After a few months of calm, tariffs are back on the menu. The EU’s trade commissioner has said that trade between the EU and the US will be “almost impossible” if Donald Trump imposes his threatened 30 per cent tariffs on the bloc. Of course, we know by now that what Trump says, and what Trump does, are often two different things.

Larger EU member states have been reluctant to play hardball for fear of inviting Trump’s wrath. However, the foreign minister of Denmark said that the EU should consider using its anti-coercion instrument, which has been nicknamed a “trade bazooka”. The idea here is that it allows the EU’s executive arm to impose restrictions on trade in services (as well as goods) if it believes that a country is utilising tariffs to force a change in policy.

In other news, Rachel Reeves has come to her senses and realised that cutting the cash Isa may not be a great idea. By pushing more people into paying tax on interest on their savings, the government intends to encourage more people into the stock market. That could happen. But where are people putting their money? Exchange traded funds (ETFs) and crypto. And the UK accounts for just 3 per cent or so of the FTSE All-World so very little may flow to London listed stocks.

The idea that a wall of cash will be put into the UK stock market is just that – an idea. The reality, I fear, will be somewhat different. Lots of people who do invest prefer to buy cheap index-tracking funds. Investors today can sign up to commission-free brokers that charge no account fees, and even pay out interest on uninvested cash.

One idea that has been floated is that Reeves will change Isa regulations to only allow UK stocks to be bought in stocks-and-shares Isas. There are merits to this idea, and UK fund managers are of course in favour because it will create inflows and boost their holdings. But will everyone be better off for it? I’m not so sure – most investors will stick with buying global ETFs.

However, Isas offer a tax break and giving the tax break in return for a benefit to money being invested in the UK makes sense. It doesn’t mean I agree with it, and as a UK stock trader, it makes no difference to me anyway. That said, it will be interesting to see what happens.

Read more from Investors’ Chronicle

The UK stock market is in need of help, as quality is getting taken out or delisting, and we are left with the garbage. If nothing changes, the quality of the constituents in 10 years will be more dreadful than we can imagine.

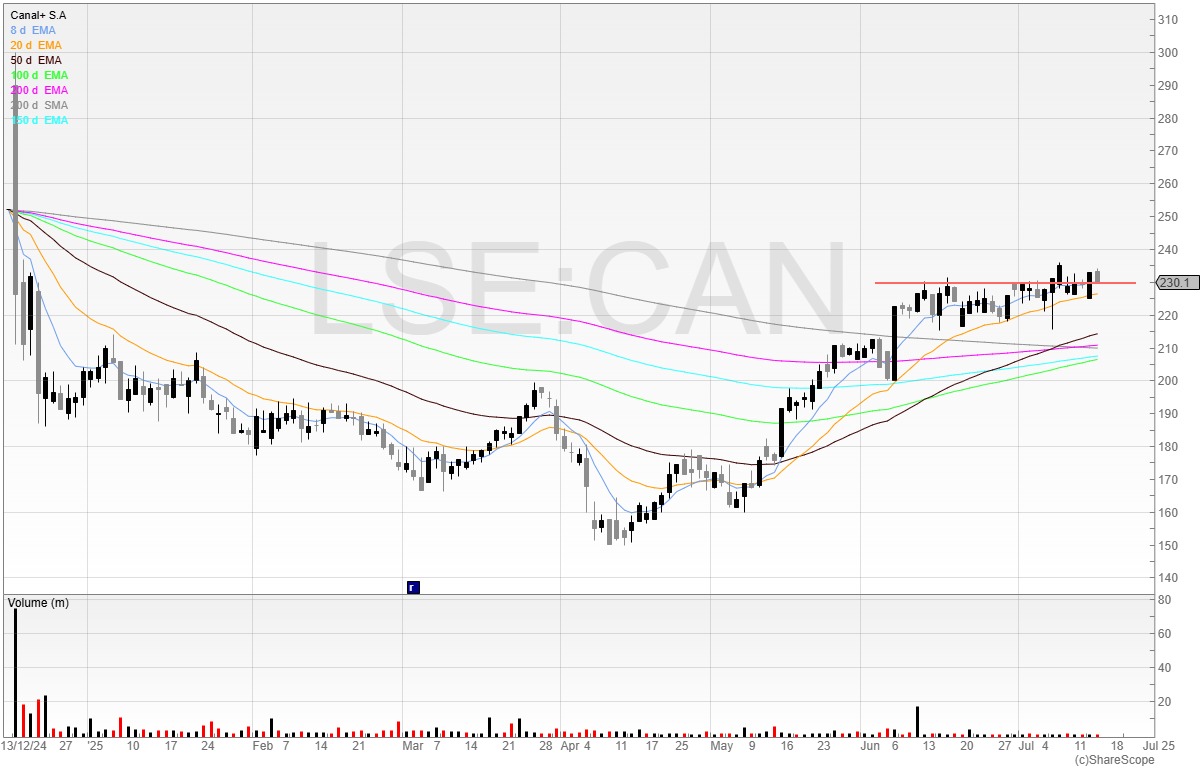

One stock that I am looking at is Canal+ (CAN). This business listed in December last year and promptly dumped 30 per cent of value within weeks, although the chief executive doesn’t regret it (or so he says).

