President Donald Trump‘s “reciprocal” tariffs caused the stock markets to plummet—leaving many Americans concerned about the grave impact the measures might have on their own finances and prompting several major institutions to up their risk of a recession from 40% to 60%.

On April 6, four days after the tariffs were announced, CNN reported that the S&P 500 had lost 15% of its value since Trump’s inauguration on Jan. 20, and by 12:00 p.m. ET on April 9, stocks had fallen by more than 12%, according to Reuters.

Article continues below this ad

However, the market saw some recovery just hours later when the president instituted a “90-day pause” on the tariffs, lowering them to 10% for all countries except China—whose tariffs he raised to 125%.

The move saw the stock market surge toward its best day in five years, with the Nasdaq composite rising more than 8%, while the Dow Jones Industrial Average and the S&P 500 both gained more than 5%.

Still, the true fallout from the “Liberation Day” tariff announcement is still being calculated, and the continued financial volatility has seen several industry titans warn that America could be at risk of another recession—with some going as far as to claim that it has already happened.

“Most CEOs I talk to would say we are probably in a recession right now,” BlackRock CEO Larry Fink said at an event for the Economic Club of New York on April 7, according to CNBC.

Article continues below this ad

“One CEO specifically said the airline industry is a proverbial bird in a coal mine—canary in the coal mine—and I was told that the canary is sick already,” Fink added.

But what about those in the housing industry? Is there concern that the implications tariffs will have on the housing market will affect investment returns? Or is owning property a better option than putting more money into the stock market? Here’s what experts have to say as of right now.

(Kevin Dietsch/Getty Images)

The outlook for the real estate market…

While tariffs can cause market uncertainty, historically speaking, investing in real estate is a solid bet, especially if you’re willing to commit for the long term.

Article continues below this ad

It was once believed that a homeowner needed to retain their property for at least five years to make a decent return on their investment. While that number has been bumped up a few years, it’s still widely believed that your home’s appreciation will grow with you.

For example, let’s say you bought a home in March 2020 for the median home price, according to Realtor.com data. You would’ve bought your home for $319,000. In 2025, the median home price rose to $424,900, marking a 33% increase in value.

“Home prices climbed significantly during the [COVID-19] pandemic as buyer demand outstripped supply,” Hannah Jones, Realtor.com® senior economic research analyst, explains. “Homeowners, especially those who bought pre-pandemic, saw and continue to see significant returns from selling their home.”

The caveat that Jones points out, however, is that even before the tariffs and stock market fluctuations, the returns on property had become immobile.

Article continues below this ad

“Still-high home prices and elevated mortgage rates mean that it is relatively expensive to finance a home purchase today,” she adds.

