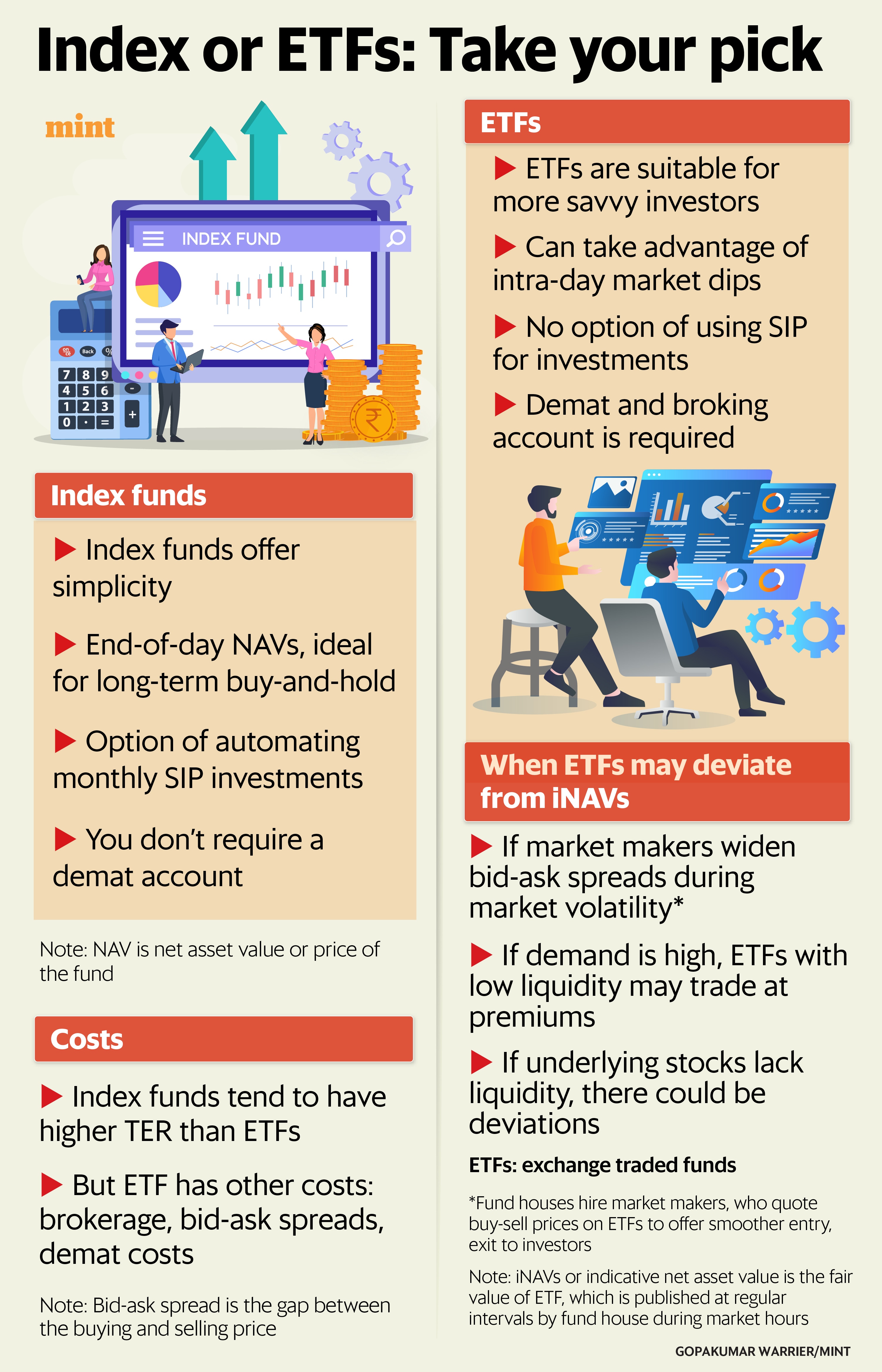

When it comes to passive funds, you have two options — index funds and exchange traded funds (ETFs). But which one should you choose?

