#AD

In 2025, India’s Union Budget introduced tax changes affecting mutual funds. Equity mutual funds now have short-term gains taxed at 20% and long-term gains at 12.5%. Just as investors seek clarity on taxation, many also want to know about the legal standing of various financial platforms in India. One common concern among traders, – is Exness legal in India and whether it operates under proper regulatory oversight. Ensuring that a broker is legally permitted to provide services in India is essential for traders who want to avoid any potential legal risks associated with trading on foreign platforms.

When it comes to taxation on mutual fund investments, the provisions outlined under Section 112A, which is a key part of the Income Tax Act, determine how gains from equity-oriented mutual funds are taxed. This section is particularly relevant for investors holding long-term equity funds, as it sets the tax rates for capital gains exceeding ₹1 lakh. A similar provision, found under Section 111A, applies to short-term capital gains. Since tax implications vary based on the type of fund—whether equity or debt—investors need to assess their holdings carefully to ensure compliance with tax regulations while optimizing returns.

Understanding tax on mutual funds: How it works in 2025

In 2025, India’s taxation rules for mutual funds are set to change, bringing new challenges and opportunities for investors. One of the most critical aspects to understand is how Section 112A of the Income Tax Act plays a role in determining capital gains tax on equity-oriented mutual funds. Since this provision affects long-term capital gains, investors need to be aware of how their tax liabilities will be calculated under the latest amendments. Keeping track of these changes is essential for making informed investment decisions and optimizing tax planning.

1. Equity-oriented mutual funds

For equity-oriented mutual funds, which invest primarily in stocks, the tax treatment is as follows:

- Short-term capital gains (STCG). If units are held for up to 12 months, gains are considered short-term and taxed at 15% under Section 111A of Income Tax Act.

- Long-term capital gains (LTCG). For units held beyond 12 months, gains exceeding ₹1,25,000 are taxed at 10% without indexation benefits, as per Section 112A of Income Tax Act. This threshold was increased from ₹1,00,000 to ₹1,25,000 in the Budget 2024.

2. Debt-oriented mutual funds

Debt mutual funds, which invest in fixed-income securities, have distinct tax implications:

- Short-term capital gains. For holdings up to 36 months, gains are added to the investor’s income and taxed according to the applicable slab rates.

- Long-term capital gains. Previously, gains from units held beyond 36 months benefited from indexation and were taxed at 20%. However, as per the Budget 2025, the indexation benefit has been removed. Now, long-term gains are taxed at the investor’s applicable slab rate, aligning debt fund taxation with that of fixed deposits.

3. Hybrid Funds

Hybrid funds, like the SBI Equity Hybrid Fund, combine equity and debt investments. Taxation depends on the fund’s equity exposure.

- Equity-oriented hybrid funds. If the equity component is 65% or more, they are taxed similarly to equity mutual funds.

- Debt-oriented hybrid funds. If the equity component is less than 65%, they follow debt mutual fund taxation rules.

New tax rules for mutual funds in 2025: What’s changing?

In 2025, India’s tax policies related to mutual funds have seen significant revisions, affecting both resident and non-resident investors. Under the updated framework, any income earned from mutual funds, including capital gains, is now subject to taxation. A tax on earnings from mutual funds applies at a fixed rate of 10% on both short-term and long-term gains, ensuring that all investors contribute to government revenues.

For equity-based investments, the changes are even more specific. Investors dealing with mutual funds that invest in equities will now face a 20% tax on short-term capital gains, whereas long-term gains exceeding ₹1,25,000 will attract a 12.5% levy. This adjustment, introduced in Budget 2024, aligns with the government’s efforts to create a balanced investment taxation system.

Debt-oriented schemes are also affected. Any mutual fund investments in debt instruments that were purchased before April 1, 2023, but redeemed on or after July 23, 2024, will now be taxed at a flat rate of 12.5% without the benefit of indexation. Additionally, the classification for long-term capital gains has been revised, with the minimum holding period now reduced to 24 months instead of the previous requirement.

Despite these changes, some tax-saving options remain intact. The tax benefits available for mutual fund schemes such as Equity-Linked Savings Schemes (ELSS) under Section 80C continue, allowing deductions of up to ₹1,50,000 per year. This ensures that investors still have avenues to reduce their tax burden while participating in the financial markets.

Short-term vs. long-term capital gains: Tax implications

In India, capital gains tax varies based on the asset’s holding period. Short-term capital gains (STCG) apply when assets are sold within a specified period:

- Listed equity shares and equity-oriented mutual funds: Held for 12 months or less.

- Immovable property (land or buildings): Held for 24 months or less.

Short-term capital gains (STCG) on listed equities are subject to a tax rate of 20%, while gains from other assets are taxed based on an individual’s applicable income tax slab. Long-term capital gains (LTCG), which apply when assets are held beyond a specific duration, are taxed differently depending on the type of asset and the applicable tax provisions.

