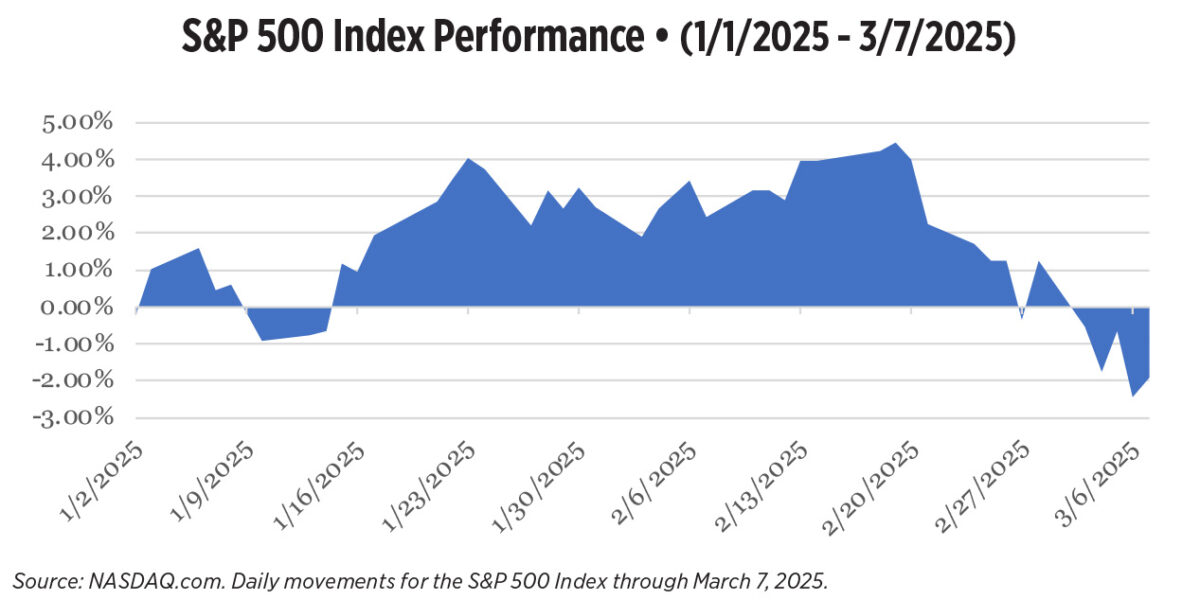

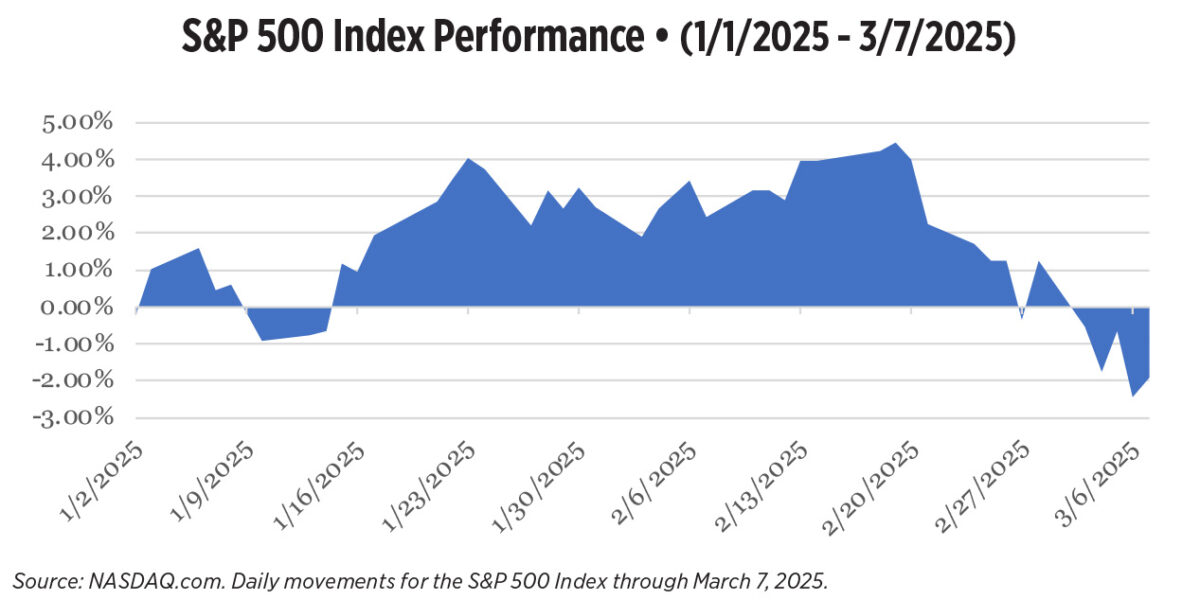

Entering this year, the S&P 500 Index celebrated an impressive milestone, posting gains of more than 25% for two consecutive years — a feat not seen since the late 1990s. Riding high on such remarkable performance, investor optimism was lofty, with many hopeful that the stock market rally would continue. However, 2025 has presented a more challenging landscape for U.S. equities. The S&P 500 Index fell nearly 9% from Feb. 19 to March 10 amid mounting concerns over U.S. economic growth and elevated equity valuations. Given the recent market tumult and the possibility of further volatility, how should clients respond?

