Indian banking has witnessed various challenges over the last few years, from mounting non-performing assets (NPAs) to regulatory action and issues of corporate governance. Banks are generally considered pillars of country’s financial stability, and thus any disruptions within prominent banks could have extensive ramifications.

Institutional investors, regulators, and analysts are keenly watching such events because they have the potential to destabilize investment decision-making and sentiment in the market. When a solidly performing bank has an internal crisis, the implications can be serious, affecting retail and institutional investors equally.

The market is buzzing with latest news, where IndusInd Bank, a leading private sector bank in India, had an accounting anomaly that sent alarm bells ringing for investors. This news has led to a drastic fall in the bank’s share prices, which has sent the market into panic.

About IndusInd Bank Ltd.

IndusInd Bank is a large private-sector Indian bank with significant retail and corporate banking presence. Founded in 1994, the bank has gradually increased its presence in every nook and corner of India, serving individuals and institutions as customers.

Having a diversified portfolio that comprises retail loans, credit cards, corporate lending, and forex services, IndusInd Bank has been identified as an institution with innovative banking solutions. For years, the bank has had a reputation of strong financial performance and stable growth, and today it is one of the important players in the Indian banking market.

In early 2024, IndusInd Bank presented robust quarterly numbers, citing enhanced retail loan growth and stronger digital banking efforts. The bank also initiated strategic collaborations to further deepen its penetration of rural credit markets, as part of India’s increasing need for accessible financial services.

IndusInd Bank Ltd. Under Scrutiny

Although there was a steady growth trajectory, IndusInd Bank recently suffered a major blow that shook investor confidence. The bank reported an accounting mismatch related to forex hedging expenses, which caused financial inaccuracies. This announcement led to a sharp drop in its share price, with the shares tumbling over fears of governance and financial stability.

Market analysts feared that the mistake could affect the bank’s earnings transparency, credibility, and business operations transparency. The event has put IndusInd Bank in the limelight, compelling stakeholders to evaluate the long-term consequences of this event.

What Led to IndusInd Bank’s Sudden Slump?

- Discrepancies in Net Worth Attributable to the Derivatives Portfolio

IndusInd Bank allegedly overestimated some of the forex hedging expenses. While reviewing internally, the bank realized discrepancies in the accounting of some hedging expenses in past quarters. This discrepancy had affected the bank’s net worth, with a reported reduction. This shocking piece of news shocked market players, resulting in the fall of stock prices and indicating possible shortcomings in the bank’s internal controls.

- Overstatement of Net Interest Margin (NIM)

Yet another important reason for the correction of the stock was IndusInd Bank’s inflated Net Interest Margin (NIM), an essential profitability ratio. The inflated NIM had the investors believing the bank was more profitable and efficient than it actually was. Once the mismatch emerged, earnings quality and health worries increased, triggering a sell-off.

- Increasing Stress in Microfinance Lending

IndusInd Bank’s exposure to microfinance institutions (MFIs) has been a cause of concern because of increasing delinquencies in the industry. This increased credit risk along with concerns of rising NPAs and the unpredictability of provisioning requirements has added pressure to the financial stability of the bank and fueled its shares’ downward movement.

- Leadership Uncertainty: CEO’s Shorter Tenure Extension

IndusInd Bank leadership transitions have increased investor fears. The CEO’s less-than-projected tenure extension has fueled rumours of leadership stability and succession planning, creating uncertainty regarding the bank’s strategic direction.

- Chief Financial Officer (CFO) resignation

IndusInd Bank’s CFO recently stepped down amidst persistent financial irregularities and governance issues, further fueling the volatility. Such high-profile exits at times of crisis tend to evoke apprehensions of internal strife or unfinished business, adding to investor negative sentiment.

These events not only led the stock of IndusInd Bank to crash but also generated concerns regarding mutual funds having heavy exposure to the stock.

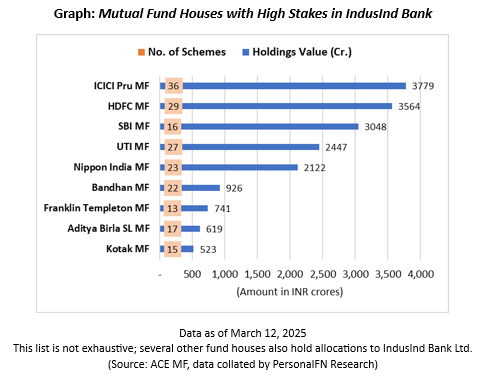

Consequently, fund houses with significant investments in IndusInd Bank are likely to suffer a significant hit. The below graph of reputed fund houses displays their exposure towards IndusInd Bank, including the number of schemes that are invested in the stock.