How you buy and sell matters

An index fund is more like a regular mutual fund scheme. Every transaction happens at the end of the day, and takes into account that day’s net asset value (NAV). Whether you invested at 10 am or 3 pm, you receive the same day’s closing NAV.

With index funds, investors can also opt for systematic investment plans (SIP), where they can set a fixed monthly investment, which can be as low as ₹500. Another benefit of SIPs is rupee cost averaging. Here you get more units for the same SIP when index levels are low and vice versa. That way, you can keep your average buying cost lower without worrying about timing your investments.

ETFs, on the other hand, trade on stock exchanges just like shares, and their prices fluctuate throughout the day. You can buy or sell them in real-time, taking advantage of market dips. You can even set limit orders, which simply means you set the maximum price you’re willing to pay when buying, or the minimum price you’re willing to accept when selling. Remember, you need a demat account to invest in an ETF.

The question of liquidity

Liquidity — how easily you can buy or sell — is where index funds score on reliability. Because they’re transacted directly with the fund house, there’s always a buyer (the fund itself). You can redeem at any time, and you’ll receive the same day’s NAV if you transact before the 3 pm cut-off time.

View Full Image

ETFs, however, rely on market demand and supply. If trading volumes are thin, you might find it hard to exit, or may not get an exit at fair values. Price distortions can happen in two scenarios. When demand is high but few sellers, ETF prices can shoot above their fair value — and the reverse can happen when buyers vanish.

This price distortion recently happened with silver ETFs, which were trading up to 18% premium over their iNAVs (indicative net asset values), due to high investor demand for these ETFs, but physical silver was facing supply challenges.

Silver ETF prices are directly pegged to physical silver, which is stored in vaults.

Tracking differences

Both index funds and ETFs aim to mimic their benchmark index as closely as possible. But in practice, they never track perfectly. This mismatch, known as tracking error, tells you how much the fund’s return deviates from the index’s.

Index funds tend to have slightly higher tracking errors because they hold some cash to meet redemption requests. ETFs, which don’t face redemptions in the same way, can stay almost fully invested and thus hug their benchmarks more tightly. As mentioned earlier, buying and selling ETFs is like buying and selling stocks of any company on the stock market. So, the fund house doesn’t need to keep any cash holdings to facilitate investor exits in ETFs.

The cost equation

Index funds typically have a higher total expense ratio (TER) than ETFs. But that doesn’t automatically make ETFs cheaper.

“Investors often overlook the total cost of ownership (TCO),” says Anil Ghelani, head of passive investments and products at DSP Investment Managers. “TCO includes not just the expense ratio, but also brokerage charges, bid-offer spreads, and other implicit costs that come with trading ETFs.”

The bid-offer spread is the difference between the buying and selling prices quoted on the exchange. When an ETF doesn’t trade frequently or tracks illiquid stocks, this gap can widen, making it costlier to buy or sell. This can also happen during heightened volatility as market makers quote wider buy and sell prices to offset the risk of large market swings.

So, while ETFs might boast a lower TER on paper, their total costs can add up — especially for small investors who buy in small lots or face higher brokerage fees. In contrast, index funds are straightforward and simpler products.

So, which one is right for you

It depends on the kind of investor you are — and how hands-on you want to be.

“ETFs and index funds both track market indices, but their suitability depends on how an investor participates,” says Anubhav Srivastava, partner and fund manager at Infinity Alternatives.

ETFs offer real-time pricing and liquidity through market mechanisms, making them efficient for those comfortable with trading platforms and execution risk, he said. “Index funds, by contrast, are simpler to operate, better suited for systematic investors who prefer end-of-day NAV pricing and can tolerate minor tracking differences. In essence, ETFs serve the informed, execution-driven investor; index funds serve the hands-off, disciplined saver,” Srivastava added.

Consider index funds if you are this type of investor. If you prefer simplicity, don’t want a demat account, and can invest small amounts regularly through SIPs, they might suit you. You will always buy or sell at NAV, and there’s no need to worry about market liquidity or ETF volumes. You are simply a buy-and-hold long-term investor.

However, if you are a market-savvy investor with a demat account and prefer the flexibility to trade in real-time during market hours — or even to make tactical bets on the market — consider ETFs.