When considering LTCG from listed equities, any gains exceeding ₹1.25 lakh are taxed at 12.5%. However, for other assets, the tax rate remains 12.5% but does not allow for indexation benefits. These revised tax rates were introduced in the Budget 2024 and have been applicable since July 23, 2024.

For individuals selling immovable property, the government has provided two taxation options. As per amendments made in August 2024, taxpayers can either opt for a 12.5% tax rate without indexation benefits or continue with the previous taxation structure, which levies a 20% tax rate but allows for indexation adjustments. These tax provisions are largely governed by Section 111A under the Income Tax Act, which specifically outlines how gains from various asset classes, including equity investments, are taxed.

To efficiently calculate capital gains tax on mutual fund investments, taxpayers can make use of a mutual fund tax calculator, which helps in estimating tax liability by factoring in different investment durations, applicable rates, and indexation benefits. Such tools are particularly useful in planning investment strategies and ensuring tax compliance under the latest regulations.

How to legally reduce taxes on mutual fund investments

In India, investors can legally reduce taxes on mutual fund investments through strategic planning and utilizing available tax-saving instruments.

- Invest in Equity-Linked Savings Schemes (ELSS). These mutual funds offer tax benefits under Section 80C, letting you claim deductions on investments up to ₹1.5 lakh per year. With a three-year lock-in, ELSS funds provide both tax savings and long-term growth potential.

- Make use of the new tax regime benefits. The Budget 2025 raised the income tax exemption limit to ₹1.2 million, giving taxpayers more disposable income. Matching your investments to the new tax brackets can help you save more and manage liabilities better.

- Leverage Systematic Investment Plans (SIPs). SIPs let you invest small amounts regularly in mutual funds, making wealth-building more consistent. ELSS SIPs have a three-year lock-in, but you also benefit from rupee cost averaging and compounding over time.

- Plan around holding periods for capital gains. If you hold equity mutual funds for over nine months, your gains count as long-term, with a 10% tax on profits above ₹1 lakh. Debt fund gains get taxed at 15% if held for more than a year, so timing withdrawals wisely can save taxes.

- Stay updated on tax rule changes. Tax laws shift often, and staying on top of tax rule changes helps investors make smarter moves. Keeping up with Budget 2025 updates can help you maximize returns and reduce tax burdens effectively.

Best tax-saving mutual funds to maximize your returns

Investing in tax-saving mutual funds, particularly Equity Linked Savings Schemes (ELSS), gives Indian investors the advantage of reducing their taxable income under Section 80C of the Income Tax Act. These funds come with a mandatory three-year lock-in period, allowing investors to benefit from both tax savings and potential long-term wealth creation. To estimate the exact tax benefits and returns, many traders and investors rely on a calculator designed for mutual fund tax planning, which helps them make informed investment decisions. Here are some top-performing ELSS funds to consider in 2025

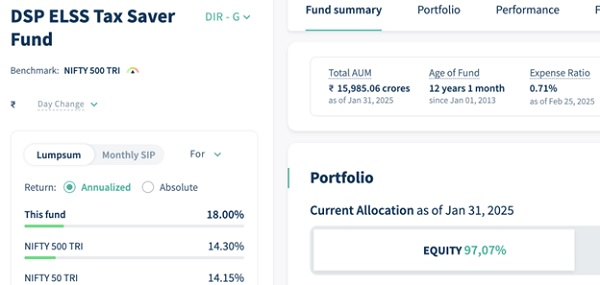

1. DSP ELSS tax saver fund

- Assets under management (AUM). ₹15,985 crore

- Expense ratio.64-1.69%

- 5-Year compound annual growth rate (CAGR). 41%

This fund has consistently outperformed its benchmark, providing robust returns with controlled risk.

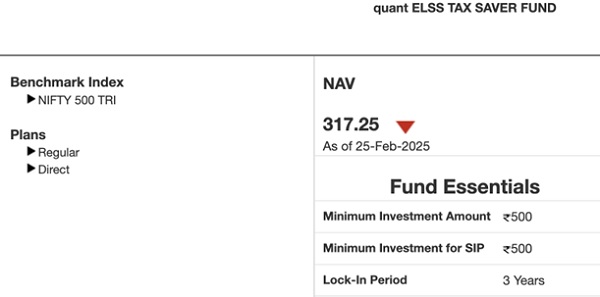

2. Quant ELSS tax saver fund

- ₹10,279 crore

- Expense ratio. 50%

- 5-Year CAGR.41%

Known for its aggressive investment strategy, this fund has delivered impressive returns, appealing to investors with a higher risk tolerance.

3. SBI Long Term Equity Fund

- ₹27,306 crore

- Expense ratio. 95%

- 5-Year CAGR.26%

Managed by SBI Mutual Fund, this scheme focuses on large-cap stocks, aiming for steady growth and capital appreciation.

