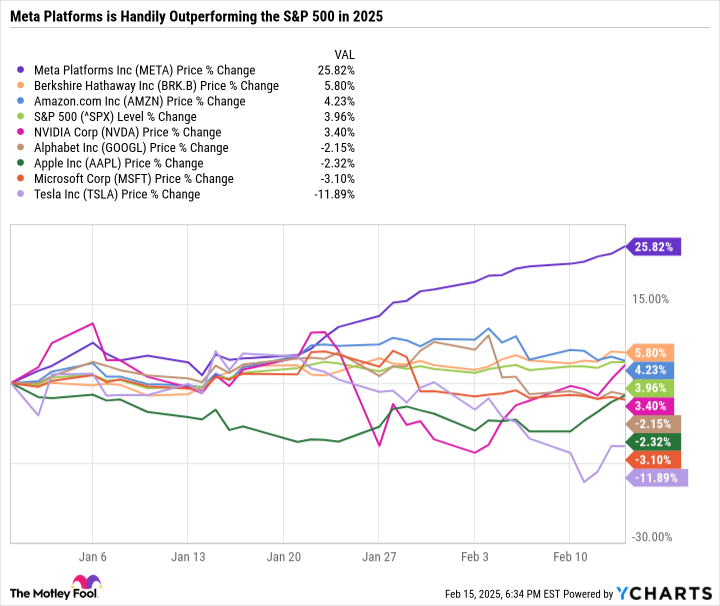

The “Magnificent Seven” refers to seven of the largest technology-focused companies by market cap. These companies drove most of the gains on major market indexes like the S&P 500 (^GSPC 0.24%) and Nasdaq Composite (^IXIC 0.07%), to new heights in 2023 and 2024.

But many non-tech companies, like Warren Buffett-led Berkshire Hathaway, have been outperforming the Magnificent Seven so far this year. Some investors may be gravitating toward Berkshire for its reasonable valuation, track record of enduring economic uncertainty, and diversification across various industries.

Berkshire is undoubtedly a top value stock to consider buying now. But growth-focused investors may want to take a closer look at Meta Platforms (META -1.76%) — the best performing Magnificent Seven stock year to date.

Meta is monetizing AI

After gaining 194.1% in 2023 and 65.4% in 2024, Meta is already up over 25% year to date.

As AI advances, investors want to ensure companies are monetizing their AI programs. In other words, is a company just throwing money toward AI endeavors, or is it actually seeing those investments translate into bottom-line results?

Perhaps the simplest reason Meta remains a strong performing stock is its clearly defined approach to AI.

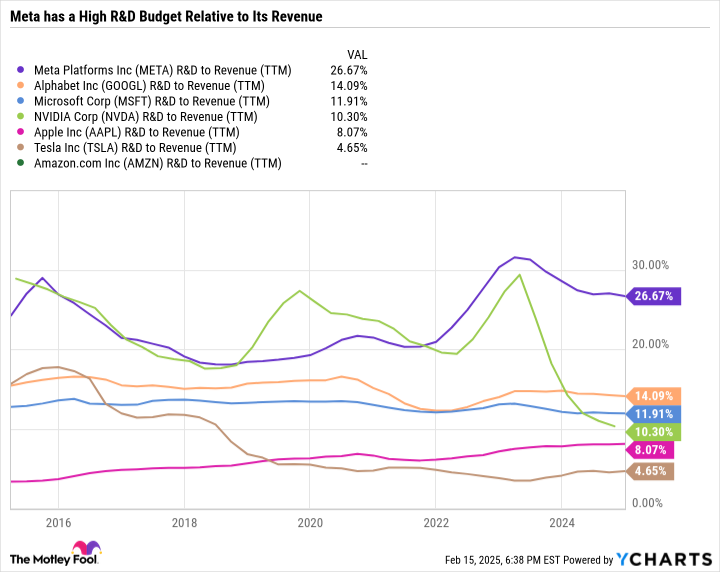

Compared to the rest of the Magnificent Seven, Meta spends far more on research and development (R&D) as a percentage of revenue.

META R&D to Revenue (TTM) data by YCharts.

