Investing

-

President Trump gave investors a lot to worry about on Monday, sparking a stock selloff that’s continuing into today.

-

As growth prospects dim, three major U.S. bank stocks catch downgrades from abroad.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Live Updates

Live Coverage Has Ended

The Vanguard S&P 500 ETF closed less than 0.1% lower on Tuesday, indeed, almost flat at 570.38.

In an update today, S&P 500 component company Boeing (NYSE: BA) reported that it delivered 150 commercial airplanes in Q2 205, and 280 total year to date. 737s were the most numerous deliveries (104 units in the second quarter), followed by 787s (24 delivered in Q2).

The company’s defense, space, and security business delivered a mix of 36 warplanes, tankers, and space satellites in the second quarter, and 62 year to date. Boeing stock is down 1.2% so far today. The Voo is precisely flat at a 0.00% gain/loss.

In happier news, Morgan Stanley today raised its price target on S&P 500 component company Corning (NYSE: GLW) to $50, despite maintaining only an equal weight rating on the shares. Increasing data volumes will require more optical fiber from Corning, and the AI opportunity is “meaningful.” That said, the recent rally has taken Corning’s stock price beyond “historical multiples,” warns the analyst. Investors still need to be careful not to overpay.

The Voo has turned green in the first few minutes of trading, but still up less than 0.1%. Corning stock, however, is rising 0.5%.

This article will be updated throughout the day, so check back often for more daily updates.

The Vanguard S&P 500 ETF (NYSEMKT: VOO) sank an unlucky 0.7% on Monday, closing at 570.55, as investors digested a wide variety of troubling news — from continued political feuding between President Donald Trump and tech magnate Elon Musk, to the July 4 passage of the “One Big Beautiful Bill” (OBBB), to, eventually, the afternoon news that Trump is nowhere near done levying tariffs on U.S. trade partners.

