The day after President Trump softened his stance on reciprocal tariffs, some of his top economic advisers continued to work out the messaging on where this strategy is taking both Trump’s policies and the US economy in the months ahead.

In a post on X early on Thursday, Commerce Secretary Howard Lutnick said a “Golden Age” is coming and that the economy would soon be “exploding.”

An interesting choice of words, given that Lutnick clearly means an explosion in the positive sense, though a more negative interpretation isn’t far away for those skeptical either of Trump’s temporary pause or his continued pursuit of evening out America’s trade relations.

Late on Wednesday, both The New York Times and The Wall Street Journal published in-depth play-by-play reconstructions of the events that led to Trump’s eventual pivot away from his harshest measures.

Treasury Secretary Scott Bessent and the bond market both emerged as key figures working in the background to push Trump toward a 90-day pause. Lutnick also reportedly began looking for the president to ease off some tariff pledges quickly, after the “Liberation Day” announcements shocked markets.

In the end, though, Trump remains a man on a mission. As the Journal reported: “The episode was classic Trump: He took a drastic action, closely tracked the reaction, kept advisers and allies guessing, and then changed course.”

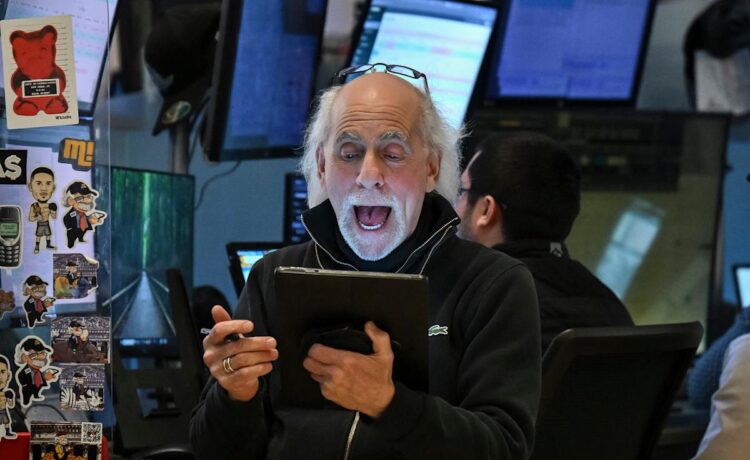

Early Thursday, stocks were lower, giving back some of the gains from Wednesday’s historic rally as investors take stock of what we learned, who has influence, and return to the place from which we came: A world of advisers backing up strategies they only partially own while investors pressure the administration for better answers, sooner.