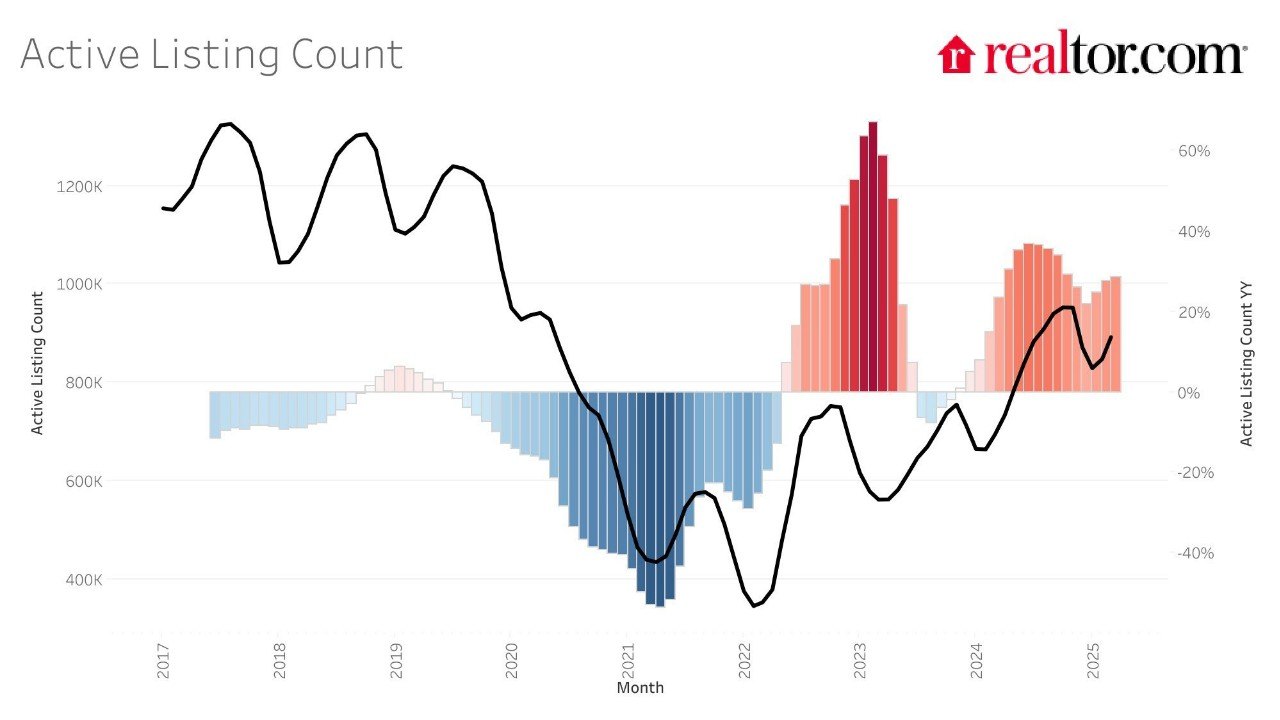

If we look at the past five years individually, you can see the trend of “stagnant, stubbornly high home prices,” as Jones puts it, thus a rate of return falling much shorter than what was once the average.

Article continues below this ad

Article continues below this ad

MORE FROM REALTOR:

Because of this, buying property simply as a mere investment might not be the right move

Article continues below this ad

“Still-high home prices and financing costs mean that buying a home purely as an investment may not be advantageous today,” Jones explains. “Rental prices have also leveled off or fallen across much of the country, which means that today’s investors may not be able to cover their monthly costs via rental income.”

Having said that, if you’re a first-time homebuyer or someone looking to lay down roots, buying a home is still a good investment.

“Real estate holds value beyond simply being an investment vehicle,” Jones adds. “For homeowners who live in the home they own (versus rent it out), having a place to live is valuable apart from the potential return on a home investment. Buying may be the right decision for households who want or need to purchase a new home to live in.”

(Realtor.com)

Article continues below this ad

… versus the outlook for the stock market

The days following Trump’s tariff announcement prompted quick comparisons to the 2008 financial crisis and the COVID-19 crash of 2020.

Companies and consumers alike, in fear of an economic slowdown and reduced investor confidence amid new trade wars, saw stock prices fluctuate—and in many cases, plummet.

In particular, those who were invested in the real estate sector of the market, putting money behind homebuilders, construction companies, and suppliers, saw a significant falloff after the tariffs went into effect in Canada, a key supplier of lumber for U.S. homebuilders.

Article continues below this ad

The biggest publicly traded homebuilders, including D.R. Horton, Lennar, PulteGroup, and Toll Brothers, all suffered declines, with their stock dropping between 3.5% and 6.1% at the closing bell on April 7.

Anytime an investor sees they’re losing money, it feels bad. It especially hits hard when you’re a recent retiree dependent on your investments to get by.

The good news is that most financial experts agree that recoveries from these recent falls will come, though when is much harder to gauge.

“Data has shown, historically, that no one can time the market,” Odysseas Papadimitriou, CEO of WalletHub, told the Associated Press. “No one can consistently figure out the best time to buy and sell.”

Article continues below this ad

In this case, if we look again at the S&P 500, the rate of growth has still outpaced the recent decline. In 2020, the average closing price was $3,217.86, according to MacroTrends. In 2024, the number increased to $5,428.24. In 2025, albeit before the tariffs went into effect, the average was $5,853.43.

And so, the collective advice from most financial advisers right now is to sit tight, because the investments will come back.

“Market fluctuations are normal. They can be triggered by headlines, interest rate news, or global events—but they’re not permanent,” advises Melissa Murphy Pavone, CFP, CDFA, and founder of Mindful Financial Partners.

“Staying invested is key. History shows that the worst days in the market are often followed by some of the best. Trying to time the market usually does more harm than good.”

Article continues below this ad

“It’s really hard to predict the future,” adds Cynthia Meyer, a financial planner at Real Life Planning in Gladstone, NJ. “If you take the long view and you’re really well diversified across investments, so you don’t own one stock, you own hundreds of stocks … some of those cylinders are always going to be firing.”

Moreover, if you’re in the position to buy, now might be the best time to jump into investing. Never forget Warren Buffett’s famous quote from his 2008 op-ed in the New York Times, published right at the peak of the Great Recession: “In short, bad news is an investor’s best friend. It lets you buy a slice of America’s future at a marked-down price.”

Buy real estate or stocks?

So, which is better right now to buy: real estate or stocks? While both will likely provide a return in the long run, you stand a better chance of increasing your investment with real estate, especially if the country does move into a recession.

Article continues below this ad

“If the economy moves toward a recession, we would expect to see higher unemployment, which would lead to falling demand and perhaps more homes for sale,” Jones explains.

“Climbing inventory met with falling demand would put downward pressure on home prices. A recession usually leads to lower mortgage rates as well. Falling prices and low mortgage rates could create an investor-friendly housing market, but the economic conditions that created that sort of environment (low growth, high unemployment) would undermine the opportunity for many.”