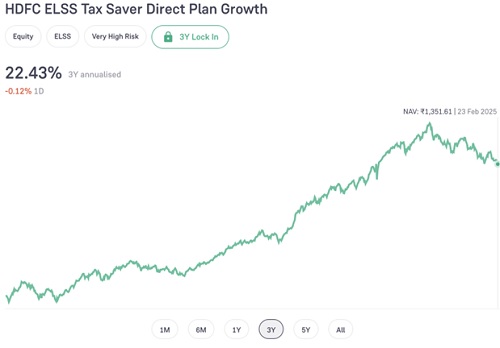

4. HDFC ELSS tax saver fund

- AUM: ₹1

5,414 crore

5,414 crore - Expense Ratio:09%

- 5-Year CAGR:09%

5. SBI Equity Hybrid Fund

- AUM: ₹71,142 crore

- Expense Ratio:73%

- 5-Year CAGR: 13.32%

Mutual fund taxation FAQs: What every investor should know

Below are some of the questions every investor in India must know their answers to.

1. How are dividends from mutual funds taxed in India?

Under the Finance Act of 2020, any dividends that investors receive from mutual funds are now subject to taxation. Instead of being exempt, these earnings are added to the investor’s total income and taxed according to their respective income bracket. This means that the tax imposed on mutual funds varies depending on an individual’s overall taxable income.

Furthermore, if the total dividend payout from all mutual fund holdings surpasses ₹5,000 in a financial year, a deduction of tax on mutual funds is applied at a fixed rate of 10% as Tax Deducted at Source (TDS). This ensures that a portion of the investor’s liability is collected in advance, reducing the final tax burden when filing returns.

2. What is the tax implication for non-resident Indians (NRIs) investing in mutual funds?

NRIs are subject to TDS on capital gains from mutual funds. For equity-oriented funds, short-term capital gains are taxed at 20%, while long-term gains exceeding ₹1.25 lakh are taxed at 12.5%. For debt-oriented funds, both short-term and long-term gains are taxed as per the investor’s income tax slab rate.

3. Are systematic investment plans (SIPs) taxed differently?

Each investment in a SIP is treated as a separate purchase. The holding period for tax purposes is calculated individually for each installment. Thus, gains from SIPs are taxed based on the duration each installment is held, following the respective short-term or long-term capital gains tax rules.

4. How does the new tax regime affect mutual fund investors?

The Budget 2025 introduced a new tax regime with revised income tax slabs and increased the exemption limit to ₹12 lakh. However, capital gains from mutual funds are considered “special rate income” and are taxed separately from regular income. Investors should assess their individual financial situations to determine whether the new or old tax regime is more beneficial.

5. Are ELSS mutual funds tax-free?

Equity Linked Savings Schemes (ELSS) provide tax deductions under Section 80C, allowing investments up to ₹1.5 lakh to be tax-exempt. However, gains beyond ₹1.25 lakh after the three-year lock-in period are taxed at 12.5% under Section 112A of Income Tax Act.

Expert opinions: How tax changes will impact investors in 2025

Anastasiia Chabaniuk, an expert in finance, suggests that the Union Budget 2025 has introduced significant tax reforms impacting mutual fund investors in India. One notable change is the simplification of the tax structure, proposing a reduction in long-term capital gains tax to 12.5% and short-term gains to 20%. This initiative aims to enhance investor confidence and stimulate both domestic and foreign investments.

Additionally, the budget has increased the personal income tax exemption limit to ₹1.2 million, effectively boosting disposable income for middle-class families. This increase is expected to encourage higher savings and investments, potentially leading to a surge in mutual fund investments.

Industry experts also advocate for the restoration of long-term indexation benefits for debt mutual funds. Reinstating these benefits would help neutralize the impact of inflation on capital gains, making debt investments more attractive to investors.

Conclusion

Understanding how mutual funds are taxed in India is crucial, especially with the latest changes in the Union Budget 2025. The removal of indexation benefits for debt mutual funds and revised tax rates mean investors need to rethink their strategies.

Sections 111A and 112A of the Income Tax Act lay out how capital gains on mutual funds are taxed. Section 111A covers short-term gains, while Section 112A applies to long-term equity investments. Knowing how these rules work can help investors minimize their tax burden.

A mutual fund tax calculator can make tax planning simpler. Staying updated and consulting a financial advisor can help you make informed investment decisions in the current tax environment.

FAQs

What are the new tax rules for mutual funds?

In 2025, India’s Union Budget revised mutual fund taxation: equity fund gains are taxed at 12.5% (long-term) and 20% (short-term), while debt fund gains are taxed per your income slab.

How to avoid tax in mutual funds?

Utilize tax-loss harvesting to offset gains with losses, and invest in Equity-Linked Savings Schemes (ELSS) for deductions up to ₹1.5 lakh under Section 80C.

How to save tax on long-term capital gain?

Invest in ELSS funds for Section 80C benefits and consider tax-loss harvesting to reduce taxable gains.

Is mutual fund taxable after 3 years?

Yes, mutual fund gains are taxable upon redemption, regardless of the holding period.

About the Author

This article was written by Ivan Andriyenko, a financial specialist at Traders Union. With eight years of experience in Forex, cryptocurrency, and stock trading, he focuses on trading strategies, market analysis, and broker evaluations.