I heard one person describe the stock market as a gauge of rich people’s feelings. That’s funny, but overstated. It comes from the overly simplistic Main Street versus Wall Street adage.

Nevertheless, does investing matter for those who aren’t “rich”?

After all, Humboldt County, the home of Lost Coast Outpost, is not considered an affluent county. The median household income is $61,135 per year which is the 7th lowest in the state¹, and 16.7% of the population is in poverty.²

What about those who want to develop healthy financial habits? Where should they start?

First, divest yourself of resentment. Resenting “rich” people may make for punchy social media posts for a particular demographic, but it corrodes and does not inspire self-development or the development of others. Deconstructing everything builds nothing. You can work toward offering solutions for the increasing wealth gap in America, but cynicism alone is not the answer.

The comedian Conan O’Brien, after suffering a setback of losing a popular talk show, said it wisely:

Please do not be cynical. I hate cynicism. It’s my least favorite quality—it doesn’t lead anywhere. Nobody in life gets exactly what they thought they were going to get. But if you work really hard and you’re kind, amazing things will happen.³

His last sentence is far too karmic—amazing things don’t always happen, but his attitude is a model for moving forward in a positive direction.

None of this undermines the reality of many people being in challenging situations who must rely on the financial help of others. Still, there are others for whom the help they need most—even if it’s hard to hear—is to be told to stop asking for it.

Second, before you begin investing money, invest in yourself.

Investing in yourself is not code for following your heart. You may need to spend most of your time in a job you don’t like that simply pays the bills and then use your spare time to follow your passion. The job you don’t want may end up becoming the pathway to fund the job you’ve always wanted.

The key is to never stop learning—be it in an official academic setting or an apprenticeship in a trade school. Find mentors. Take responsibility. Sharpen your craft. Work hard wherever you’re at.

Seek knowledge that, as investor-philosopher Naval Ravikant puts it, is timely and timeless:

If you become a world-class expert in machine learning just as it takes off and you got there through genuine intellectual interest, you’re going to do really well. But 20 years from now, machine learning may be second hat; the world may have moved on to something else. That’s timely knowledge.

If you’re good at persuading people, it’s probably a skill you picked up early on in life. It’s always going to apply, because persuading people is always going to be valuable. That’s timeless knowledge.⁴

Combine both and then start somewhere. Now is better than tomorrow because, as someone once put it, “action is the antidote to anxiety.”

Third, once you establish an income, save it, invest it, and attempt to increase it.

Start an emergency savings account and a retirement account. Begin saving one portion of your paycheck and investing another portion of your paycheck automatically. If you have a job with a 401k or the like where a company is matching funds, take all the free money you can by contributing up to whatever they match.

Investing is important, but investing in the stock market with a small amount of money is not normally going to fix all your money problems. Nick Maggiulli, a personal finance author, writes,

With small amounts of money, the total return over the course of a year will be trivial. It would be far better for an individual to focus on saving more money (or growing their income) than worrying about what return they will get in the short run.⁵

It’s too easy to fall into complacency and not seek to increase your income. This can singlehandedly increase your ability to save and invest. Don’t leave this out of your financial plan. Try asking for a raise, starting a side hustle, networking with new people, or looking for a better paying job.

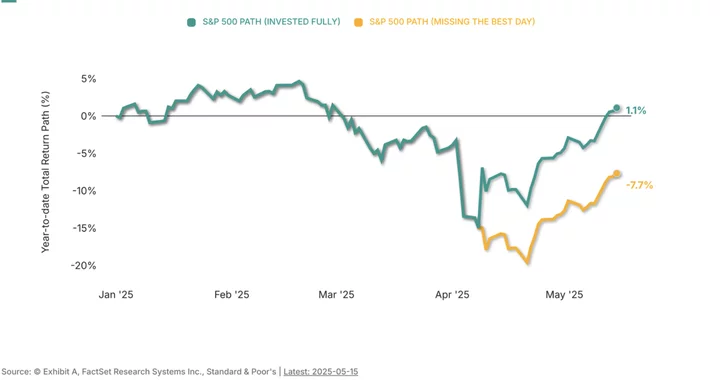

Fourth, treat investing as a lifelong habit and not a single moment in time. The most recent market activity around tariffs this year is a great illustration. If you were investing the last few months by gut feeling or political tribalism and market commentary, how would you have known exactly when to buy and exactly when to sell and not made a mistake along the way? While timing can be your worst enemy, time in can be your best friend.

