As the current bull market rages on, now midway into its third year, some investors are beginning to worry that the tides are turning. According to the most recent weekly survey from the American Association of Individual Investors, a whopping 60% of U.S. investors feel bearish about the market’s future — the highest that figure has been in the last 12 months.

Nobody can say when the next downturn will begin, but there’s one stock market metric investors may want to keep an eye on. Here’s what history says about times like these and how to prepare your portfolio accordingly.

Image source: Getty Images.

Investors could be “playing with fire” right now

The “Buffett Indicator,” popularized by investor Warren Buffett, examines the ratio between the total market cap of U.S. stocks and gross domestic product (GDP). In 2001, Fortune published an article based on Buffett’s prediction two years earlier that the stock market was on the verge of a serious downturn. He made that prediction with help from the Buffett Indicator, explaining that when this ratio gets too high, it could signal that a market slump is ahead.

“If the percentage relationship falls to the 70% or 80% area, buying stocks is likely to work very well for you,” he explains. “If the ratio approaches 200% — as it did in 1999 and a part of 2000 — you are playing with fire.”

As of February 2025, the Buffett Indicator sits at just over 205%. The last time this figure neared 200% was in November 2021, when it reached 193% — and shortly after, in January 2022, the market descended into a bear market.

How worried should you be?

To be clear, no stock market indicators are completely accurate, and the Buffett Indicator also has its flaws.

For example, corporations and economic conditions have drastically changed over the past couple of decades, largely due to technological advancements. Companies, in general, have much higher valuations than they did even a decade ago, so older metrics, like the Buffett Indicator, may not be as accurate in determining whether stocks are overvalued or undervalued.

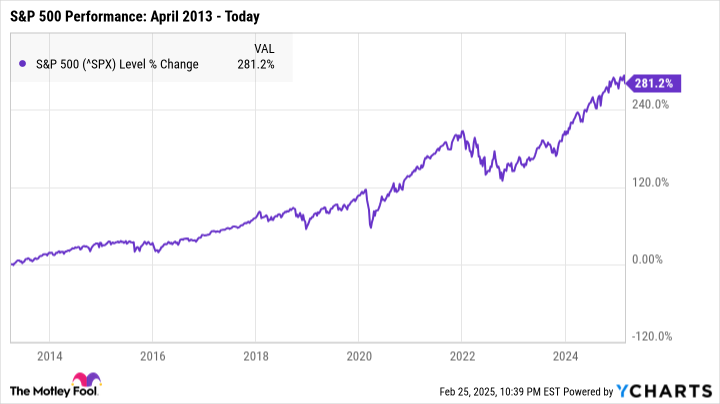

Case in point: The Buffett Indicator metric has not dipped below 100% since April 2013, suggesting that stocks have been overvalued for the last 12 years. Yet, in that time, the S&P 500 (^GSPC 1.59%) has soared by 281%, as of this writing. If you’d stopped investing because this metric implied it wasn’t the ideal time to buy stocks, you’d have missed out on serious gains.

Also, using the market’s past performance to predict future returns is always risky. Stocks can be unpredictable at times, and even Warren Buffett himself can’t say where the market will be in a few months or a year. Even the most accurate market indicators can still be wrong sometimes, and when your financial future is at stake, it’s wise to avoid relying too heavily on any single metric.

How to protect your investments going forward

One of the best things you can do to protect your portfolio is to avoid making any sudden decisions. It can be tempting to sell off your stocks if you’re worried about an impending downturn, but there’s always a chance the market could have months or even years of growth still ahead.

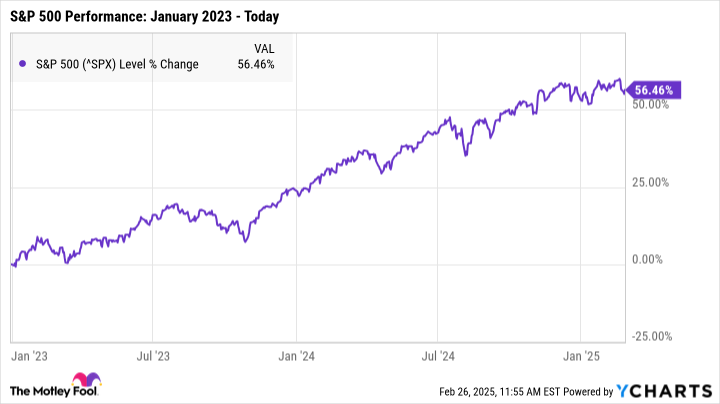

Timing the market accurately is next to impossible, even for the experts. Many analysts predicted a recession would hit at some point in 2023 or 2024, for example. Yet, in reality, the market reached record high after record high. If you’d stopped investing at the first warning, you’d have missed out on those earnings.

One thing that is fairly certain, though, is that the market will thrive over the long term. In fact, a study from Crestmont Research found that every single 20-year period in the S&P 500’s history has ended in positive total returns. In other words, if you’d invested in an S&P 500 index fund and held it for 20 years, there’s never been a point in history where you’d have lost money — as long as you’d stayed invested throughout all the highs and lows.

The future may be uncertain for the stock market, but keeping a long-term outlook is perhaps the best way to protect your money. While it’s often easier said than done, ignoring the market’s short-term fluctuations and staying invested for the long haul will pay off down the road.