ICICI Prudential Mutual Fund has the maximum exposure with holdings of around Rs 3,779 crore in 36 schemes. HDFC Mutual Fund follows closely with Rs 3,564 crore in 29 schemes. SBI Mutual Fund comes third with Rs 3,048 crore in 16 schemes, reflecting a relatively high concentration of exposure compared to ICICI Pru and HDFC MF.

Other prominent fund houses with significant exposure are UTI Mutual Fund (Rs 2,447 crore in 27 schemes) and Nippon India Mutual Fund (Rs 2,122 crore in 23 schemes). Fund houses such as Bandhan, Franklin Templeton, Aditya Birla SL, and Kotak Mutual Fund have relatively lower exposure, each of them having values below Rs 1,000 crore. Although they have lower numbers of schemes, some of these fund houses have high investment values, which reflect focused bets on IndusInd Bank in chosen funds.

For investors, this serves as a reminder of the risk that those holding more-exposed funds to IndusInd Bank face, particularly following the recent correction in the bank stock price. Though diversified portfolios will mitigate some of this risk, investors must keep their fund holdings under careful review and consider how these exposures support their investment strategy.

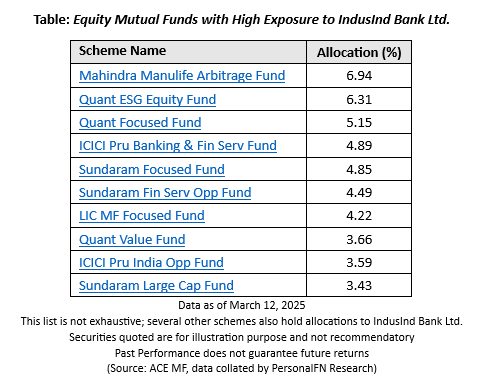

Among these, Mahindra Manulife Arbitrage Fund has the highest exposure at 6.94%, which shows a significant exposure to the stock. Next in line are Quant ESG Equity Fund and Quant Focused Fund with exposures of 6.31% and 5.15%, respectively. These larger exposures show fund managers conviction in IndusInd Bank’s potential before the recent news.

Investments in the stock by funds such as ICICI Pru Banking & Financial Services Fund and Sundaram Focused Fund are also significant, which is in line with their sectoral theme for banking and financial services. Likewise, sector funds such as Sundaram Financial Services Opportunities Fund exhibit focused behavior towards the banking space. Diversified funds such as Quant Value Fund and ICICI Pru India Opportunities Fund also carry moderate level of holding in the stocks, diversifying the risk across several sectors.

However, investors holding these mutual funds should closely monitor IndusInd Bank’s performance, given its recent challenges. While the exposure levels vary, these allocations may influence the funds’ short-term NAV fluctuations. Evaluating the fund manager’s strategy and portfolio diversification is crucial in deciding whether to stay invested or rebalance holdings.

Should You Be Concerned As an Investor?

If you are invested in the above listed mutual funds or any other holding IndusInd Bank Ltd., it’s important to assess the broader picture rather than act on panic. Here are key points to consider:

- Diversification

Despite IndusInd Bank’s setback, most mutual funds listed above maintain diversified portfolios. A well-diversified fund can absorb short-term volatility from a single stock without severely impacting returns, so there is no need to panic-sell based on market buzz.

- Fund Manager’s Strategy

Understand your fund manager’s investment strategy. Value funds may retain IndusInd Bank as part of a recovery strategy, while growth-focused funds may reduce exposure to minimise volatility.

- Investment Horizon

Investors with a long-term horizon may see IndusInd Bank’s correction as an opportunity for future recovery. Short-term investors should assess their risk appetite and review their portfolio allocation.

- Sector Outlook:

IndusInd Bank’s recent missteps aside, the Indian banking sector remains poised for long-term growth. If macroeconomic fundamentals remain stable, banks may recover steadily going forward.

Steps to Consider:

- Check the latest portfolio disclosure to understand the extent of exposure.

- Monitor how significantly IndusInd Bank’s decline has impacted your mutual fund’s NAV.

- If you are unsure about your investment strategy, seek professional guidance to determine whether adjustments are needed.

- Reducing concentrated exposure to individual stocks or sectors can mitigate risk in volatile market conditions.

To Conclude…

IndusInd Bank’s stock correction has undoubtedly impacted several prominent mutual funds. However, for disciplined investors following a long-term strategy, this setback may present a potential recovery opportunity.

By carefully evaluating fund performance, diversification, and investment objectives, investors can make informed decisions to navigate the current volatility effectively. Ultimately, understanding how each fund manager responds to IndusInd Bank’s challenges will be crucial in assessing future growth prospects.

This article first appeared on PersonalFN here.

Disclaimer: The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.