safety through their predictable growth trajectories. Even if you do not buy them at their absolute cheapest, the long-term compounding effect—like 20 percent annual growth—delivers substantial returns over time.

The essence of the barbell strategy lies in avoiding the middle ground. We don’t bet on mediocre companies or those with inherent weaknesses trying to become market leaders. For example, in the banking sector, many banks have been expected to replicate the success of leading institutions, but very few achieve that. Instead, we focus on the extremes—companies with clear turnaround stories on one side and resilient, growth-oriented market leaders on the other.

This approach ensures that our portfolio combines the potential for outsized returns from undervalued opportunities with the stability and consistency of strong compounders. It is about securing safety and maximising opportunities on both ends.

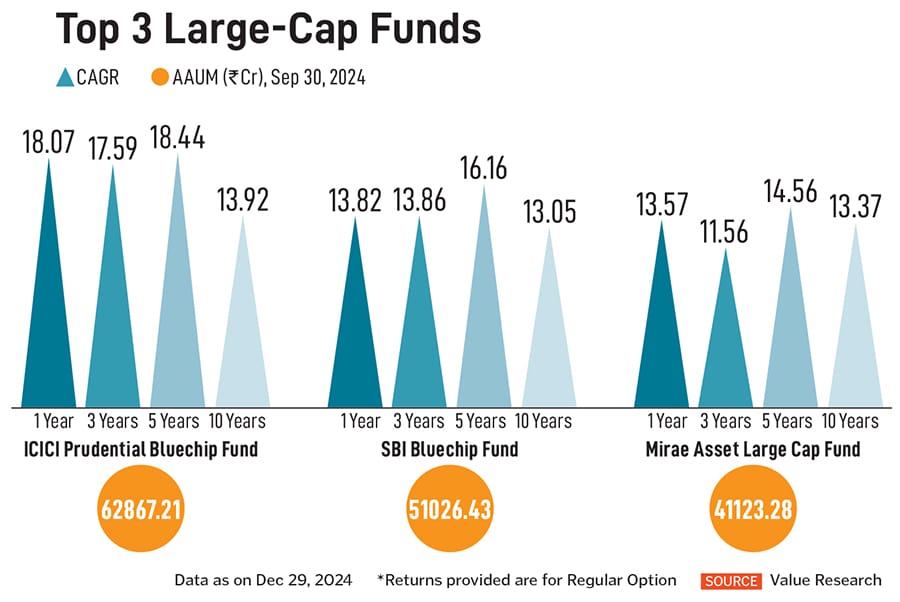

Large-caps: Risk adjusted strategy

Our preference for large-cap companies in 2025 stems from their relative attractiveness in terms of valuations. The large-cap segment has experienced significant FII (Foreign Institutional Investor) selling, which has tempered valuations and appear much better placed compared to mid- and small-cap stocks, which are currently trading at significantly stretched levels. If one were to probe deeper, some of these small-caps have weak business models, which do not justify the high valuations.

Investing in large caps under these conditions offers a sound, risk-adjusted strategy. These companies are typically market leaders with resilient business models, strong governance, and the ability to sustain earnings growth even in uncertain macroeconomic environments. This makes them an ideal choice in the current market setup, especially when juxtaposed with the overheated mid- and small-cap segments.

In 2025, our focus will be on identifying large-cap stocks with solid fundamentals and scalable business models that are well-positioned to benefit from India’s structural growth drivers. This approach not only mitigates risks but also ensures stable, compounding returns over the long term.

Also read: Bruised blue chips are like Rishabh Pant: Raamdeo Agrawal

Remaining contrarian in 2025

Our investment philosophy will remain contrarian in 2025 because we believe valuation discipline is fundamental to long-term wealth creation. In a market often driven by momentum, where rising prices attract more buying, we aim to focus on the fundamentals of companies rather than chasing trends. For example, if you like a stock at ₹100, it is logical that you should like it less at ₹200 because higher valuations reduce potential returns. Conversely, if a stock drops from ₹200 to ₹100 but the fundamentals remain intact, it becomes more appealing.

This principle is one of the reasons why active funds can outperform passive funds which tend to buy more of a stock as its price rises, increasing their holdings at higher valuations. This momentum-driven behaviour can lead to overvaluation risks.

In contrast, our contrarian approach of active investing prioritises valuation discipline, allowing us to avoid these risks and instead capitalise on opportunities where the market misprices companies.

In a dynamic market like India’s, where cyclical shifts are frequent, maintaining a contrarian stance helps us navigate irrational market behaviour while focusing on long-term value creation.

If India’s real estate sector continues to see improved demand and supply, so have to domestic cyclicals such as cement, capital goods and also financials.

The one area I am concerned about is unsecured credit, where we could see more pain. This is the only business in an economy where once your revenues decline, your costs actually go up in absolute terms, because the costs are built into collections.

Earnings estimates in fast-moving consumer goods are still too high and steel will have challenges, considering demand from China is sluggish. With the US economy already growing, we are not too sure how much more additional demand for the Indian IT sector will come from there.

Investment allocation

We do not expect mega, but modest returns from large caps in 2025: Investors with a moderate risk appetite can consider investing in balanced advantage products or multi-asset products. The ICICI Prudential Business Cycle Fund is uniquely positioned to capitalise on India’s evolving economic cycles by dynamically adjusting its portfolio allocation across sectors that are expected to benefit from the current phase of the business cycle.

The rationale behind this fund lies in understanding that markets move in cycles, and different sectors perform differently at various stages of the economic cycle. By aligning sectoral exposure with the prevailing macroeconomic environment, this fund ensures that investors can ride the growth of sectors poised for outperformance while avoiding cyclical downturns.

● Anish Tawakley is ICICI Prudential AMC’s Co Chief Investment Officer – Equity

(As told to Salil Panchal)

(This story appears in the 24 January, 2025 issue

of Forbes India. To visit our Archives, click here.)