Yet the business has traded in line with expectations and over the past six months has been stabilising.

We can see that the stock made its lows around April’s so called “liberation day” and is now closing in on 26-week highs. I look for 26-week highs because it shows strength. It may not always yield a stock worth trading, but essentially I am looking for stocks that are consolidating and where I can trade them with tight stops.

Stage analysis is incredibly important before placing a trade. Then, it’s on to red flag checks on the fundamentals.

The recent trading update showed everything is in line, and so I feel it’s safe to move on to the next step, which is price action.

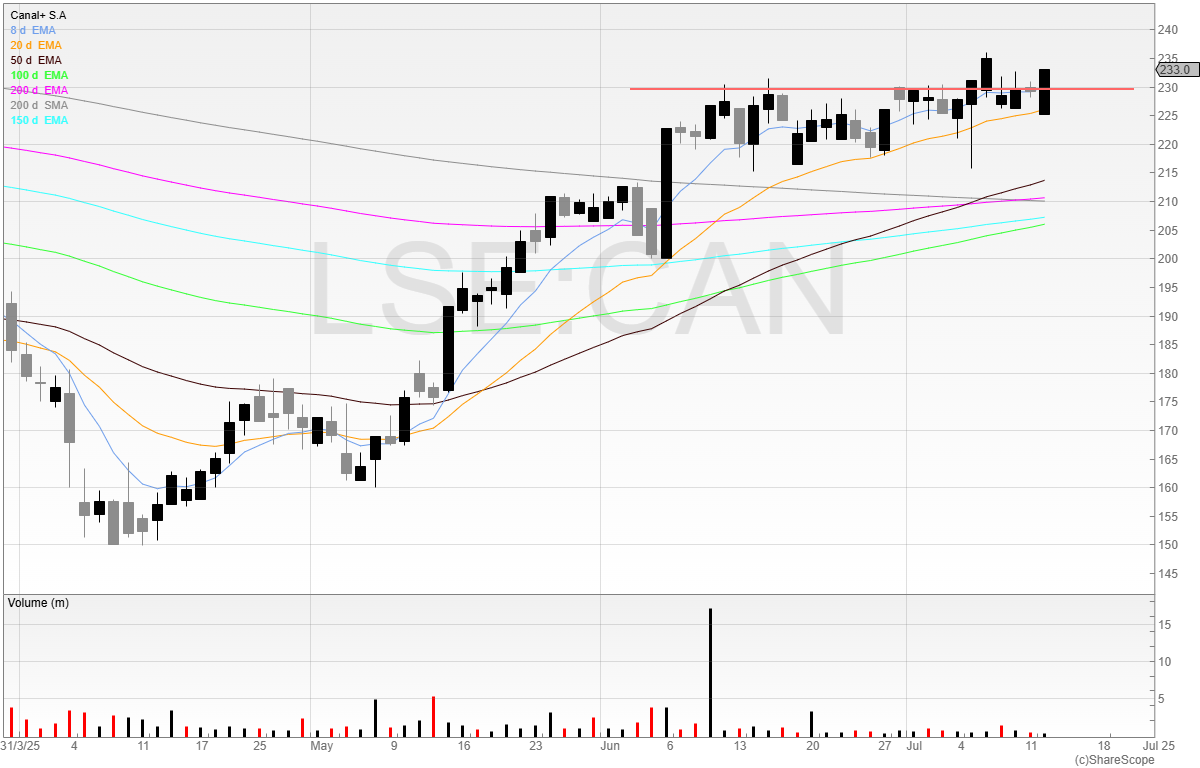

Moving to Chart 2, we can see that the stock is hitting a key price level at 230p. Not only is the volume declining but the volatility is reducing too, suggesting that the stock is reaching its equilibrium point.

I like that the stock is well off the lows at 150p, as whenever a stock is only just off the lows there is no real evidence that the price action has changed and that the stock is powering higher.

However, we can clearly see that since April, the stock has been slowly grinding higher and is up 53 per cent from its worst point.

The moving averages are also trending higher and the stock is printing above these.

To trade this, I’d keep my stop nice and tight, below the recent lows around 210p. Of course, you can always go below the BRN (big round number) of 200p and have a trade that is less likely to be stopped out, however you are stunting your upside as a wider stop means you will have fewer shares and exposure in the position.

Canal+ is a SETS stock, which means orders can be placed directly on the London Stock Exchange’s order book, and I’m watching for a break of recent highs.