Deep-pocketed investors have adopted a bearish approach towards MongoDB MDB, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MDB usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 9 extraordinary options activities for MongoDB. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 11% leaning bullish and 66% bearish. Among these notable options, 3 are puts, totaling $139,088, and 6 are calls, amounting to $267,922.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $150.0 and $420.0 for MongoDB, spanning the last three months.

Insights into Volume & Open Interest

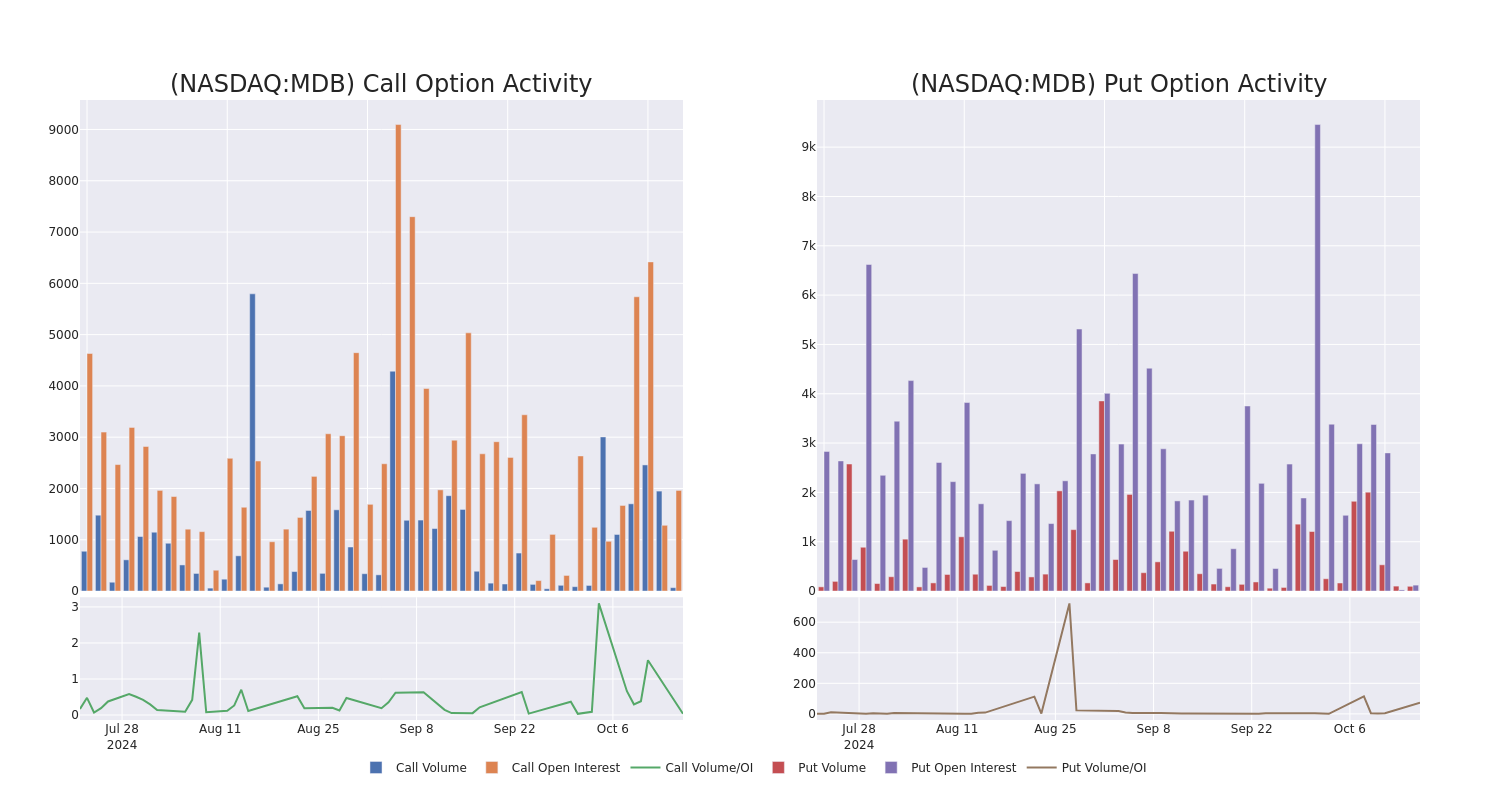

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for MongoDB’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of MongoDB’s whale activity within a strike price range from $150.0 to $420.0 in the last 30 days.

MongoDB 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MDB | CALL | TRADE | BEARISH | 12/20/24 | $20.15 | $19.9 | $19.9 | $300.00 | $79.6K | 669 | 44 |

| MDB | CALL | TRADE | BULLISH | 01/17/25 | $23.3 | $22.25 | $23.3 | $300.00 | $58.2K | 1.2K | 0 |

| MDB | PUT | TRADE | BEARISH | 05/16/25 | $31.55 | $31.0 | $31.55 | $260.00 | $53.6K | 1 | 45 |

| MDB | PUT | TRADE | BEARISH | 05/16/25 | $31.55 | $31.0 | $31.55 | $260.00 | $53.6K | 1 | 28 |

| MDB | CALL | TRADE | BEARISH | 01/17/25 | $23.35 | $23.0 | $23.0 | $300.00 | $41.4K | 1.2K | 44 |

About MongoDB

Founded in 2007, MongoDB is a document-oriented database with nearly 33,000 paying customers and well past 1.5 million free users. MongoDB provides both licenses as well as subscriptions as a service for its NoSQL database. MongoDB’s database is compatible with all major programming languages and is capable of being deployed for a variety of use cases.

Following our analysis of the options activities associated with MongoDB, we pivot to a closer look at the company’s own performance.

Where Is MongoDB Standing Right Now?

- Trading volume stands at 220,009, with MDB’s price down by -1.84%, positioned at $279.42.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 48 days.

Professional Analyst Ratings for MongoDB

1 market experts have recently issued ratings for this stock, with a consensus target price of $340.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from DA Davidson persists with their Buy rating on MongoDB, maintaining a target price of $340.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for MongoDB, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.