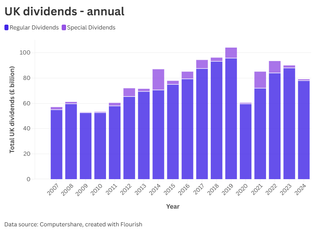

Regular dividends from UK companies fell 0.4% in 2024, according to new analysis from Computershare.

Dividends are an important part of investing in stocks. While some equities are best added to a portfolio for their future share price growth potential (growth stocks), others are sources of income. Anyone considering buying new stocks needs to consider whether they are aiming for growth or income.

UK businesses paid out a total of £92.1 billion through the year, 2.3% more than in 2023, but this figure includes one-off payments. Total regular dividend payments fell to £86.5bn, marking a decline on the previous year.

Sign up to Money Morning

Don’t miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don’t miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

(Image credit: Computershare)

However, the decline was mainly driven by falling dividend payments from mining stocks. The mining sector had been the top dividend payer between 2021 and 2023, but mining dividends fell by $4.5 billion, or 40%, in 2024.

Factoring out mining – which is heavily exposed to macroeconomic business cycles – dividend payouts from UK companies increased by 8.4% including one-off payments, and by 4.0% on an underlying basis.

“It is worth highlighting that dividend growth was better outside the highly cyclical mining sector,” said Mark Cleland, CEO issuer services, Computershare. “In addition, share buybacks are having an impact, diverting an estimated £42-45bn of cash in 2024 to shareholders that might previously have been paid mostly in dividends.”

Ex-mining sector dividend growth of 4.0% is “reasonable given the uncertain economic outlook”, says David Smith, portfolio manager at Henderson High Income Trust.

“The impact of the UK Budget is likely to curtail dividend growth for some domestic businesses given corporate margins are coming under pressure from the increase in National Insurance and minimum wage,” Smith added. “ However one must remember that 75% of the UK market’s revenues are derived from overseas where the global economy is improving.

“Additionally the outlook for dividends in the banking sector is robust, especially in an environment of higher for longer interest rates, while the negative impact from dividend cuts in the mining sector is coming to an end.”

Which UK sectors and shares are best for dividend yield growth?

According to AJ Bell, the following five companies posted the highest dividend yield growth in the FTSE 350 last year:

| Rank | Company | Dividend per share growth |

|---|---|---|

| 1. | Spire Healthcare | 320% |

| 2. | Easyjet | 169% |

| 3. | TI Fluid Systems | 169% |

| 4. | Haleon | 150% |

| 5. | PPHE Hotel | 140% |

Source: AJ Bell, Sharescope, Company announcements. Based on the most recent annual dividend declaration. Data from 1 Jan to 3 December 2024. Excludes special dividends.

Computershare’s report shows that the best sectors for UK dividend stocks in 2024 were banking, which paid out 28.8% (£873 million) more in dividends during 2024 than 2023; insurance, which benefitted from Direct Line (LON:DLG) restoring its previously-cancelled dividend; and food retailers, with Tesco (LON:TSCO) increasing its dividend and Marks & Spencer’s (LON:MKS) making a comeback.

Besides mining, housebuilding was the other sector to significantly cut dividends. Persimmon (LON:PSN) and Bellway (LON:BWY) in particular dragged the sector’s average yield down by reducing their payouts.

The FTSE 250 isn’t traditionally the favoured hunting ground for high dividend yields, but if investors are selective then the best FTSE 250 dividend stocks could deliver yields well in excess of the FTSE 100’s average.

Indeed, the FTSE 250’s dividend yield change outperformed the larger index during 2024. Both indices’ yields fell during the year, but the FTSE 100’s by 0.9% compared to the FTSE 250’s 0.4%. This doesn’t account for the impact of high-dividend stocks like Howden Joinery (LON:HWDN) being promoted into the FTSE 100; this, according to Computershare, knocked 2.5 percentage points off the FTSE 250’s dividend yield growth.

What is the outlook for UK dividends in 2025?

Dividends from UK equities are expected to display limited growth this year, and in fact – given the precarious state of the UK economy – might underperform the yields that investors could realise from bonds.

“Over 2025 we predict equities to yield 3.8%,” says Cleland. “The top 100 is likely to yield 3.8% and the mid-caps 3.5%.”

These yields are below the returns that 10-year gilts are yielding, which increased to over 4.6% in recent weeks. Gilts are generally regarded as a safer investment than equities, and in the current climate they are also offering higher yields.

“This means UK gilts are offering a significantly better income than shares at present for a lower risk (if they are held to maturity),” says Cleland.

Computershare’s analysis predicts “dividends in 2025 to reach £92.7bn at the headline level: up just 0.7% year-on-year”.

How have share buybacks impacted UK dividends?

Dividends aren’t the only means by which companies return capital to shareholders. They also do so via share buybacks, and UK companies have ramped these up over the last year.

Computershare estimates the size of UK share buybacks in 2024 at £42-45 billion; “less than the record achieved in 2022 when companies returned cash preserved during the pandemic-inspired dividend cuts but well above the pre-2020 annual average”, says Cleland.

Buying back shares reduces the number in circulation, so increases the value of those that remain. However, it also makes less money available for dividend payments, and Cleland argues that this has been another contributing factor to the decline in dividend payments.

“The trend for companies to buy back their shares with excess cash at the expense of special dividends continues,” says Smith, while adding that “underlying dividend growth next year should be supported by international earners and banks, while dividend cover for the UK market in aggregate is healthy.”