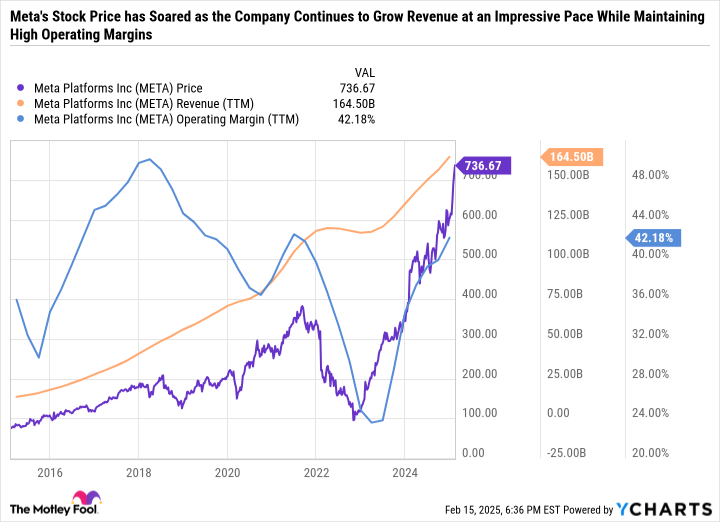

Spending too much on R&D can lead to lower profit margins. And if R&D investments don’t pay off, it can hurt a company’s investment thesis. But Meta is proving that its spending has been worth it. As you can see in the following chart, Meta’s stock price has exploded higher, along with exponential revenue growth.

But even as it ramps spending, its operating margins are still very high, suggesting that Meta can afford to recruit and retain top talent, build out AI infrastructure, and support its generative AI products.

Meta’s differentiating factor

Meta makes money on ads. The larger the audience and the better the engagement, the more likely advertisers will choose to run campaigns on Meta’s Family of Apps. At least, that’s how it used to work.

Now, advertisers are demanding better analytics and more targeted campaigns. Meta uses AI to improve app engagement by showing users the content and ads they are interested in. This approach can increase user activity, leading advertisers to convert more impressions into sales.

Meta Advantage+ provides advertisers with AI-powered tools to create and manage ad campaigns. However, some advertisers, especially those just starting out on the platform, may prefer a more hands-on approach. Meta is testing a new idea that focuses the campaign around a certain objective rather than running it as an AI campaign or a manual campaign. Meta CFO Susan Li said the following on the fourth-quarter earnings call:

Given the strong performance and interest we’re seeing in Advantage+ shopping and our other end-to-end solutions, we’re testing a new streamlined campaign creation flow. So, advertisers no longer need to choose between running a manual or Advantage+ sales or app campaign. In this new setup, all campaigns optimizing for sales, app or lead objectives will have Advantage+ turned on from the beginning. This will allow more advertisers to take advantage of the performance Advantage+ offers while still having the ability to further customize aspects of their campaigns when they need to.

Image source: Getty Images.

Meta is putting on a clinic in AI monetization. Instead of trying to sell an AI tool to customers, it integrates AI into its services without taking control away from users. Since Meta runs the platform, it can use AI tools to connect advertisers with users. It has the data and makes the rules. In other words, it operates a controlled environment, which gives Meta a lot of advantages compared to companies that make money on adds without operating the platform.

Meta is a good value

Meta’s earnings have more than tripled in the last five years, but its stock price is up even more. So Meta’s valuation has gotten more expensive, with a trailing price-to-earnings (P/E) ratio of 29.5 and a forward P/E of 27.9. The relatively small difference between Meta’s trailing P/E and forward P/E suggests that analyst consensus estimates don’t show Meta growing earnings by that much in the near term.

Meta definitely isn’t cheap, but it’s worth keeping in mind that its valuation could be a lot lower if it wasn’t investing so much back into the business. Meta booked a staggering $17.73 billion loss from its Reality Labs segment in 2024. Without that loss, its income from operations would have been over 25% higher. So Meta is a far better value than it appears at first glance.

A foundational AI stock to buy now

Meta is one of the best AI stocks to buy now, even after its massive run-up to kick off 2025. The company continues to improve its platforms, making them coveted digital real estate for advertisers looking to run intelligent campaigns.

Investors should continue monitoring Meta’s AI investments and new strategies like integrating Advantage+ into the new campaign flow for advertisers. If these developments translate into measurable results, Meta’s stock price could increase while remaining a good value. But if growth slows, Wall Street may grow less tolerant of Reality Labs’ losses, which could pressure the company.

Therefore, it’s best to approach Meta only if you believe in the company’s aggressive capital allocation strategy and that its Family of Apps will continue growing engagement and attracting advertising dollars.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.