(Bloomberg) — Britain is losing foreign investment by insisting that companies sound out other countries first to gauge the level of state support on offer, according to both a former minister and a senior civil servant.

Institutional fear about “picking winners” and value for money has resulted in strategic investments destined for the UK going to rival countries instead, said Ceri Smith, director general for strategy and investment at the Department for Business and Trade.

His comments were backed by Richard Harrington, a former government minister who published a review into foreign direct investment last month. Harrington labelled the advisory body that scrutinizes government assistance for big inward investment projects the “deal-busters.”

Harrington and Smith were speaking at a Bloomberg event on the Harrington Review, in which the former business minister called for a cross-government committee to act as a “concierge service” for major investors into the UK.

Recent successes include commitments to build electric car battery gigafactories by Nissan and Jaguar Land Rover. The government is believed to have provided some form of incentive, though the details have not been revealed.

In the last few years, the UK has also lost big investments by drugs giant AstraZeneca and carmaker Tesla that it was expected to secure. Harrington highlighted the success of a recent “partnership” with vaccine maker Moderna in his review but said it “was seen as the exception rather than the rule.”

“As an example of how our system doesn’t work properly, if we have a good proposition that we want to fund, part of our appraisal is we force the company who is interested in the UK to go and look for other offers elsewhere so we can say we are definitely beating the other offer,” Smith said.

“And then some of them actually go and say the other offer is rather more attractive. That is just a function of our processes because we are so scared of picking winners.”

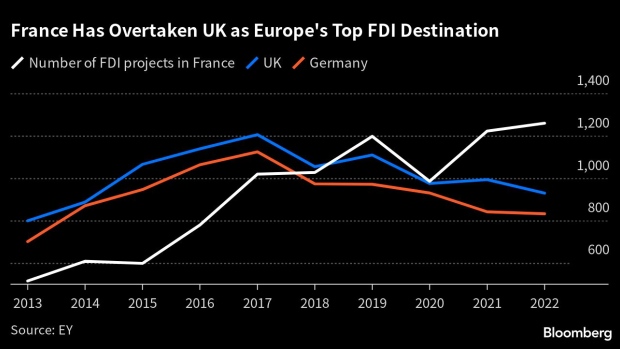

The UK has fallen behind France for inward investment. Chancellor of the Exchequer Jeremy Hunt has made raising investment central to his growth plans. He said last month the government would accept all the headline recommendations from the Harrington Review.

“Officialdom has to justify a value for money concept when no one quite knows what it is,” Harrington said.

“It’s been felt that the way to get value for money is to get a competing offer from another country. If someone goes to JP Morgan, they don’t say: ‘See what Morgan Stanley comes up with and bring it back to us.’”

Harrington was particularly critical of the Industrial Development Advisory Board, an arms-length group of private sector experts who approve assistance programs. He described IDAB, established in 1972, as “a mystery body.” When he was a business minister between 2017 and 2019, “we called them the deal-busters,” he said.

Like many countries, the UK has a long history of offering incentives to lure investment. Margaret Thatcher, the former prime minister, brought Nissan to Sunderland in 1984 with tax breaks and land subsidies.

Also speaking on the panel, Exchequer Secretary to the Treasury Gareth Davies said: “I think it’s quite right that the Treasury puts taxpayer money and the value that we place on that at the center of every decision. But we need to be very clear why we have taken certain decisions.”

©2023 Bloomberg L.P.