Stock market filings in the US on Thursday revealed the chief of oil giant ExxonMobil was paid almost four times as much as the bosses of BP and Shell, underlining the gulf in awards. Shell’s chief Wael Sawan this week raised the prospect of moving its listing to New York, citing the company’s depressed share price.

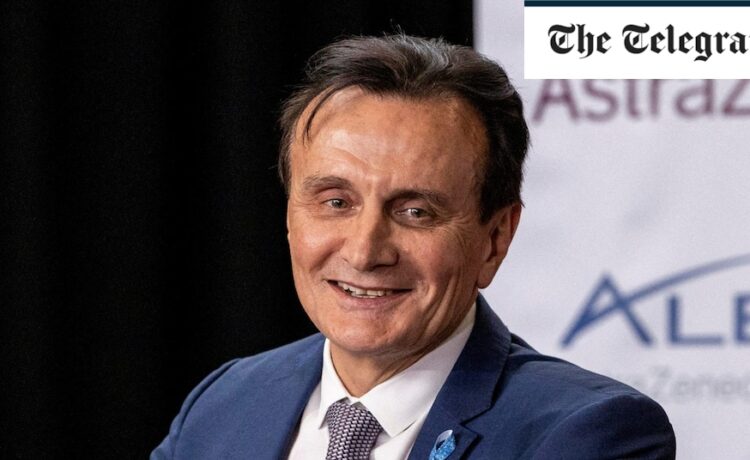

Earlier this week one of AstraZeneca’s top shareholders came out in favour of the increased reward for Mr Soriot. Rajiv Jain, chief investment officer at CQG Partners, said the only “compensation issue” at the company was that the pharmaceutical chief was “massively underpaid”.

While the company suffered a significant revolt, the majority of investors backed its pay policies.

AstraZeneca said after the result of its AGM vote that it would “continue to engage with our shareholders and the proxy advisors to explain our need for global benchmarks and pay for performance”.

The backlash comes amid growing concerns that London-listed companies are underpaying their bosses.

David Schwimmer, the head of the London Stock Exchange Group, said in February that the UK should be considering copying US-style pay packages. He warned London was at risk of losing its status as a global financial centre if it did not allow executives to earn more.

Mr Schwimmer and others are concerned that British companies are losing the battle for talent. A reluctance to pay executives more is also encouraging companies to list in the US over the UK, it has been argued.

Mr Schwimmer, an American, is himself pursuing a US-style pay package that would see his reward more than double to £13.2m.

As with Mr Soriot, the London Stock Exchange Group chief’s reward deal has proved controversial.

Daniel Valentine, of the Chartered Governance Institute UK & Ireland, said on Thursday: “It’s unfortunate that the London Stock Exchange Group seems to be spending more energy on designing the perfect executive remuneration package rather than fixing our shrinking stock exchange.”