Each quarter, investors wait for Warren Buffett’s company Berkshire Hathaway (BRK.A 0.12%) (BRK.B 0.20%) to file its 13-F form with the Securities and Exchange Commission, disclosing what stocks the company owned at the end of each quarter. By comparing 13-F filings, investors can gain insight into what stocks Berkshire bought and sold each quarter.

Given that Buffett is arguably one of the greatest investors ever, people want to learn about what sectors Buffett and his team of investors like and don’t like — and, sometimes, how they are thinking about the broader market.

In Berkshire’s fourth quarter 13-F, we learned that Buffett effectively pressed the sell button on the stock market (or at least on two funds that represent the market). While this is perhaps a dour warning from the Oracle of Omaha, there was a silver lining.

Buffett thinks the market is overvalued

Through all of 2024, Buffett and the Berkshire team have been making moves that signal they think the stock market is overvalued. Berkshire purchased far fewer stocks in 2024 than it sold. It also purchased less of its own stock than in prior years. Additionally, Berkshire hoarded cash, allowing its cash and short-term Treasury bills to surpass a whopping $320 billion.

In Q4, Buffett and Berkshire arguably made their loudest warning to investors yet: The company sold its positions in the SPDR S&P 500 ETF (SPY 0.23%) and the Vanguard S&P 500 ETF (VOO 0.24%), two exchange-traded funds (ETFs) that track the broader benchmark S&P 500. Given Berkshire’s cash position, this is Buffett’s biggest signal about the stock market yet. Berkshire first purchased these ETFs in late 2019 and hasn’t touched either position since, until selling them in Q4.

These moves can’t be too big a surprise. The stock market has in many cases defied gravity with its more than two-year bull run, which has plowed through multiple recession indicators and high valuations to surpass 6,100 (as of Feb. 16). Even more impressive as of late is the market’s ability to keep moving higher, despite elevated yields and inflation data that suggests that the Federal Reserve is likely to hold interest rates higher for longer. Some don’t think another rate hike or series of rate hikes is out of the question.

The silver lining

If there was a silver lining, it would be the fact that Berkshire did not sell any more of its stake in Apple (AAPL 0.16%), the largest stock in the S&P 500 (consuming over 7% of the index), in the fourth quarter. Berkshire trimmed 67% of its stake in Apple in the first three quarters of 2024. But Berkshire still holds 300 million shares of the consumer tech giant, which makes up nearly a quarter of Berkshire’s roughly $300 billion equities portfolio.

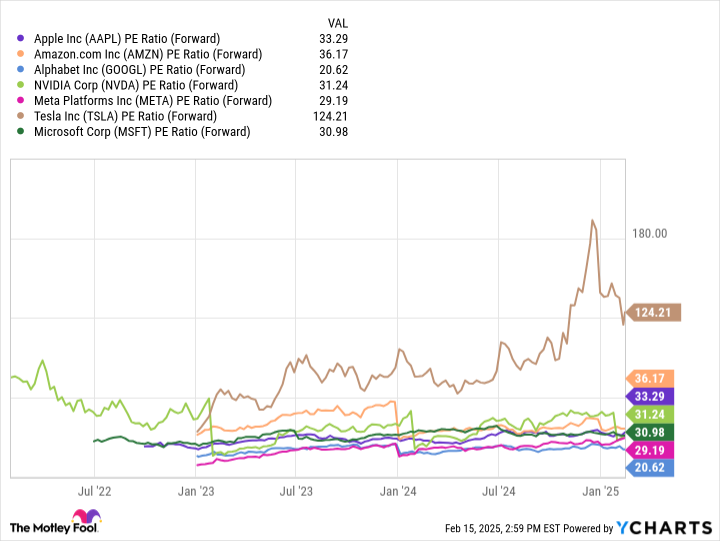

One could conclude that if Berkshire and Buffett were that concerned about the market, they would have continued to sell their largest position, which happens to make up the largest weight in the S&P 500. Of course, Berkshire may continue to sell Apple in the future, but given that such a small number of stocks currently consume so much of the S&P 500, perhaps Buffett and the team at Berkshire still see pockets of opportunity. Interestingly, Apple stock is not exactly cheap when you compare its forward price-to-earnings ratio to other companies in the Magnificent Seven.

AAPL PE Ratio (Forward) data by YCharts.

However, there is debate among analysts over how much potential Apple has with artificial intelligence and how much of that has been baked into the stock price. Apple also hasn’t exactly knocked it out of the park with iPhone sales lately. It’s possible Buffett and his team think Apple’s valuation is warranted and does not include it in the same hype as the rest of the Magnificent Seven, leaving it fairly valued with upside potential.

It’s hard to know for sure, but I think it is positive to see Berkshire maintaining its Apple position as it dumps its stake in the broader market for the first time in about five years.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, Tesla, and Vanguard S&P 500 ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.