Former Speaker of the House Nancy Pelosi has made a name for herself in the investment space due to her stock picks performing even better than expert analysts. Her portfolio is primarily managed by her financier husband, Paul Pelosi, and the gains have been remarkable.

In 2023, the portfolio returned 65% vs. the S&P 500’s 24%. 2024 gains were at 54% and outperformed the broader market and top hedge funds. NVIDIA (NASDAQ:NVDA) has returned multibagger gains since its June 2021 purchase, and Microsoft (NASDAQ:MSFT) has returned significant gains on call options purchased in 2023.

Now, each time she buys a stock, investors rush to pile in. She has made a few bets this year, but considering the unexpected decline in the stock market, how has her portfolio performed? Let’s take a look at the bets she made in mid-January this year and how they’ve been doing.

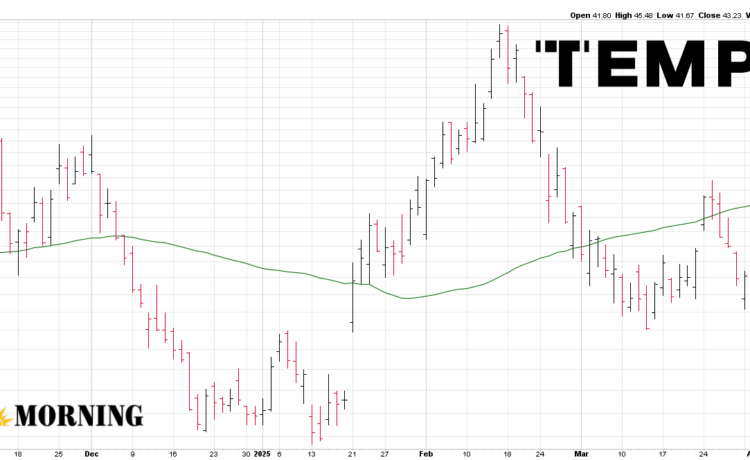

Tempus AI (TEM)

Nancy Pelosi purchased 50 call option contracts on Tempus AI (NASDAQ:TEM) stock with a strike price of $20, expiring January 16, 2026. Each contract covers 100 shares, so this implies the right to buy 5,000 shares at $20 each before expiration. The estimated total investment was around $80,000, with the contracts reportedly priced near $16 each at the time of purchase.

The stock surged after the trade became public. Right now, TEM stock is at $43.23. Pelosi’s $20 strike call options remain well in-the-money, and for 50 contracts (each contract typically represents 100 shares), the total intrinsic value is: 50 x 100 x 23.23 = $116,150. However, this does not account for the premium paid for the options, which would reduce the net profit.

The position is still down from its peak when the stock traded near $91.

NVIDIA (NVDA)

Nancy Pelosi purchased 50 call option contracts on NVDA stock with a strike price of $80, expiring January 16, 2026. Each contract covers 100 shares, so this gives the right to buy 5,000 shares at $80 each before expiration. The estimated total investment for these options was between $250,001 and $500,000, based on congressional disclosures.

Pelosi made this purchase on January 14, 2025, when NVDA was trading significantly higher than the strike price. The call options were deep in the money at the time of purchase. As such, she likely paid a higher premium here.

However, since then, NVDA stock has dropped. The current stock price is $98.89.

Here’s the intrinsic value: 50 x 100 x 18.89 = $94,450.

Vistra Corp (VST)

Nancy Pelosi purchased 50 call option contracts on Vistra Corp (NYSE:VST) stock with a strike price of $50, expiring January 16, 2026. Each contract covers 100 shares. This gives her the right to buy 5,000 shares at $50 each before expiration. The total value of this options purchase was reported to be between $500,000 and $1,000,000 at the time of the trade. It was executed on January 14, 2025, and disclosed shortly after.

Since Pelosi’s trade, Vistra Corp’s stock price has surged significantly. The current stock price is $112.63, which is well above the $50 strike price. The options are deep in the money. The intrinsic value per option contract is now $62.63 ($112.63 current price minus $50 strike price). For 50 contracts (5,000 shares total), the total intrinsic value is: 50 x 100 x 62.63 = $313,150.

Amazon (AMZN)

Nancy Pelosi purchased 50 call option contracts on Amazon (NASDAQ:AMZN) stock with a strike price of $150, expiring January 16, 2026. Each contract covers 100 shares, so this gives the right to buy 5,000 shares of Amazon at $150 each before expiration. The total value of the trade was reported in the range of $250,001 to $500,000, with the purchase taking place on January 14, 2025.