Be a gardener more than a gambler. Sure, you might hear of the thirty-year-old dude who took out a HELOC a few years ago, put it in Bitcoin or bet big on Draft Kings (yes, I know those aren’t the same things), and is now rich taking Instagram photos on the beach with his wife drinking piña coladas. It may have worked, but it ain’t wisdom. That could have ended in debt, too much drink, and no wife.

Investing should be a lifestyle, not a lottery ticket. It should be automatic and not just when your nervous system feels like it or your friend found the latest get-rich-quick idea on Reddit.

Fifth, invest consistently to unlock the magic of compound interest. I think it was Benjamin Franklin (didn’t he, along with Mark Twain and CS Lewis, seem to say everything?) who said, “Money makes money. And the money that money makes, makes money.” This is true only if you invest it and don’t just bury it or let it sit in an account doing next to nothing. Unsaved and uninvested money gets eaten by inflation. Money compounded by interest multiplies. Here is a visual:

The younger you are, the better this works out. Investopedia illustrates the power of compound interest by comparing three scenarios over 50 years: investing $7,000 annually (the current IRA contribution limit) in the stock market could yield $4,342,407, while the same amount in a high-yield savings account might grow to $1,312,035, and in a standard savings account to just $395,946.⁶ Obviously this uses past stock market history and present interest rates, but the point is clear: equity ownership, though risky, has been one of the best places to invest to crush inflation and grow capital.

You know who else knows the magic of compound interest? Credit card companies. So, if you are prone to use them and not pay them off, avoid them. The dark magic of credit card debt has kept many under the spell of crushing and ever-increasing balances. The sorcery of “the minimum payment” can make you feel like you are making progress when oftentimes you are spinning your wheels. Make compound interest your friend through intentional investing, not consumer indebtedness.

So much in life compounds. Trauma. Tiny decisions. Addiction. Exercise. Love. The long-term effects can be ruinous or rewarding.

Sixth, aim at a long-term legacy, not status. Wealth building has an inverse relationship with status-seeking. There is no shortage of cocky rich people flamboyantly displaying their wealth, nor is there a shortage of cocky indebted people flamboyantly displaying their spending. Status-seeking, or as some like to call it—pride—is not simply a deadly sin but a deadly life decision. If you’ve “won at money” but have left a legacy of hoarding, hubris, and broken relationships, you’ve lost. Instead focus on long-term outcomes for your future self, your family, and your community over the short-term gratification of self-appeasement and the approval of others.

Our money habits have a revelatory power. They unveil what we truly value and who we really are.

Whether you consider yourself rich or poor, everyone alive invests.

What does how you spend, save, and invest your money say about you?

——-

Sources:

1. Taken from United States Census Bureau. Accessed online: (March 26, 2025).

2. Taken from United States Census Bureau. Accessed online: (March 26, 2025).

3. “Conan O’Brien’s Farewell Has Lasting Impact”, Breeanna Hare, CNN. Accessed online: (February 16, 2010).

4. “Finding Time to Invest in Yourself” (January 13, 2020). Accessed online.

5. “Saving is for the Poor, Investing is for the Rich” (April 4, 2017). Accessed online.

6. “Can You Grow an IRA to Millions or Even Billions” (March 20, 2025). Accessed online.

# # #

Brandon Stockman has been a Wealth Advisor licensed with the Series 7 and 66 since the Great Financial Crisis of 2008. He has the privilege of helping manage accounts throughout the United States and works in the Fortuna office of Johnson Wealth Management. You can sign up for his weekly newsletter on investing and financial education or subscribe to his YouTube channel. Securities and advisory services offered through Prospera Financial Services, Inc. | Member FINRA, SIPC. This should not be considered tax, legal, or investment advice. Past performance is no guarantee of future results.