US stock futures rose on Monday to put the S&P 500 on track for another record high, as investors became more upbeat about the health of the economy and looked to coming earnings for signs of an AI boom for techs.

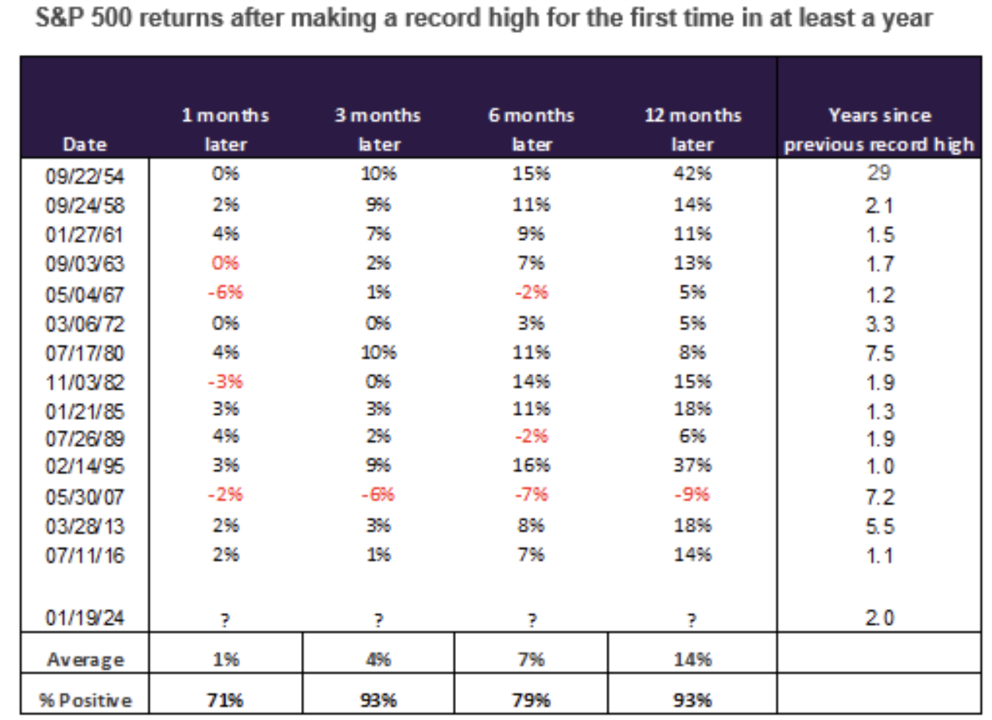

S&P 500 (^GSPC) futures gained 0.3% after the index notched its first record close since January 2022 on Friday. Dow Jones Industrial Average (^DJI) futures added roughly 0.2%, while those on the tech-heavy Nasdaq 100 (^NDX) jumped 0.6%.

An AI-fueled surge in tech shares has helped pull stocks out of their early-2024 doldrums, bringing the major indexes into positive territory for January. Given that, quarterly results from the likes of Netflix (NFLX) and Tesla (TSLA) later this week will be closely watched, as how tech earnings perform could well indicate where the market heads in the short term.

At the same time, the Federal Reserve officials whose comments have buffeted stocks will stay quiet ahead of policymakers’ next meeting on Jan. 30. But readings on GDP and the Fed’s preferred inflation gauge later in the week could shed light on the debate that has been driving markets: when the Fed will pivot to cutting interest rates.

Read more: What the Fed rate-hike pause means for bank accounts, CDs, loans, and credit cards

In individual stocks, Boeing (BA) came under more pressure after the FAA urged airlines to carry out checks on another class of 737 jet that uses the same door plugs as on the MAX 9 that suffered a midair blowout.

Meanwhile, Archer-Daniels-Midland (ADM) shares sank 12% in premarket. The agricultural trading giant has placed its CFO on leave and cut its earnings outlook as it faces a probe into its accounts.

Live1 update

Click here for in-depth analysis of the latest stock market news and events moving stock prices.

Read the latest financial and business news from Yahoo Finance