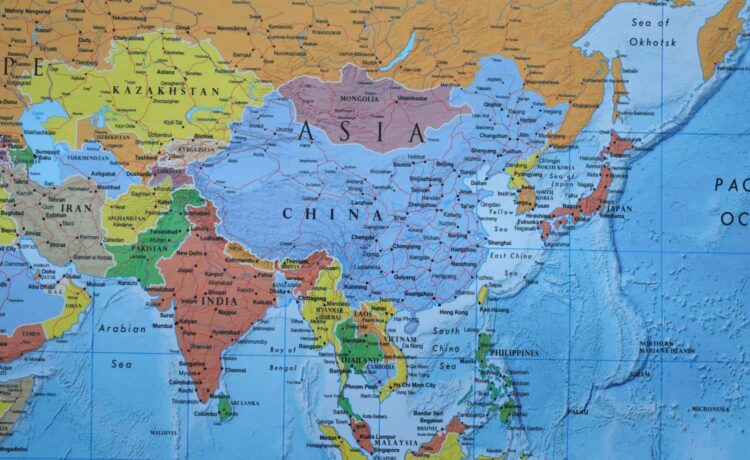

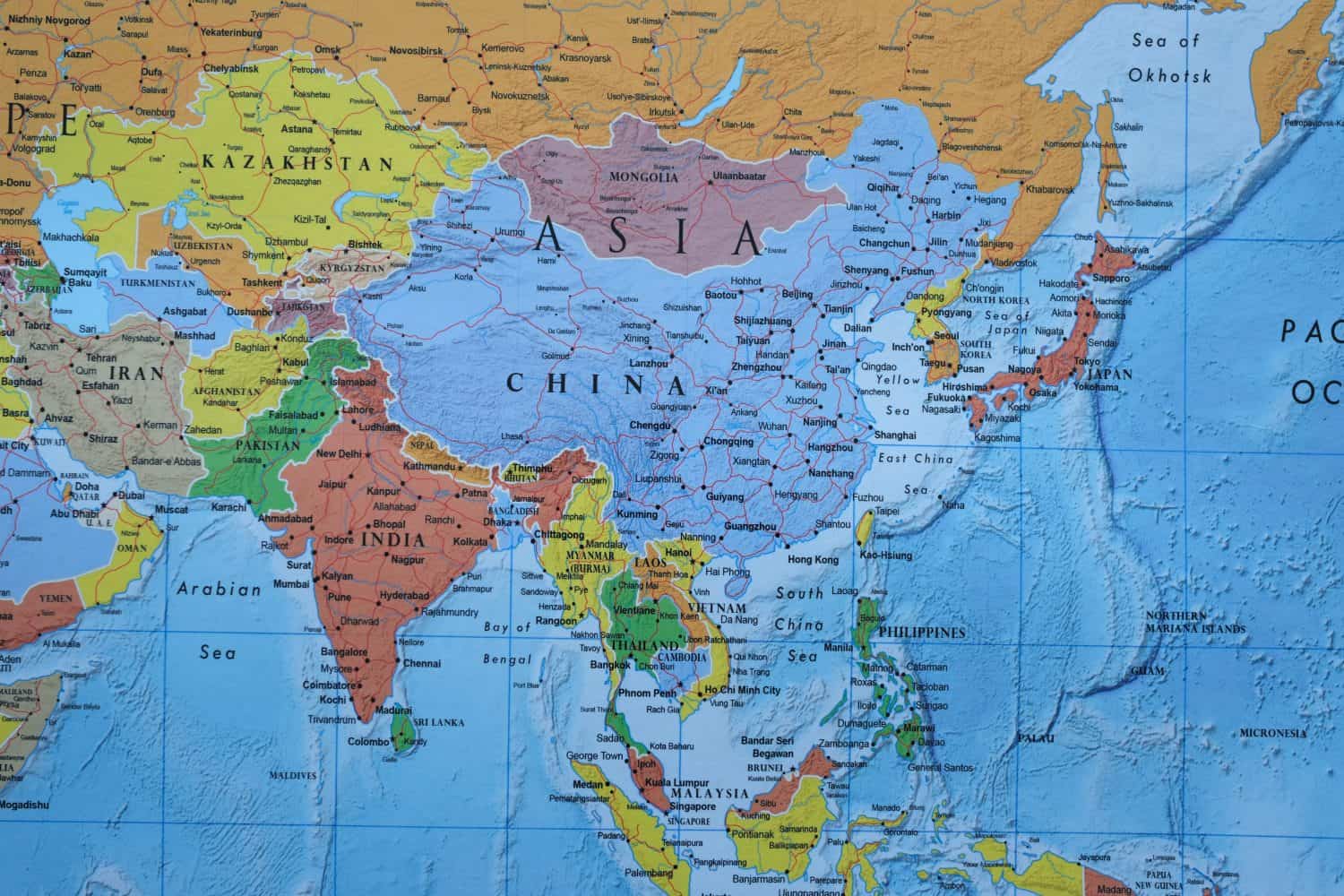

The President announced tariffs will go into effect August 1 on more than a dozen countries, with important U.S. allies South Korea and Japan, for example, both suffering 25% tariff levies on their exports to the U.S. Bangladesh, Bosnia and Herzegovina, Cambodia, Indonesia, Kazakhstan, Laos, Malaysia, Myanmar, South Africa, Serbia, Thailand, and Tunisia all also number among Mr. Trump’s tariffs targets.

Laos and Myanmar are particularly at risk, facing 40% tariffs, while Cambodia and Thailand will face a 36% rate, and Bangladesh and Serbia, 35%. Granted, most of these rates are similar to what the President already announced back on “Liberation Day,” April 2, and were in theory at least expected to snap back into effect 90 days later in the absence of signed trade deals.

Still, many investors seem to have maintained the belief that these tariffs were a bluff, and that hope’s now been called into question. The Vanguard S&P 500 ETF is trading down another 0.2% premarket today.

Analyst Calls

Adding to the bad news, HSBC announced today that it’s downgrading shares of three of America’s biggest banks. S&P 500 components Goldman Sachs (NYSE: GS) and JPMorgan Chase (NYSE: JPM) are both downgraded to “reduce,” while Bank of America (NYSE: BAC) suffers a smaller cut to “hold” this morning.

Valuation is HSBC’s primary concern. The banker notes, for example, that JPMorgan stock must grow in a “low-double-digit range” in order to justify its current 16x forward earnings valuation. “If EPS growth does not reach this threshold,” warns the analyst, “JPMorgan’s PE multiple would need to expand further” for the stock price to go up at all.

In the case of Goldman, meanwhile, “the absence of a material increase in [investment banking] activity over a sustained period and/or a cool-down in market performance could lead to disappointment and a sharp correction.”

Credit Card Companies Are Doing Something Nuts (Sponsor)

We’ve been writing about ways to make, save, and invest money for over 20 years. But some of the cash back credit card rewards today still make our jaws drop. There are $200 cash bonuses, 3% back on gas and groceries, $0 fees, and even some 5% rewards out there right now. For the average American that could mean hundreds, even thousands of dollars on rewards a year.

Don’t miss out on rewards this good, there is no saying how long they’ll last. Click here to see our top picks.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.