Assess recent market performance and adjust expectations accordingly

To gain a better understanding for future return prospects, it can be helpful to assess the factors driving recent market performance. Contrary to popular belief, the impressive gains in U.S. stocks over the past two years were not a case of a “rising tide lifting all boats.” An analysis by DataTrek Research revealed that, excluding the substantial contributions from the Magnificent Seven stocks, the S&P 500 Index would have posted a price return of just 6.3% in 2024 and a mere 4.1% in 2023.

Investors should guard against the “danger of extrapolation,” as those hoping for the S&P 500 Index to continue producing such outsize performance over the next decade are likely to be disappointed.

Vanguard, in its 2024 midyear outlook, projected the possibility that U.S. bonds could outperform U.S. stocks over the next decade (in part due to “stretched” equity valuations), which would be a notable departure from years past.

Tune out the noise and focus on the long term

Clients should regularly revisit their investment objectives, emphasizing long-term goals over short-term market trends. Investor behavior often favors immediate gains, which tends to lead to poorer long-term outcomes.

DALBAR’s Quantitative Analysis of Investor Behavior report consistently shows that the average equity fund investor often underperforms the market. This is typically due to the practice of buying at high prices and selling at low prices, which can significantly affect returns when compounded over longer periods of time.

As author Morgan Housel once observed, “If you can focus on the next five years while the average investor is focused on the next five months, you have a powerful edge. Markets reward patience more than any other skill.”

Allocate thoughtfully and rebalance regularly

Hockey legend Wayne Gretzky reportedly remarked on his career success by stating, “I skate to where the puck is going to be, not where it has been.” Investors should adopt a similar approach, as chasing past winners is unlikely to yield consistent success. Regular rebalancing compels investors to reallocate from recent high performers to potentially undervalued investments or asset classes.

Clients with most of their assets in tax-deferred retirement accounts may rebalance with little or no tax implications. Conversely, those with substantial assets in taxable investment accounts must consider the tax consequences (capital gains) of paring back equity exposure; U.S. stock holdings, in particular, are likely to have significant embedded gains.

One strategy for charitably inclined individuals is to gift long-term appreciated securities from a taxable account to charity. The charity receives the same monetary benefit as a cash donation, while the individual can rebalance the portfolio through the charitable gift.

Minimize tax drag

“Location, location, location.” It’s a well-known adage for real estate investing but also has important applications for an investment portfolio. Why? Strategically allocating investments among different account types can reduce a portfolio’s “tax drag,” thereby enhancing a portfolio’s longer-term return (this concept is frequently referred to as “asset location”).

Investors should consider how their investment portfolio is divided among taxable accounts, traditional retirement accounts and Roth retirement accounts. Instead of holding similar investments across all accounts, strategically allocate investments based on growth prospects and tax treatment.

For example, Roth retirement accounts are tax-advantaged accounts with the goal to grow assets to the greatest extent possible. This tends to favor allocation to global equities and other high-growth strategies. In contrast, traditional retirement accounts may be better suited to holding less tax-efficient asset classes, such as taxable bonds and real estate investment trusts, which produce income otherwise taxable at ordinary income rates (if held in a taxable account).

Manage concentrated stock positions

Clients with significant investments concentrated among a few individual stocks should consider the risk that that entails. Possible options for managing single-stock risk include paring back exposure (while factoring in tax consequences), gifting those appreciated securities to charity and implementing stop-loss orders. In recent years, “direct indexing” has become increasingly popular, with investors building around a few select positions to replicate the construction of an index such as the S&P 500.

Prepare for cash flow needs

Clients should evaluate their cash flow needs. Planning ahead can reduce the risk of being a forced seller at an inopportune time. Ideally, individuals should maintain a cash reserve that could cover expenses for the next three to 12 months. With short-term interest rates still at favorable levels, clients should also monitor yield opportunities. Certain money market funds and high-yield savings accounts may offer more than 4% interest, whereas traditional bank accounts may be well below 1%.

Stay the course

Adhering to an investment plan is crucial during periods of market stress. Investors should avoid making drastic changes to their portfolio and should instead adhere to an investment plan anchored to long-term goals, time horizon and risk tolerance.

While clients frequently feel compelled to do something amid heightened market volatility, the best course of action is often staying the course. An investment plan tailored to an investor’s specific circumstances and preferences should be capable of enduring market fluctuations. As Charles Schwab’s chief investment strategist Liz Ann Sonders often reminds investors, “time in the market” is far more important than “timing the market.”