SINGAPORE – Singapore and Asean investors keen to jump into Australia’s housing market have typically favoured brick-and-mortar investment properties – but private real estate credit funds are gaining traction as an alternative avenue.

Mr Alan Greenstein, chief executive officer of Australia’s non-bank lender Zagga, told The Straits Times that strong demand for Australian real estate private credit is seen from institutional investors, family offices and wealth managers across South-east Asia.

Unlike investors in Japan or South Korea, those in Singapore and neighbouring countries are more familiar with Australia and have deep connections through education, family ties and business relationships, he said.

“We are expanding our footprint and making it easier to invest with us,” he said.

About 15 per cent of Zagga’s funds under management (FUM) is from Asean investors, with its two biggest investors in the region based in Singapore and Japan. He hopes to double the Asean FUM in two years.

Zagga has appointed Ms Roushana Sjahsam as its senior board adviser for Asean – a newly created role – to double down on its expansion here and in the region.

Ms Sjahsam was previously managing director at financial services firm Cantor Fitzgerald Capital Markets in Hong Kong. She also worked at Citibank and credit provider ADM Capital before.

She said investors in South-east Asia have put their money mostly in the US and European private credit markets, but Australia is gaining attention, underpinned in part by the country’s strong governance and legal systems as well as a housing crunch fuelled by population growth and immigration.

Zagga has appointed Ms Roushana Sjahsam as its senior board adviser for Asean – a newly created role – to double down on its expansion here and in the region.PHOTO: ZAGGA

Private real estate credit are loans provided by non-bank lenders, like Zagga, to property developers.

For property developers, such loans offer an alternative funding source to traditional banks, and for investors, an opportunity to earn income through interest payments.

Mr Greenstein reckoned the private real estate credit in Australia is worth about A$90 billion (S$75 billion), representing about 17 per cent of the total real estate credit market there, which means about 83 per cent of the market is still being funded by banks.

Zagga recently launched a new Singapore Variable Capital Company (VCC) – the Zagga Real Estate Credit Fund (ZRECF) – and has obtained A$20 million in commitments.

Unlike in a regular fund structure where each fund has to be registered into one account, asset managers are able to incorporate multiple funds into a single VCC.

Mr Greenstein said the target is to “at least match” its Australia fund size of A$200 million.

Mr Alan Greenstein told The Straits Times that strong demand for Australian real estate private credit is seen from institutional investors, family offices and wealth managers across South-east Asia. PHOTO: ZAGGA

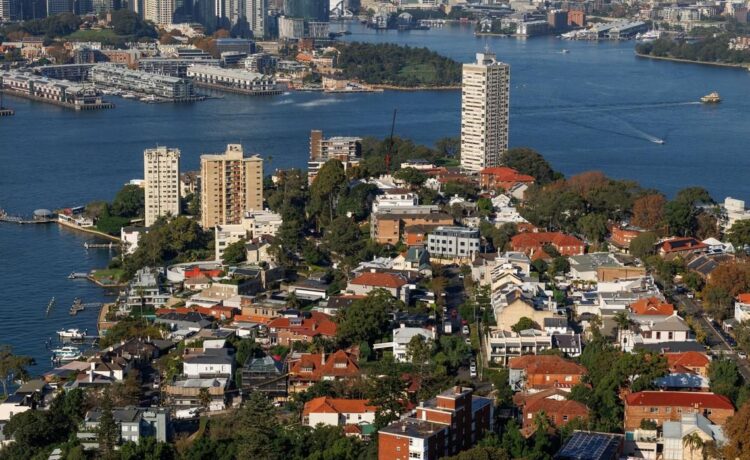

ZRECF will invest directly in prime commercial real estate across Australia’s east coast, where the markets are “most liquid”.

Investors can choose to invest in their preferred currency – Australian dollar, Singapore dollar, Hong Kong dollar or the greenback.

In Singapore, Zagga is one of the Australian real estate private credit managers from whom Bigfundr, a Singaporean family-controlled fintech platform, sources loan investments to offer to the retail base here.

The Monetary Authority of Singapore-licensed and regulated Bigfundr offers retail investors access to real estate debt investment opportunities starting from $1,000, opening up an investment avenue that was previously only available to institutional or high-net-worth individuals.

Since giving out its first loan in 2017, Zagga has invested over A$2.5 billion across more than 300 transactions in Australia’s commercial real estate sector, spanning residential, commercial and industrial properties.

The private real estate credit market in Australia has grown in recent years, fuelled by tighter banking regulations which have constrained traditional bank lending and increased demand for flexible financing solutions, Mr Greenstein said.

This has allowed Zagga to carve out a niche in financing development projects in Australian cities experiencing housing shortages.

While Australia’s property development is considered hot, growth is not uniform across the continent, Mr Greenstein said.

Melbourne’s high-rise apartment market, for instance, has faced some challenges because of an over-supply which grew on the back of inflows of foreign students and large Chinese investments.

“But there was a cooling off in the relationship between China and Australia. Coupled with Covid-19, many didn’t come,” he said.

He expects the situation in Melbourne to improve with the return of international students and improving China-Australia ties.

Zagga has a robust risk management system in place, he said. The firm maintains a zero-loss record, achieved through a conservative lending strategy that typically provides loans at only 65 per cent of a property valuation. This approach provides a significant equity buffer of 35 per cent against potential market fluctuations.

He said: “Even if we had to sell an investment at a reduced price, our investors have a significant cushion.

“The underlying asset value must diminish by 35 per cent before an investor loses a single dollar – something you simply don’t see in the equity markets.”

Zagga’s expansion in Singapore is timely, Mr Greenstein said, as investors look for safe havens in times of market turbulence and are seeking to diversify from the US and Europe.

Real estate private credit in Australia is delivering “decent returns” of around 8.5 per cent in Sing dollars versus the dismal savings rates offered by banks, he said.

Join ST’s WhatsApp Channel and get the latest news and must-reads.