AMZN is a far bigger company, so her disclosure didn’t make a big difference.

AMZN stock is currently at $173.18. This means Pelosi’s call options are now well in the money. The intrinsic value per share is $173.18 (current price) minus $150 (strike price), which equals $23.18 per share. For 50 contracts (5,000 shares), the total intrinsic value of the position is: 50 x 100 x 23.18 = $115,900.

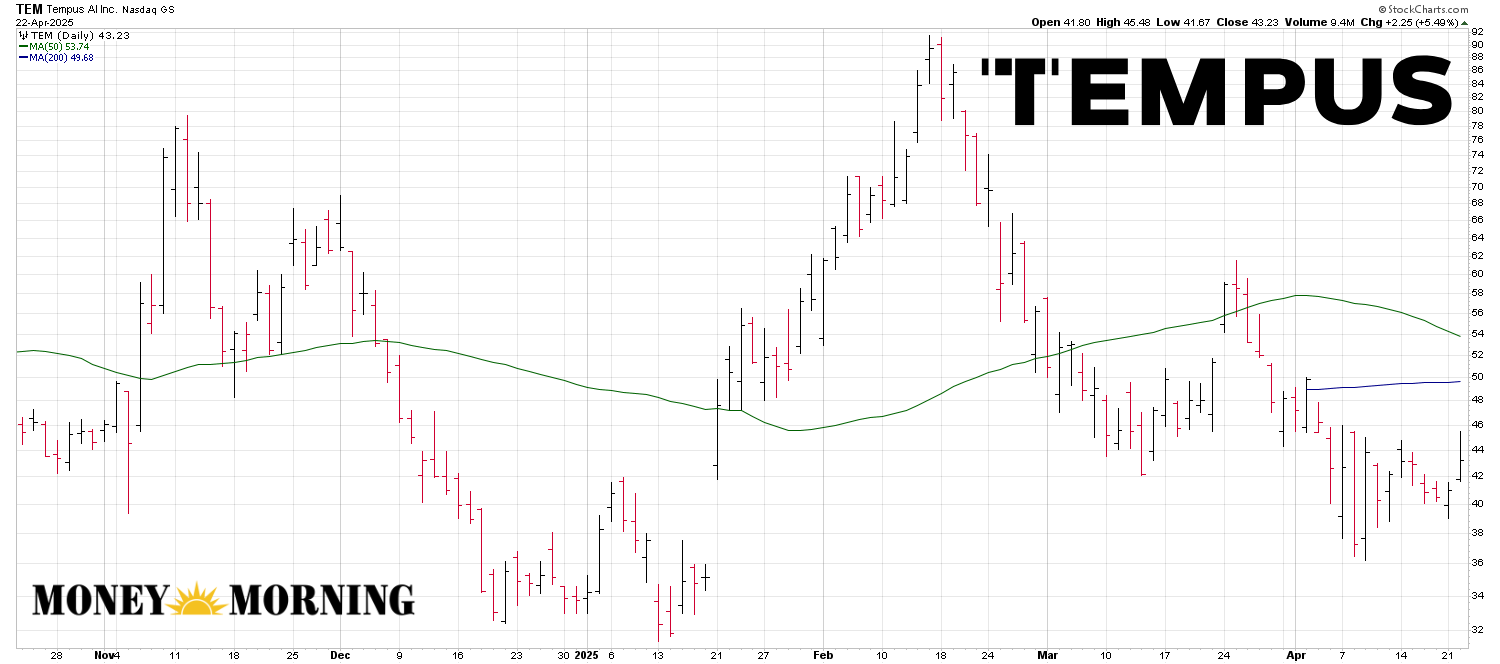

Alphabet (GOOGL)

Nancy Pelosi purchased 50 call option contracts on Alphabet Inc. (NASDAQ:GOOGL) stock. She did so with a strike price of $150 per share and an expiration date of January 16, 2026. Standard contracts cover 100 shares. As such, this position gives her the right to buy up to 5,000 shares of Alphabet at $150 each before expiration. The total investment for these options was reported in the range of $250,001 to $500,000, with the transaction executed on January 14, 2025.

The options are just barely in the money and have an intrinsic value of $1.47 ($151.47 – $150). So, for all the contracts, the total intrinsic value is: 50 x 100 x 1.47 = $7,350.